Liquefied natural gas (LNG) development company NextDecade Corporation NASDAQ: NEXT stock has been breaking out on strength in the energy sector and notably midstream master limited partnerships (MLP). Despite the clean energy faction calling for the end of the fossil fuel industry, it’s here to stay. However, LNG is the cleanest form of fossil fuel and one of the most cost effective means of reducing greenhouse gas emissions. It qualifies as an advanced biofuel under the Renewable Fuel Standard. Carbon-neutral LNG is an economical way to satisfy both the environmentalists and motorheads by reducing carbon impact without excessively higher costs. Along with ESG (environmental, social and governance) at its core while lending to the clean and renewable energy movement, Next Decade is a stock that prudent investors can watch for opportunistic pullbacks to gain exposure.

About the Company

The Company is divided into three segment under two divisions. NEXT Carbon Solutions, LLC, was formed on Mar. 18, 2021, and is expected to handle the development of one of the largest CCS projects in North America at the Terminal, advance proprietary processes to lower the cost of utilizing CCS technology, help other energy companies in the reduction of greenhouse gas (GHG) emissions associated with the production, transportation and use of natural gas, and generate high-quality, verifiable carbon offsets. NEXT Carbon’s CCS project is expected to reduced permitted carbon emissions by more than 90% without major design changes to the Terminal. NextDecadeLNG, LLC, owns the Rio Grande LNG, LLC, which handles the operations at the Rio Grande LNG terminal facility. According to its latest 10-Q released on March 31, 2021, NextDecade engages in development activities related to the liquefication and sales of LNG and the reduction of carbon emissions. The Company has focused its development efforts at the Rio Grande LNG terminal facility (Termina) at the Port of Brownsville in southern Texas and carbon capture and storage project (CCS) at the Terminal. On March 25,2021, the Company announced partnerships with Oxy Low Carbon Ventures, a subsidiary of Occidental Petroleum NYSE: OXY for the offtake and storage of carbon capture from the Terminal. The Company also partnered with Mitsubishi Heavy Industries to assist with the CCS project at the Terminal.

The Process

Natural gas is liquefied and cools at -260 degrees Fahrenheit thereby reducing the volume by 600X. The LNG is odorless, non-flammable, non-toxic liquid. It has the appearance of water and can’t contaminate soil or water. If it ever gets spilled on land or in water, it vaporizes and leaves no residue. It’s been a clean energy shipped safely since 1964. When LNG is vaporized to use as a fuel it reduces carbon emissions by 70% compared to other fuels. When its burned for power generation, sulfur dioxide emissions are “virtually” eliminated while carbon emissions are reduced significantly. The Company is structured as a pass-through MLP. As of March 31, 2021, it had $39.3 million in cash along with additional assets including Property, Plant and Equipment totaling $222 million. Net loss per diluted share was (-$0.06) on 118,262 million weighted average shares outstanding, compared to (-$0.02) on 117,353 million shares in the year ago same period. The Company entered into a 20-year sale and purchase agreement with Shell for the supply of approximately two million tonnes per year of LNA from the Terminal. The agreement calls for the Rio Grande to deliver the contracted volumes upon the first liquefication train at the Terminal being commercially operable.

