Strong Tailwinds Support NVIDIA

NVIDIA NASDAQ: NVDA, and the entire chip industry, has been in the market's crosshairs for months. The growing inventory crisis in the microchip industry is causing supply chain disruptions for many businesses but driving robust revenue gains for chipmakers. Simply based on the current demand for microchips, it could be several quarters and up to a year before the supply of chips is flush again. If you add in the rapidly expanding EV market, growing use of mobile devices, and the accelerated shift to digitization driven by the pandemic it could be several years before the chip manufacturing industry catches up with the market. That is going to drive big gains for NVIDIA and other chipmakers and that is already evident in the data.

A Blowout Quarter For NVIDIA Really Means Something

NVIDIA posted a blowout quarter and that is saying something. The consensus estimate for Q2 earnings is up more than 20% since the first of the year and set a high bar for the company to beat. NVIDIA reported $6.51 billion in net consolidated revenue and beat the consensus by 260 basis points. The beat is large but revenue is up 68.2% over last year and that is no easy comparison because last year's fiscal Q2 sales grew 50%. On a two-year basis, NVIDIA's revenue is up more than 152% and is driven by secular strength within the microchip industry.

On a segment basis, the company reports record results in three of its most important operating units. The gaming segment, which is the largest segment, grew 85% over last year while the data center segment grew by 35%. The data center growth is noteworthy because that market slacked off over the past year and is now picking back up. Professional visualization, a small but quickly growing segment, saw its revenue grow by 156% while the automotive segment grew by 37%. The only area of weakness was in sales to cryptocurrency miners but we are not worried about that.

Moving down the report, the company experienced a significant and robust margin expansion due to sales leverage and internal efforts to improve profitability. The GAAP earnings of $0.94 beat the consensus by $0.12 and are up 276% from last year. The adjusted earnings are equally strong at $1.04 and beat the consensus by $0.02. The most important factor is that revenue strength and earnings are driving strong cash flow which has allowed the company to nearly double its capital position since the first of the year.

As for guidance, the company is expecting revenue strength to continue accelerating into the next quarter. The company is guiding the market to $6.80 billion in net revenue for a sequential gain of roughly 450 basis points. This also betters the consensus by about 450 basis points and is compounded by an expectation for widening margins.

The Analyst Are Extra Bullish On NVIDIA

At least 10 major sell-side analysts have come out with commentary on NVIDIA in the wake of the Q2 earnings report. None included a rating upgrade but 9 of the 10 included price target increases that have the stock trading in the range of $230 to $235. That's worth a gain of roughly 23% and compares to the broader consensus of only $200 or about 6% upside. Oddly enough, 1 of the 10 analysts downgraded NVIDIA from neutral to sell and we think that's a mistake.

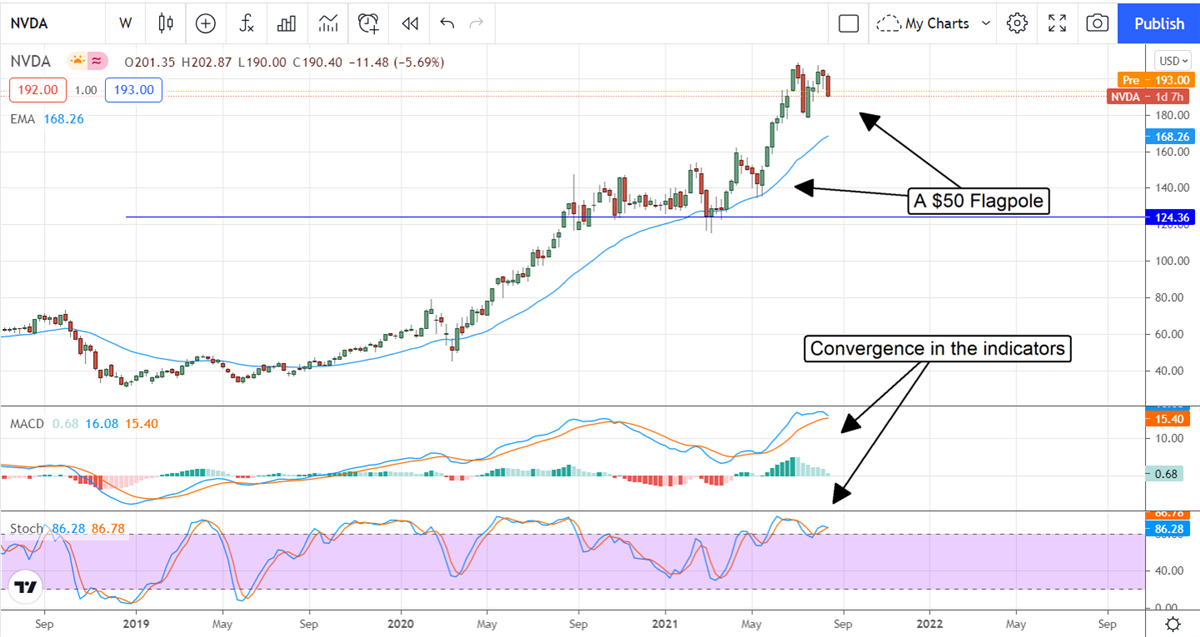

On a technical basis, the $230 price target should be easy to reach. The price action appears to be forming a bullish flag that, if confirmed, could add $50 to the price if not more. That puts the target at $240 or more than 26% upside and we see that happening before the next earnings report.

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.