Worldwide vehicle parts manufacturer

Magna International NYSE: MGA stock has been selling off as the

electric vehicle (EV) momentum has been cooling off. However, Magna is emerging as the go-to manufacturer for some of the most popular EV makers like

Fisker NYSE: FSR. The Company is already a supplier to the

legacy U.S. automakers like

Ford NYSE: F and

General Motors NYSE: GM as well as major European players like

Volkswagen OTCMKTS: VWAGY and BMW. The Company is riding two strong tailwinds in the recovery of the

automobile market and the

EV and electrification trend. The Company has 342 manufacturing factories in over 24 countries and is one of the three largest auto parts

suppliers worldwide. Prudent investors looking for exposure into the two majors tailwinds of an

automobile recovery and EV surge can watch for an opportunistic pullback in shares of Magna International.

Q1 Fiscal 2021 Earnings Release

On May 6, 2021, Magna released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings-per-share (EPS) profit of $1.86 excluding non-recurring items versus consensus analyst estimates for $1.60, a $0.26 beat. Revenues rose 18% year-over-year (YoY) to $10.2 billion beating analyst estimates for $9.69 billion. Global light productions rose 18% driven by a 87% increase in China. Adjusted EBIT was up 91% and income from operations before income taxes rose 109% YoY. The global chip shortage negatively impacted global light vehicle production. The Company generated $1.03 billion. The Company repurchased 1.7 million shares or $150 million in the quarter and declared its first dividend of $0.43 per common share. The Company issued in-line guidance for full-year 2021 with revenues coming in between $40.2 billion to $41.8 billion, up from $40 billion to $41.6 billion.

Conference Call Takeaways

Magna’s new CEO, Swamy Kotagiri, set the tone, “In the area of electrification, we're developing and bringing to market our largest generation - our latest generation of eMobility products and technologies. These cover a range of powertrain configurations and vehicle segments. We have received significant interest from many OEMs on these new products. In fact, we recently received a program award for our latest e-drive technology for an upcoming battery electric vehicle. Our opportunities in electrification extend beyond the powertrain.” He continued, “We have a strong competitive position in battery enclosures, a product that has significant technology and engineering content that is needed on every high voltage vehicle. We already have two program awards for this technology, and there is a lot more interest in the pipeline. In the area of autonomy, we have highlighted a program award for a driver monitoring system launching next year. Here, we are combining our experience in both cameras and mirrors to develop fully integrated systems.”

Recovery Disruptions

CEO Kotagiri stated that the first half of 2021 is seeing a recovery in global vehicle demand and auto production. The vehicle segment mix is shifting to light trucks in both North America and Europe. The weaker U.S. dollar is enabling a tailwind in the sales offset by the global chip shortage headwinds. They aren’t out of the woods yet, “We expect the chip shortage to continue to have an impact throughout the year. Supply issues-particularly in chemicals and resins are driving higher commodity costs for us in the remainder of the year. And the ongoing pandemic continues to impact the industry, including through stay-at-home orders and other restrictions. COVID remains a risk to the industry through this year.”

