The BRICS are comprised of Brazil, Russia, India, China and South Africa and have a population exceeding 4.4 billion people. These are considered growing economies with abundant, rich natural resources. However, they also come with political instability and geopolitical tensions, as evidenced by the Ukraine war and trade tensions with China. Brazil is the fifth largest country by land mass and larger than the United States, occupying nearly half of South America.

Digital banking disruptor

Digitalization is spreading rapidly in Brazil, with over 75% of the population having internet access. Mobile internet penetration is at a whopping 95%, making it the fifth most mobile-first country worldwide, just ahead of Russia and behind the United States. E-commerce will grow to generate over $130 billion in sales in 2023, indicating the adoption of online shopping. This naturally leads to the growth of digital banking. One of the leading disruptors of digital banking is Nu Holdings Ltd. NYSE: NU. While not a direct benefactor of the whole BRIC economy, it has become the dominant digital banking platform for Brazil and Latin America as a member of the financial services sector.

Nu Holdings

Nu Holdings is based out of San Paulo, Brazil. It provides a digital banking platform and digital financial services primarily in Brazil, Mexico and Columbia. Like Sofi Technologies Inc. NASDAQ: SOFI, its products are coined Nubank services accessed through the Nu app, a one-stop shop for all things financial. NuAccount customers can access money transfers, personal loans, insurance, buy-now-pay-later services, bill pay and personal and business accounts. NuInvest provides access to investment services from equities, ETFs, and options to fixed-income products.

NuCrypto provides access to cryptocurrencies. Nu serves nearly 90 million customers, fostering access to financial services across Latin America. Nu has grown into the fifth-largest financial institution in Latin America. The company has provided over five million people with their first credit card. It has over 12 million active investment customers, one million insurance policies, and 10.5 million active Nucoin customers.

Gangbuster growth

On November 14, 2023, Nu Holdings released its third-quarter 2023 results for the quarter ending September 2023. The company reported an earnings-per-share (EPS) profit of 6 cents versus consensus analyst estimates for a gain of 5 cents, a 1-cent beat. Net income surged to $303 million. Gross profits expanded to $915 million, up 100% YoY. Gross profit margin expanded to 43%, up from 33% YoY. Revenues surged 53% to $2.1 billion, beating analyst estimates of $2.05 billion.

Solid growth metrics

Nu had an interest-earning portfolio of $6.7 billion, whose total deposit rose 26% to $19.1 billion. Its loan-to-deposit ratio rose to 35%, up from 25% in the year-ago period. The company added 5.4 million new customers and 18.7 million YoY for a total of 89.1 million customers. Monthly average revenues-per-active-customer (ARPAC) reached a new milestone, growing 18% YoY to $10.00. In Brazil, Nu has 84 million customers, accounting for 51% of the country's adult population, making it Brazil's fourth largest financial institution.

Credit card holders rose to 39 million, NuAccount holders rose to 65 million, and personal loan holders rose to 7 million. Nu is the largest digital investment platform in Latin America. The company expanded its portfolio of products in the quarter, rolling out payroll loans for federal public servants, retired and pensioners who are beneficiaries of the INSS and FGTS-backed loans.

CEO Insights

Nu Holdings CEO David Velez noted that the pace of its customer growth over the past 12 months outpaced the five largest incumbent banks combined, averaging over 1.5 million monthly new accounts. Over 50% of Brazil's adult population is part of its customer base. Velez noted, "This level of scale allows us to aggregate both structured and unstructured data, which becomes an invaluable competitive asset as we currently accumulate over 30,000 data points on each active customer annually. And this is growing exponentially over time."

He continued, "Through harnessing cutting-edge technology, we've transformed this data into actionable intelligence, continually enhancing our credit underwriting and customer insights models." The momentum experienced in the past year is a direct result of the flywheel accelerating. He stated that their Brazilian operation's excess cash alone could cover 3.1X the required capital for Brazil.

Nu Holdings analyst ratings and price targets are at MarketBeat. Nu Holdings peers and competitor stocks can be found with the MarketBeat stock screener.

