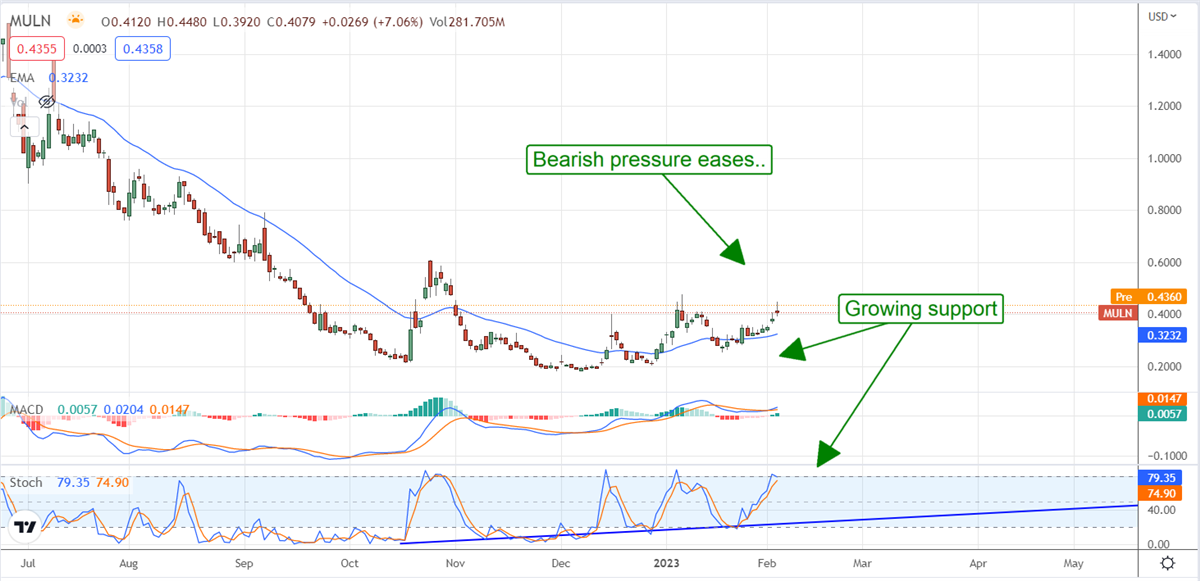

While Mullen Automotive NASDAQ: MULN is not out of the woods, it appears the tide has turned for the stock. The short-interest data suggests the bearish wave is relenting, and the technicals show the bulls gaining ground. In the near term, there is a growing possibility for a sharp pop in share prices, but there are still risks.

If the company continues to issue positive news and build on its momentum, shares will surely increase. However, if there are hiccups in the story or, dare I say it, actually bad news, the shorts will pile right back in and drive this lemon down to new lows.

The Short-Covering Has Begun

The difference in short interest on and off-exchange since last week is phenomenal. Fintel.io is listing the on and off-exchange short-interest at 11.88% and 35%, which are both still very high but down from 14.8% and nearly 50% last week. The cost to borrow is also rising and up roughly 4X in the previous few weeks and will indeed impact bearish sentiment.

The takeaway is that falling short-interest is a clear sign that bearish interest is fading and will likely continue to support the price action in the near term.

This is coupled with growing institutional interest as well. Yet another new institution has bought into this name, adding another bit of weight to the bullish case. The latest to show up on Marketbeat.com institutional tracking tools is by Integrated Advisors Network LLC and follows a purchase by Private Advisor Group LLC in mid-January. Both companies are platform/service providers for independent financial advisors and their clients.

Why is this important? The company has until March 6th to get its share prices above $1.00 or risk delisting from NASDAQ. At the time, the bias in price action is upward, and new near-term highs are in sight. If the company can build enough momentum to get the short sellers to cover more quickly, the share price could easily get above $1.00 without needing a reverse stock split.

Even if share prices don’t reach or stay above $1.00, it will give the company some added leverage and lessen the need for a large reverse split.

The Catalysts For Mullen Are …

The two most obvious catalysts on the horizon are the I-Go in Europe and the onset of production in the US. The I-Go is in Europe now, and the following news the market is waiting for is that it has arrived at Newgate Motors and is available for testing and marketing. The icing on the cake will be the first positive reviews and sales, and that news could be compounded by production in the US.

The deal for ELMS assets, the acquisition of controlling interest in Bollinger, and the plant in Tunica have it set up to begin production of Class 1-2 vehicles in Q1 of this year and to launch additional production lines in Q2. This catalyst is compounded by an existing order for 6,000 vans from the Randy Marion Group and a recently announced trial at LAX that could result in another several thousand preorders. The takeaway is that multiple catalysts in the works may compound each other and result in additional catalysts as they unfold.

The Technical Outlook: Mullen On Track For 3-Month High

The technical picture has Mullen Automotive on track for a 3-month high. If the market can reach that level, a little above $0.47, the short-covering may pick up speed. In this scenario, a move up to $0.60 and maybe $0.80 may be next. If good news follows soon after, a move to $1.00 is not out of the question, but there are risks that short-sellers may reposition at higher prices, and the news may not be great.

Before you consider Mullen Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mullen Automotive wasn't on the list.

While Mullen Automotive currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.