Norfolk Southern NYSE: NSC is back within striking distance of all-time highs after plummeting to around $111 a share in the early stages of the pandemic.

NSC is one of several railroads that has seen its shares perform well despite posting weak numbers since the onset of the pandemic. But similar to the others, Norfolk Southern has made its operations more efficient – cutting costs in the process.

I recently covered Kansas City Southern (NYSE: KSU), concluding that while the P/E ratio was a bit high, the chart looked great. If you bought its recent breakout, you’d already be up 10+ points.

I also covered Canadian Pacific NYSE: CP, recommending you get in ahead of potentially blowout Q3 and Q4 numbers. The chart hasn’t offered a nice entry point yet, but shares have continued to chug along.

Let’s explore how NSC stacks up.

Low Revenue in Q2

NSC had a rough Q2, with revenue down 29% yoy. But the numbers improved markedly over the second half of the quarter; volume was up 8% in the second six weeks of the quarter compared to the first six weeks.

Furthermore, Q3 revenue is expected to decrease by around 13% yoy and Q4 revenue is expected to be down around 4.8% yoy. So revenue is expected to improve moving forward, but not return to pre-pandemic levels.

NSC’s automotive business is representative of the rest of the company, if a little exaggerated:

Early in Q2, weekly volumes were down over 90%. But volumes picked up in late May and ended up decreasing around 60% for the full quarter. With the automotive industry showing signs of life, it’s reasonable to expect numbers to continue trending upwards for NSC in Q3 and Q4.

Efficient Operations in Q2

Operational performance, on the other hand, was a bright spot during Q2.

On its Q2 earnings call, CEO James A. Squires listed some of NSC’s accomplishments during the quarter:

- “We achieved record train performance, train speed, terminal dwell and shipment consistency. Many other service metrics were near all-time best levels.”

- Reduced its workforce by 20%

- Fuel efficiency improved

All in, operating expenses were down $385 million, or 21%, against a 26% decline in volume. Lower compensation and benefits costs were responsible for $126 million of the savings, while lower fuel costs accounted for $74 million of the reduction.

But Operating Ratio is Still Much Higher Than Canadian Pacific’s

Norfolk Southern did a fine job reducing costs, all things considered. But in Q2, NSC posted an OR of around 70%. CP, on the other hand, recorded an OR of around 57% in Q2, and is pushing for an OR in the mid-50s.

At first glance, this seems like an awful blow to NSC’s investment prospects.

But there’s another way to look at it – NSC has a lot of room for improvement.

On its Q2 earnings call, Norfolk Southern reiterated its plans to achieve a 60% OR. While this could be viewed as lip service, its Q2 improvements could alternatively be seen as a sign of things to come.

The Price is Right on NSC

So why consider NSC if it’s trying to do what CP has already accomplished?

The price is right.

NSC trades at similar multiples to CP, at around 24x projected 2020 earnings and around 19x projected 2021 earnings. But NSC’s operations have more room for improvement, meaning that its earnings have more upside as a percentage of revenue.

Now, don’t get me wrong: I’m not saying to ditch Canadian Pacific. CP has better revenue growth prospects than NSC moving forward.

But overall, these stocks are neck and neck from a fundamental perspective.

And in the near-term, NSC’s chart looks a little better.

Look for a Breakout

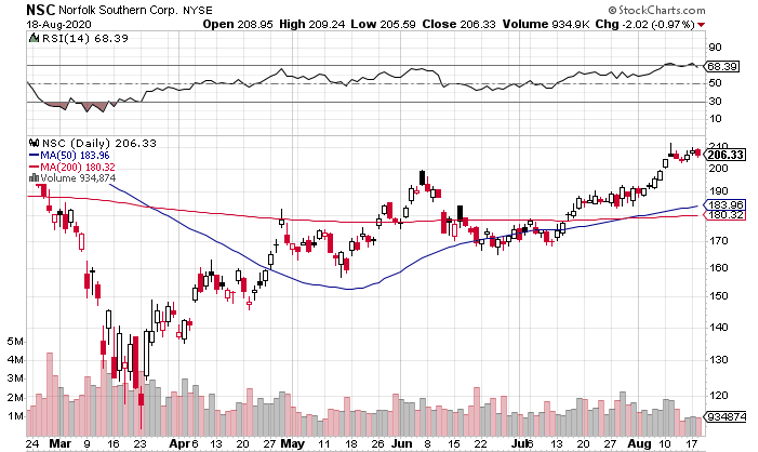

After running up from $168 a share to $211, NSC shares have taken a short breather just shy of the all-time highs.

NSC has been flirting with overbought territory on the RSI, so it would be nice if it spent another week or two consolidating at these levels, before breaking out to fresh all-time highs. At that point, you could look to get in.

The 50-day moving average crossed over the 200-day moving average a few weeks ago, providing a tailwind for shares. But those moving averages are well below $217-220 (the breakout level), so you’d have to pick an arbitrary number if you want to limit your downside to 5-10% on a breakout.

The Final Word

KSU is offering investors a nice technical play. And CP, if you can find a spot to get in, looks like a solid value play over the next 6+ months. In the case of NSC, the chart hasn’t yet provided the go-ahead, but if it does, you’ll have a great combination of fundamentals and technicals.

Keep a close eye on NSC over the next couple of weeks.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report