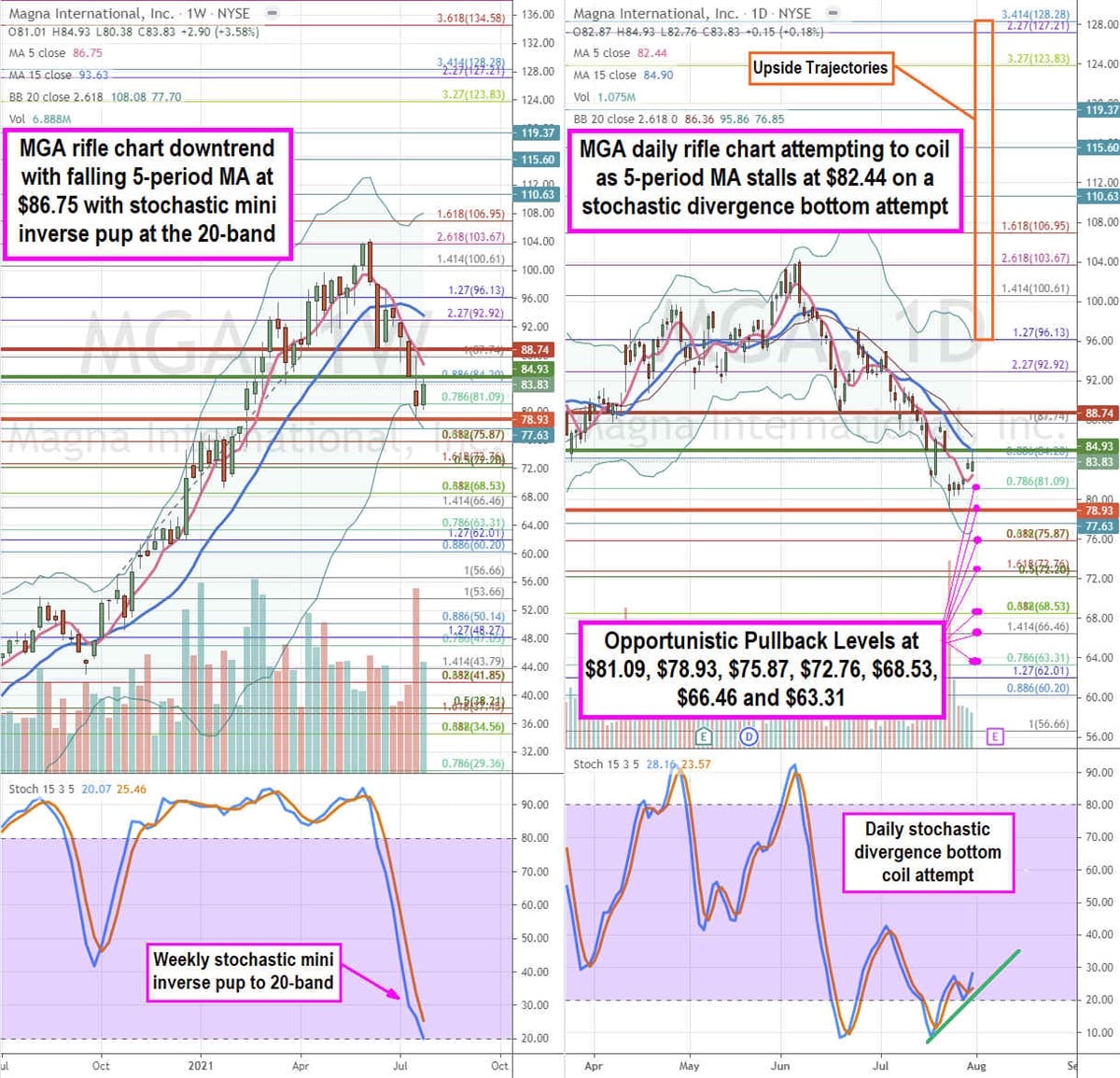

MGA Opportunistic Pullback Levels

Using the rifle charts on the monthly and weekly time frames provide a broader view of the price action playing field for MGA stock. The monthly rifle chart has been in a strong mini pup uptrend that is starting to peak out with the shooting star peak. The monthly upper Bollinger Bands (BBs) sit at $74.39 with monthly 5-period moving average (MA) is rising at the $59.82 Fibonacci (fib) level. The monthly and weekly rifles charts formed market structure low (MSL) buy triggers above $43.21 and $7.83, respectively. The weekly rifle chart peaked out at the $77.39 fib resistance causing the weekly stochastic to peak triggering a mini inverse pup under the weekly 5-period MA. The daily formed a market structure high (MSL) under the $72.35 trigger. Selling pressure on the weekly mini inverse pup can form opportunistic pullback levels at the $64.82 weekly 15-period MA/fib, $59.82 fib, $56.50 fib, $52.67 fib and the $47.89 fib. The upside trajectories range from the $80.19 to the $93.95 fib with further upside potential through $100.

Before you consider Magna International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Magna International wasn't on the list.

While Magna International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.