Having watched shares drop as much as 12% from all-time highs in recent weeks, investors of Nvidia (

NASDAQ: NVDA) got a big boost last night when the chipmaker released their Q4 earnings. GAAP EPS came in at $2.31, a full $0.33, or 15%, higher than what

analysts were expecting. Topline revenue was also hot and showed year-on-year growth of 60%. It was by any measure a stellar report for the $350 billion company whose shares have rallied well over 200% in the past year.

Founder and CEO Jensen Huang didn’t hold back when he said “Q4 was another record quarter, capping a breakout year for NVIDIA’s computing platforms. Our pioneering work in accelerated computing has led to gaming becoming the world’s most popular entertainment, to supercomputing being democratized for all researchers, and to AI emerging as the most important force in technology. Demand for GeForce RTX 30 Series GPUs is incredible. NVIDIA RTX has started a major upgrade, and our A100 universal AI data center GPUs are ramping strongly across cloud-service providers and vertical industries.”

The Smartphone Moment

All of this will be music to the bull’s ears as Nvidia enters what Huang called “the smartphone moment” for the industry. There was bullish guidance issued too for Q1, with a forecasted revenue of $5.3 billion set to outdo the $5.0 billion they’ve just logged.

Like for many tech companies, the COVID pandemic shift to a work-from-home economy was a blessing in disguise for Nvidia. Their Gaming and Data Center lines have done particularly well here and both logged a record quarter and full year revenue in Wednesday’s report. Investors will be hoping for more of the same as we head into 2021.

Nvidia’s GPUs are flying off the shelves again as cryptocurrencies find themselves in yet another bull market and miners go to work. Investors saw in 2018 just how much of an impact this surge in demand can have on the topline numbers and much of the recent rally in Nvidia shares has been underpinned by what the likes of Bitcoin and Ethereum have been doing. Only earlier this week the company announced plans for new graphic cards that would be designed specifically for mining cryptocurrencies.

Next Steps

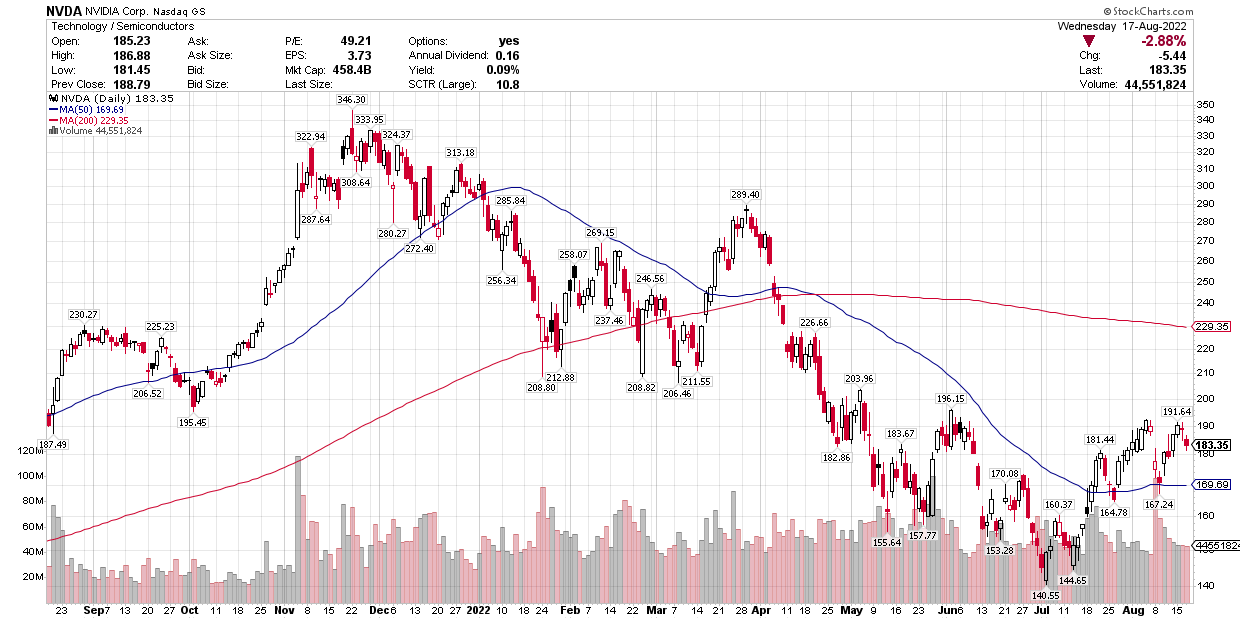

For all this though, shares were trading down 3% in Thursday’s pre-market session. It could be that this is a ‘buy the hype, sell the news’ kind of event, and if so, it’s good news for those of us still on the sidelines. Nvidia has been a dream tech stock to own in recent years and while it offers investors a fair amount of volatility, that’s a small price to pay for a company whose shares have jumped almost 2,000% in just half a decade.

A price-to-earnings ratio of 84 could well be considered high, but again a triple-digit billion-dollar company that’s still growing revenues by 60% can handle a bit of froth. Investors willing to buy into the long-term potential here should watch for any continued weakness to run into some solid support around the $500 mark. That would make for a fairly attractive entry point before shares turn back north and head for the blue sky territory they’ve become so used to.

One of the biggest issues the company has this quarter is making sure they have enough product to sell. There are some concerns about supply being able to meet demand with inventory already stretched thin. But in the grand scheme of things, isn’t that one of the best kinds of problems to have?

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.