Netflix NASDAQ: NFLXwas up 7.49% last week after the company revealed that its $7 per-month ad-based plan, which the company first launched in November, has reached 5 million monthly active users. Netflix has not yet made public the revenue generated from its ad-based plan; however, its comments were enough to send the stock soaring higher on Thursday, so much so that shares of the streaming giant experienced their best intraday performance since October 2022.

Netflix announced this during a presentation by management. During the presentation, the company added that the ad-tier plan now represents 25% of new subscribers in areas where it is available. Their last earnings release reported that the $7 per-month ad tier plan has roughly 95% of the same content as premium or ad-free plans.

The company reported mixed results for the first quarter. However, they were still able to add 1.75 million subscribers while also preparing to crack down on password sharing, a move the company hopes will further boost its revenue. Netflix also raised its full-year free cash flow projections to $3.5 billion from $3 billion.

Analysts Like What They’re Hearing

Wedbush reiterated their coverage of Netflix with an Outperform recommendation on Friday. In a new note on Friday, Wedbush analysts Alicia Reese and Michael Pachter wrote: “We think Netflix has reached the right formula with its global content to balance costs and generate increasing profitability.”

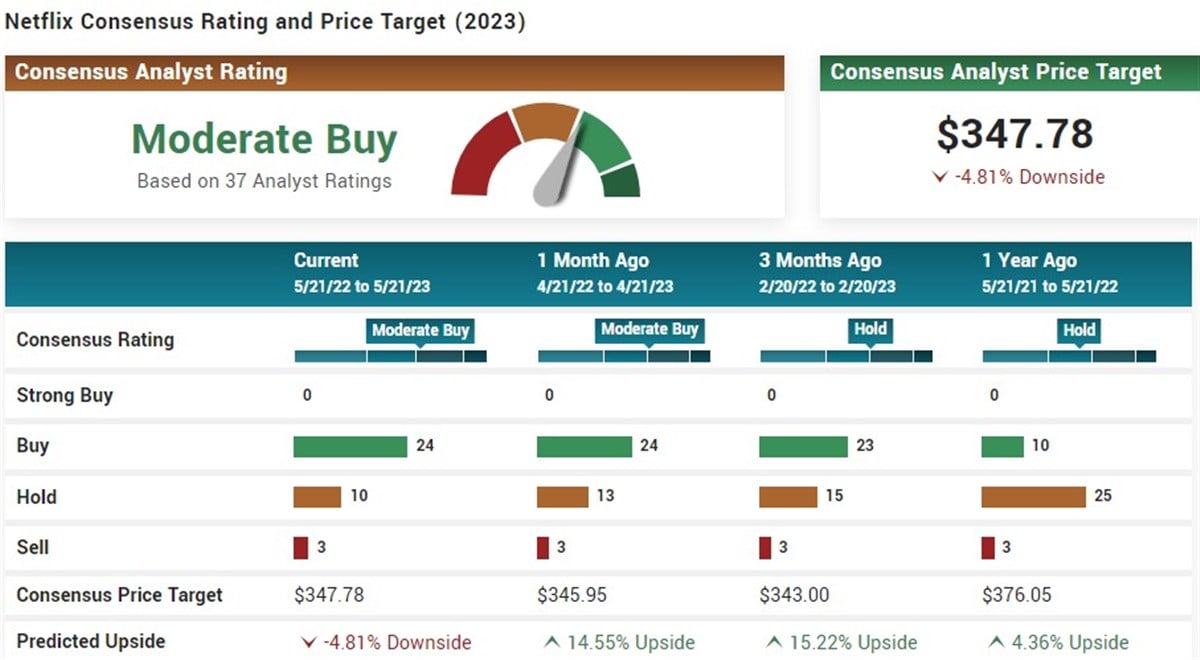

Netflix currently has a moderate buy consensus based on 37 analyst ratings. The average analyst price target is $347.78, with a high prediction of $440 and a low prediction of $215. Of the 37 ratings, 24 are a Buy, 10 are a Hold, and 3 are Sell. During the same period last year, those analyst ratings painted a different outlook, with 12 Buy, 20 Hold, and 4 Sell. With the apparent shift in outlook for Netflix stock, is it time to buy?

Is Netflix Stock a Buy?

The recent comments made by the company and favorable analyst rating certainly paint the picture of further upside for shares of Netflix. But what is the chart telling us?

The breakout on Thursday marked a clear shift in momentum for Netflix, at least in the short term. The move over the previous resistance of $340 confirmed the breakout in the stock. Before breaking out on the news, the 50d and 20d SMA were converging near support of the short-term consolidation, around $330. That signaled that in the short-term, shares of Netflix were not overbought. Fast forward two days, and after Netflix broke out of the consolidation, the stock closed the week up 7.49%.

Is that sharp increase in a short period enough to deter investors? If Netflix can successfully digest the breakout and price increase by holding over $355 - $360, there could be further upside in the stock, and a short to medium-term investment might be warranted. Ideally, bulls want to see the stock turn the previous 52w high and resistance area into support, which would likely signal positive momentum and further upside. Of course, overall market sentiment will be a crucial decider in the price movements of Netflix, with significant catalysts looming.

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.