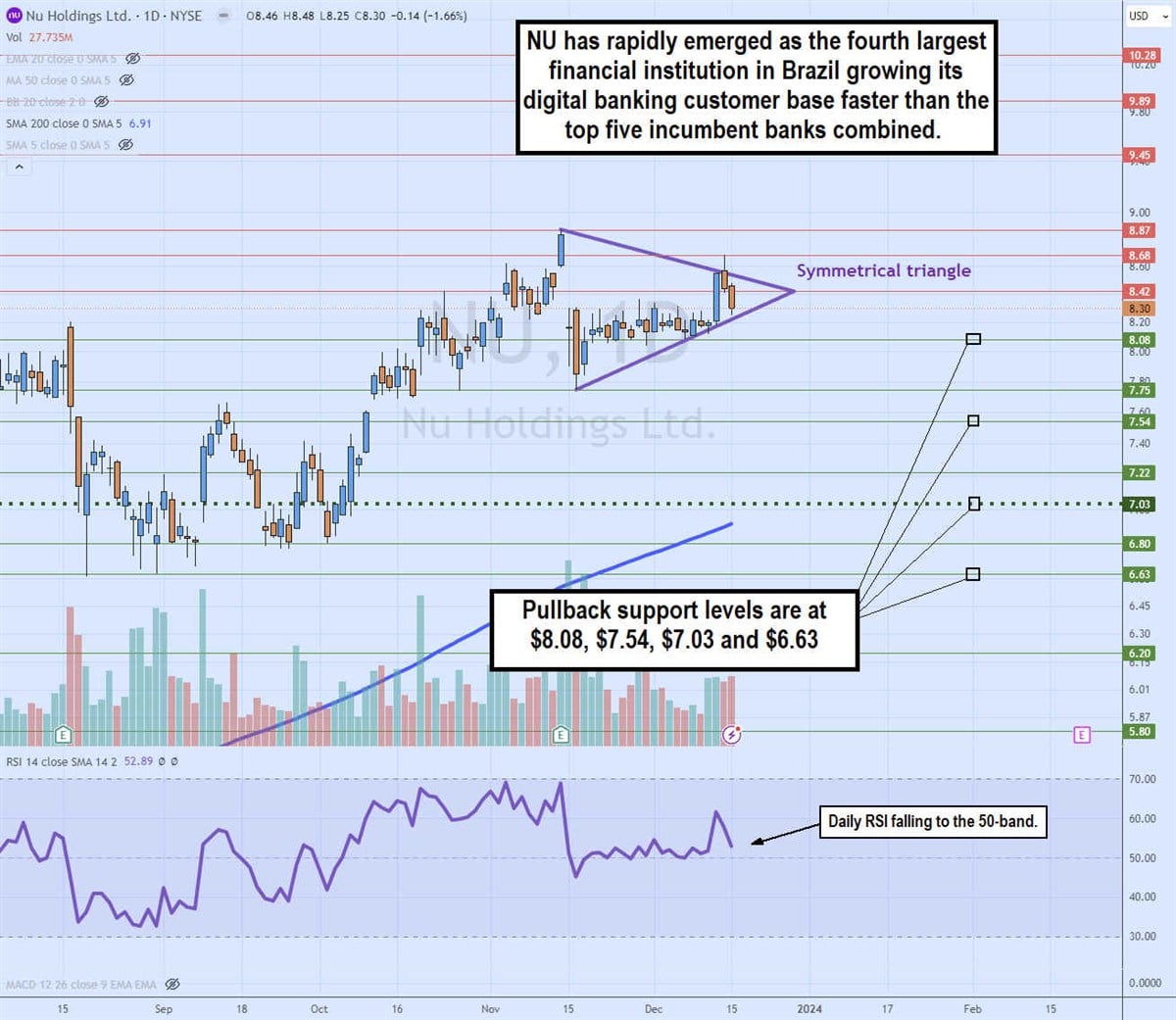

Daily symmetrical triangle

The daily candlestick chart for NU illustrates a symmetrical triangle pattern. The upper descending trendline commenced after peaking at $8.87 on November 14, 2023. The lower ascending trendline commenced after bottoming at $7.75 on Nov. 16.2023. As NU nears the apex, it will eventually break out through the upper trendline or break down through the lower trendline. The daily 200-period moving average support is rising at $6.91. The daily relative strength index (RSI) peaked at the 70-band upon the formation of the descending trendline and has been chopping between the 50-band and 60-band. Pullback support levels are at $8.08, $7.54, $7.03 and $6.63.

Before you consider NU, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NU wasn't on the list.

While NU currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.