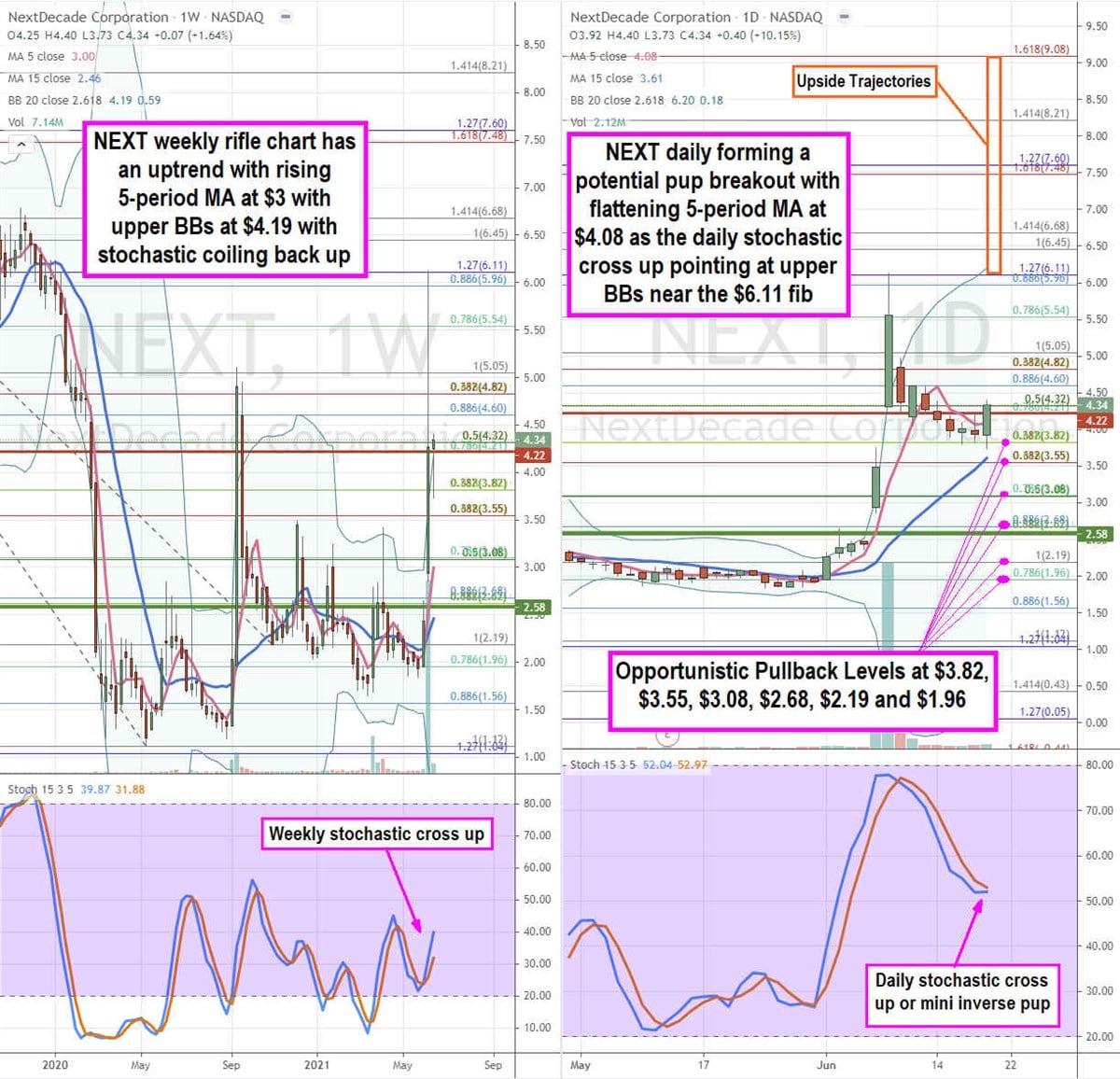

NEXT Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily frames provides a clearer view of the landscape for NEXT stock. The weekly rifle chart is uptrending with a rising 5-period moving average (MA) support at $3.08 and upper weekly Bollinger Bands (BBs) near the $4.21 Fibonacci (fib) level. The weekly market structure high (MSH) sell triggers on a breakdown under $4.22. The daily rifle chart is starting to base off the $3.82 fib as the 5-period MA flattens at $4.08 as it waits for the daily stochastic to cross up and form a pup breakout or mini inverse pup for a channel tightening back down to its 15-period MA near the $3.88 fib. The daily upper BBs sit near the $6.11 fib. The weekly market structure low (MSL) triggered on a breakout through $2.58. This sets up the playing field for opportunistic pullback levels at the $3.82 fib, $3.08 fib, $2.68 fib, and the $1.96 fib. Upside trajectories range from the $6.11 fib up towards the $9.08 fib.

Before you consider NextDecade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NextDecade wasn't on the list.

While NextDecade currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.