Nu Skin Enterprises NYSE: NUS

Nu Skin Enterprises NYSE: NUS climbed nearly 25% on massive volume during the final trading session before the long July 4

thweekend. Shares of the personal care and wellness products company moved in response to an update to its Q2 guidance; it now expects $603 to $608 million in revenue for the quarter. Nu Skin’s previous forecast called for $520 to $550 million in Q2 revenue.

The company did not offer any profitability estimates or update its full-year guidance. However, as of its Q1 2020 earnings release, Nu Skin expected $2.17 to $2.26 billion in revenue and $2.05 to $2.35 in EPS for the full-year 2020.

There’s a lot to like with Nu Skin, starting with its business model.

Operations

Nu Skin derives most of its revenue from three brands:

- Nu Skin – beauty and personal care

- Pharmanex – nutritional products

- ageLOC – anti-aging

The company’s digital strength has allowed it to withstand the effects of the pandemic, with online orders now making up more than 80% of sales.

Nu Skin actually sells its products primarily through a person-to-person sales network. Many individuals, in addition to buying and using Nu Skin products, resell them to others. These sellers also recruit and train new sellers.

As a result, selling expenses are nearly 40% of revenue.

The pandemic should only make it easier for Nu Skin to acquire low-cost online sales agents across the world, as people should be more open to side hustle opportunities in a weak economy.

And while the company’s bump in guidance was largely attributed to “strong global customer growth with particular strength in the Americas and Europe,” a better outlook in China provides a reason for optimism.

China

China accounts for around 30% of Nu Skin’s revenue.

While China has clearly struggled with the coronavirus pandemic, its overall cosmetic sales data is encouraging.

Retail sales of cosmetics fell to 22.3 billion yuan in April but jumped to over 27 billion yuan in May. For comparison, the 27+ billion-yuan level is close to the 2019 average.

Dividend and Share Repurchase

A lot of companies have canceled their dividends in the wake of the pandemic, but Nu Skin has bucked the trend, paying out $20 million last quarter. Furthermore, Nu Skin has increased its dividend every year for 19 years. Its payout of nearly 3.5% is even more attractive considering our low-yield environment.

Since August 2018, Nu Skin has been buying back its shares. The authorization limit is up to $500 million, a sizeable amount for a company with a market cap of just over $2 billion. To this point, Nu Skin has used around $90 million of that authorization.

Valuation

Nu Skin is trading at just over 18x projected 2020 earnings.

At first glance, this number looks great for a strong company that is thriving during the pandemic.

But you’re not getting much growth with Nu Skin. Annualized revenue growth is just over 1% over the past three years, and earnings are down a little over 3% annually over the same period. The company is expected to grow a bit in 2021 and has a 2021 P/E of under 16x, but Nu Skin doesn’t seem like a company that can go on a tear and see double-digit annual growth for 3-5 years.

All that said, the valuation and yield are very solid in the current marketplace.

Now let’s look at possible entry points.

Technicals

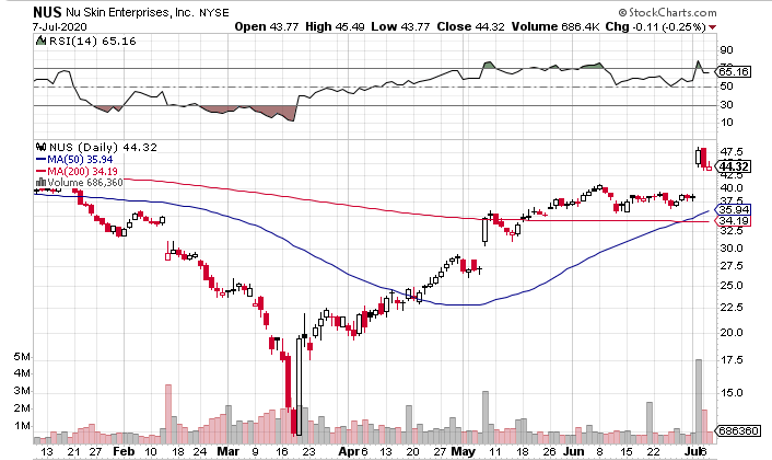

Nu Skin briefly plunged to just over $12 a share in mid-March before quickly recovering to over $20 a share.

In mid-May, shares broke above the 200-day moving average and spent six weeks basing between around $35 and $40. Volume was light and moves were controlled, showing that investors were holding tight after the big move off the lows. Thursday’s move sent shares all the way to $48 and now they’ve pulled back a bit to the mid $40s to start this week.

The 50-day moving average crossed over the 200-day moving average in late June, a bullish signal. On Thursday, shares moved into overbought territory on the RSI, but have moved towards neutral territory over the past two trading sessions.

While Thursday’s move sent shares to a 2020 high, there is still a lot of resistance overhead. The stock spent most of 2019 trading above current levels, hitting $80 a share late last summer.

So where does that leave you?

If you want a nice entry point, I would look for a pullback to around $40 a share. This would represent a retest of the recent breakout and it’s possible the 50-day moving average will meet it at those levels (or at least get closer).

On the other hand, NUS shares aren’t too extended right now. And as started earlier, it’s a good buy at current levels from valuation and yield standpoints. There’s always the risk that a stock won’t provide an ideal entry point, and it might be worth it to pick up some Nu Skin shares now.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report