Enterprise cloud data management company

NetApp, Inc. NASDAQ: NTAP stock has been trading well below its pre-COVID February highs while underperforming the benchmark

S&P 500 index NYSEARCA: SPY. The

migration to cloud data services accelerated with the surge in remote work trends spawned by

pandemic-related isolation mandates. Investors fear the recent earnings improvement will be short lived as

competition heats up as restarts accelerate. However, the third surge of COVID-19 may prolong tailwinds longer than anticipated which could set up a stronger recovery while shares are trading at

bargain price-earnings (PE) levels around 12.65. The Company purposely lowered the bar for the next earnings release which can provide prudent investors opportunistic pullback entries to gain exposure.

Q1 FY 2021 Earnings Release

On Aug. 26, 2020, NetApp released its fiscal first-quarter 2021 results for the quarter ending July 2020. The Company reported an earnings-per-share (EPS) profit of $0.73 excluding non-recurring items beating consensus analyst estimates for a profit of $0.41. Revenues grew 5.4% year-over-year (YoY) to $1.3 billion beating analyst estimates for $1.15 billion for the quarter. The all-flash array (AFA) segment annualized run rate grew 34% YoY to $2.3 billion and billings grew 6% YoY to $1.15 billion. Hardware product revenue fell (-7%) YoY while software and hardware maintenance revenues rose 14% and 7$ YoY. Due to market uncertainty, the share buyback program has been paused. The Company ended the quarter with $3.8 billion in cash and short-term investments, while raising $2 billion in long-term debt. The maintenance

Conference Call Takeaways

NetApp CEO, George Kurian, provided color on growing tailwinds, “… enterprises are prioritizing transformational and hybrid cloud projects, which drove our momentum as customers turn to NetApp to help them accelerate these plans.” This was despite the challenging IT spending environment stemming from the pandemic. Sales teams Executive Briefing Center visits grew 50% YoY through virtual visits and “doubling in the number of prospects” as part of the new normal. Companies are “now looking to accelerate digital transformations to drive competitive advantage by delivering products and services remotely, reaching customers through digital means and optimizing remote operations and collaboration.” This trend falls right into the core of NetApp product and service offerings notably its data fabric strategy and AFA growth. The AFA revenue was $567 million, up 34% YoY for the quarter with 25% of installed systems running on all-flash adoption. This provides a “health runway” for the existing base as well as new customers.

Lowered Forward Guidance

NetApp expects fiscal Q2 2021 revenues to fall (-5%) as a result of one-time sales pops in Q1 like the extra week of maintenance revenues. Results for Q1 were better than expected but expected to drop-off back to “normal sequential compares”, according to NetApp CFO Mike Berry. The Company lowered fiscal Q2 2021 EPS guidance for the quarter entering in October to the $0.66 to $0.74 range, shy of the $0.77 consensus analyst estimates. NetApp forecast Q2 revenues in the range of $1.225 billion to $1.375 billion versus $1.24 billion analyst estimates. The Company maintained its $0.48 per share dividend.

Analyst Armageddon

As slew of analysts reiterated their ratings the following morning Aug. 27, 2020, after the earnings release. The most bullish were Credit Suisse and Northland Capital reiterating Overweight positions with price targets ranging from $51 to $57 for NetApp shares. The most bearish calls came from Citigroup NYSE: C reiterating their Sell rating to a $37 to $39 price target and Morgan Stanley NYSE: MS reiterating their Underweight rating with a $34 to $37 price target. On Oct. 13, Morgan Stanley raised its rating to Overweight with a $49 price target, followed by an upgrade to a Buy rating by Summit Insights on Oct. 23, 2020. Prudent investors that believe the accelerated tailwinds of Q1 2021 will continue to accelerate moving forward can look for opportunistic pullback levels to gain exposure on NetApp shares while analysts continue to remain cautious.

