Chinese electric vehicle manufacturer

NIO Limited NYSE: NIO stock has been on fire driven by the

electric vehicle (EV) and SPAC speculation tailwinds stemming from the

meteoric rise in

Tesla NASDAQ: TSLA shares. Shares have blown away the performance of the benchmark

S&P 500 index NYSEARCA: SPY rising over 500% on the year. Pundits proclaim Nio as the next Tesla of China. It’s kind of silly as Tesla is the Tesla of China and Nio lags its sales by nearly seven years. Shares may have gotten way ahead of itself and prudent investors may consider taking some profits off the table as Nio triggered a blow-off top on its announcement of a 75 million ADS offering.

Q2 FY 2020 Earnings Release

On Aug. 11, 2020, Nio released its second-quarter fiscal 2020 results for the quarter ending June 2020. The Company reported delivery of 10,331 EVs versus 3,553 EVs year-over-year (YoY). Total revenues grew 146.5% YoY to RMB3.718 billion ($526.4 million USD) and adjusted non-GAAP net losses were RMB1.13 billion ($160.1 million USD) an improvement of 64.6% YoY. Nio expects to boost deliveries in Q3 to 11,000 to 11,500 range, representing an improvement of 129.2% to 139.6% YoY.

Perfect Storm

The Chinese government is solidly behind the push towards EV development as it tries to cut down on pollution and oil imports. For this reason, they extended EV purchase subsidies by two years to 2022. Nio in collaboration with JAC Motors rolled out its 50,000th EV in two years from their Hefei plant. The Company anticipates production capacity growth by 25% bumping up production to 5,000 EVs per month by September 2020. Tesla currently dominates with delivered 30,000 EVs in Q2 2020. For the month of June Tesla sold a total of 15,023 Model 3 EVs compared to 2,476 Nio Model ES6 EVs. Competition is steep with local brands including Oppo, Vevo, Huawei and OnePlus holding majority market share in China. Competitor Li Auto NYSE: LI shares peaked out at $24.48 on its recent IPO pulling back down to $17.60 by the end of August 2020.

Battery-As-A-Service

On Aug. 20, 2020, NIO launched a battery as a service (BAAS) subscription through new 25% jointly entity called Wuhan Weineng Battery Asset Co. This four-party owned Company will purchase, own and lease the batteries with each participant investing RMB200 million respectively. This is an add-on subscription service offered to buyers of Nio ES8, ES6 or EC6 models to use the 70kWh battery pack for a monthly subscription fee of RMB980. This enables users to take advantage of government subsidies and favorable tax exemptions. BAAS customers receive a RMB70,000 deduction off the purchase price of the EV. This could be a gamechanger

EV Speculation Peak?

On the eve of the TSLA 5-for-1 stock split effective date of Aug. 31, 2020, Nio commenced a 75 million advanced depository shares (ADS) offering on Aug. 27, 2020. Chinese EV maker upstart Xpeng Motors is expected to IPO 99.7 million ADS at $15 to raise $1.5 billion USD. With new liquidity and subsequent dilution hitting the market, the question is whether the EV hype may be reaching a peak heading into September 2020 as market seasonality tends to be bearish in the Fall. Prudent investors may want to consider taking profits on NIO into the surges using TSLA stock as a lead indicator.