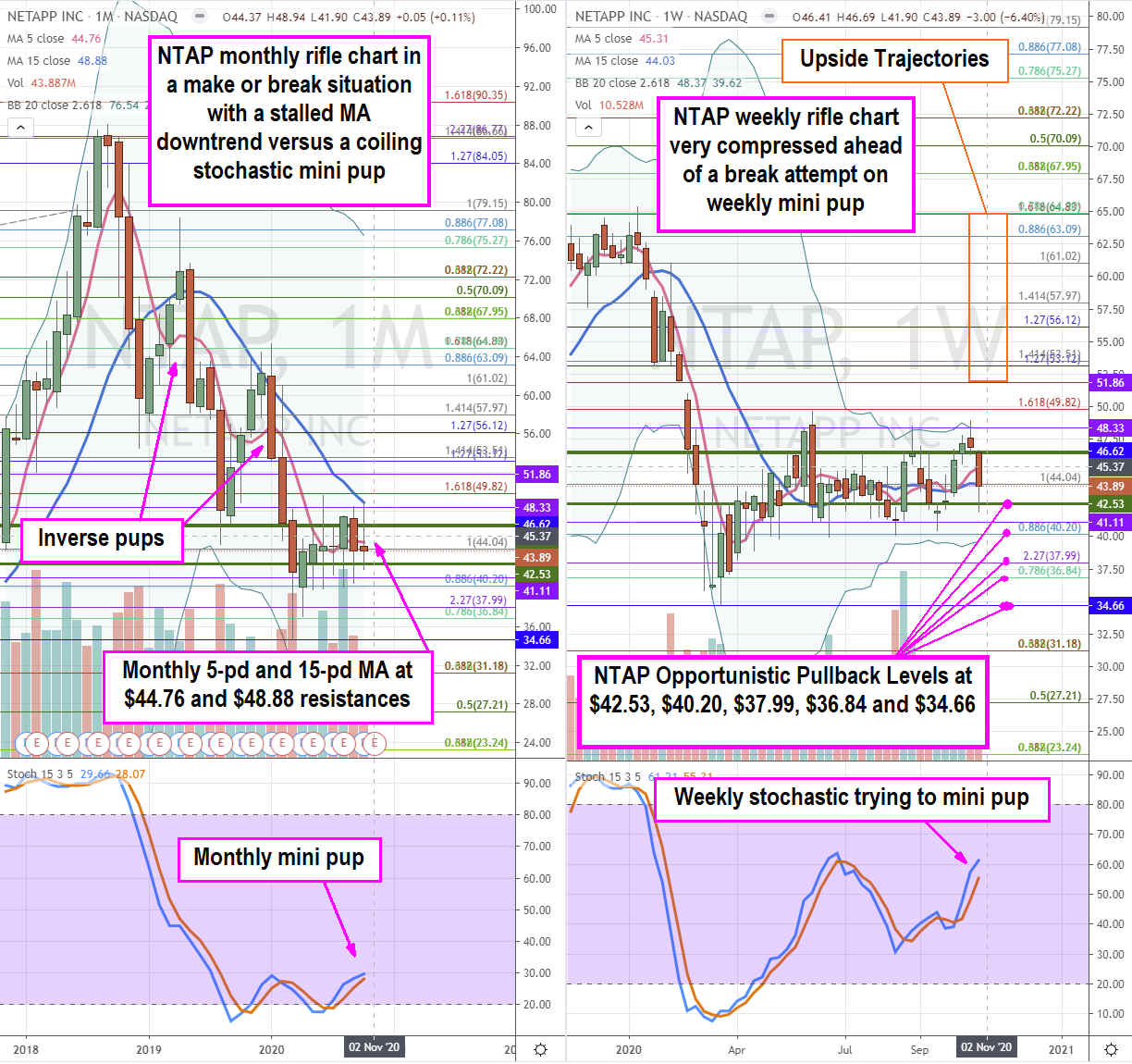

NTAP Opportunistic Pullback Levels

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for NTAP stock. The monthly rifle chart has a make or break formation where the bullish outcome triggers if the stochastic mini pup powers the 5-period moving average (MA) at $44.76 through the 15-period MA at $48.88. The bearish outcome forms shares reject back down off the monthly 5-period MA and the monthly stochastic crosses back down. The monthly stochastic can’t fall without the weekly stochastic crossing back down first. This brings us to the weekly rifle chart attempting to form a stochastic mini pup breakout during the Bollinger Band (BB) compression. Incidentally the trading range falls within the $48.82 and $40.20 Fibonacci (fib) levels. This weekly stochastic forms a market structure low (MSL) buy trigger above the $42.52 while the monthly MSL trigger forms above $46.62. Each test of both MSLs lacked follow through as shares have been ping ponging within the range. Nimble traders can monitor opportunistic pullback levels at the $42.53 weekly MSL, $40.20 multiple bottom/fib, $37.99 fib, $36.84 fib and $34.66. The upside trajectory range is the $51.86 to $64.88 pre-COVIF fib high levels from February 2020.

Before you consider NetApp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetApp wasn't on the list.

While NetApp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.