NIO Trajectory Ranges

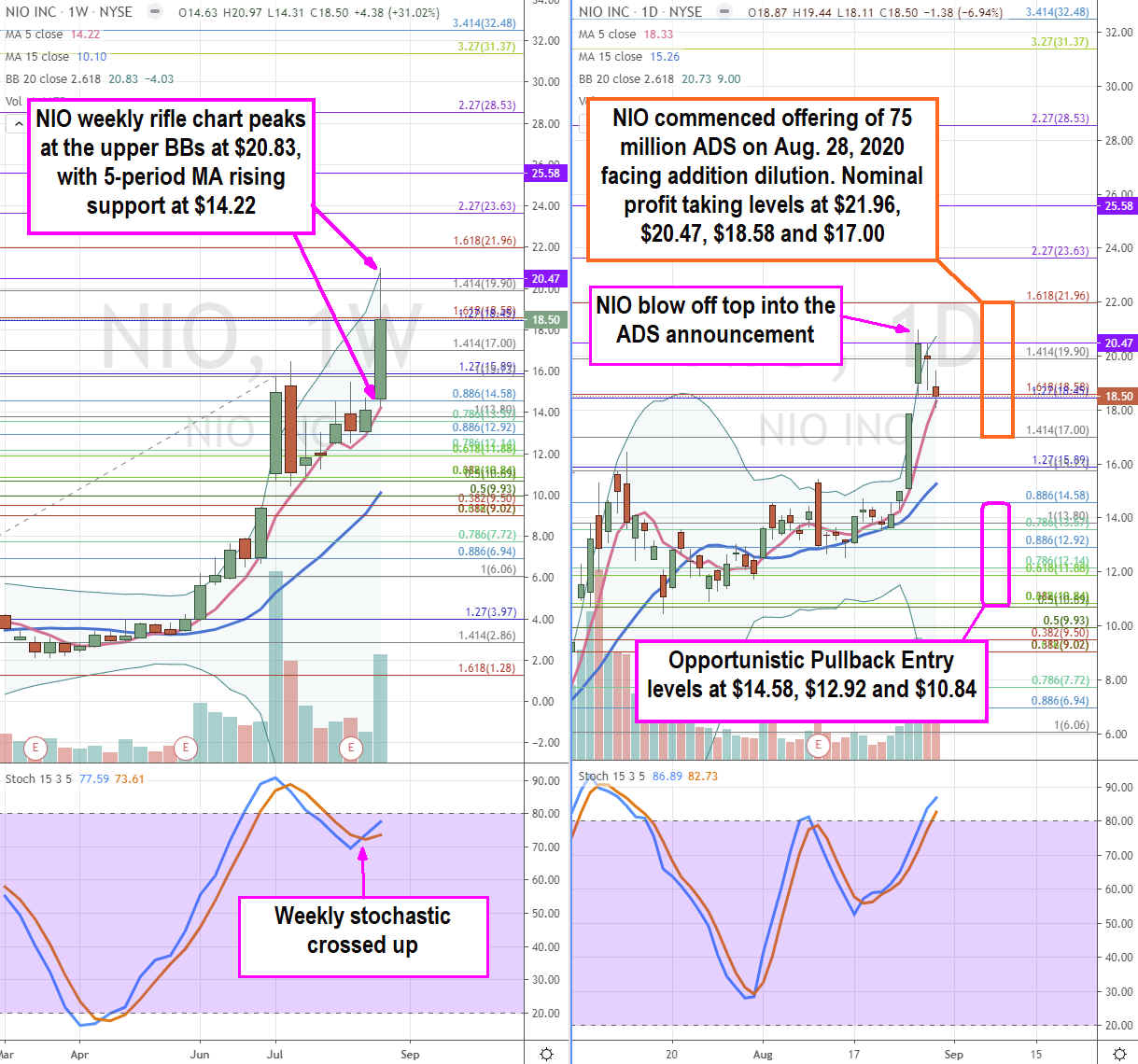

Using the rifle charts on the weekly and daily time frames provides a broader view of the landscape for NIO stock. The weekly rifle chart stochastic is starting to cross up on the pup breakout which peaked at the weekly upper Bollinger Bands (BBs) at $20.83. This can set-up a reversion back towards the weekly 5-period MA. The daily stochastic has been in a mini pup breakout which peaked at the $20.73 upper BBs. The shares are testing the $18.58 Fibonacci (fib) level. Nominal profit taking price levels are at $21.96 fib, $20.47 daily upper BB range, $18.58 daily 5-pd MA/fib and $17.00 stop-loss area. If NIO happens to make deeper pullbacks, then nimble traders can watch for opportunistic entries at the $14.58 weekly 5-period MA/fib, $12.92 fib and $10.84 fib. If the pullbacks seem too extreme, keep in mind that NIO spiked from $13.57 to a high of $20.83 in just three trading days as they announced the 75 million ADS offering. It’s prudent to monitor how TSLA shares trade after the effective date of Aug. 31, 2020 as it is the lead in the EV sector.

Before you consider NIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NIO wasn't on the list.

While NIO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.