Nvidia Corporation's NASDAQ: NVDA earnings have garnered widespread anticipation in the market, attracting keen interest from investors and speculators. This year, the company's impressive growth and incredible stock appreciation solidified its position within the sector, industry and multiple ETFs.

Consequently, the fluctuations in its earnings report and subsequent share volatility could significantly affect relevant sectors, such as the technology sector and several individual semiconductor stocks, exerting substantial influence on the market landscape.

Nvidia stands out as the beloved stock of 2023. Highly regarded by analysts, it has consistently featured on the most-upgraded stocks list and earned a prestigious spot on the top-rated stocks list. The stock's widespread popularity is evident through its status as one of the market's most searched and closely followed stocks.

It won’t come as a surprise to hear that NVDA once again crushed its earnings as the AI chip craze continues.

Nvidia crushes earnings once again

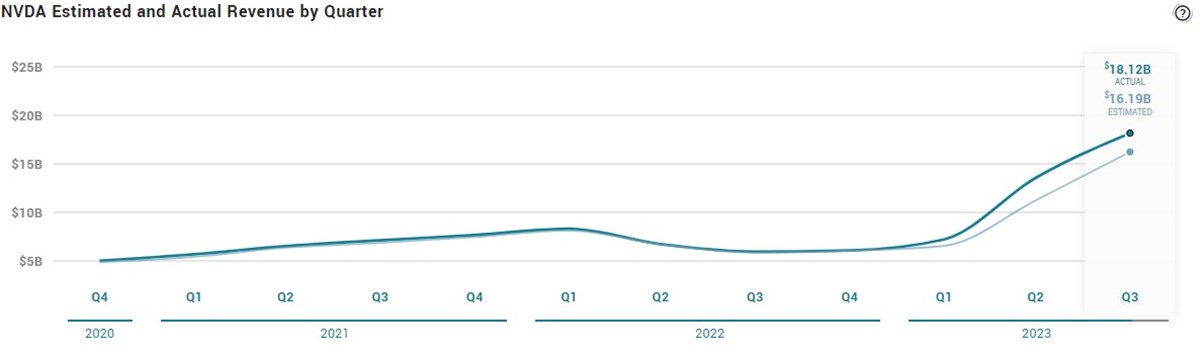

Nvidia reported impressive quarterly earnings, surpassing expectations with adjusted earnings at $4.02 per share compared to a consensus of $3.01 per share.

The company's revenue soared to $18.12 billion, exceeding the anticipated $16.19 billion. Revenue surged by 206% year-over-year, and net income hit $9.24 billion or $3.71 per share, a substantial rise from the previous year's $680 million.

Data center revenue surged to $14.51 billion, exceeding projections of $12.97 billion, with half coming from cloud infrastructure providers like Amazon. The gaming segment also performed well, contributing $2.86 billion, surpassing the expected $2.68 billion.

Nvidia's guidance for the fiscal fourth quarter anticipates reaching $20 billion in revenue, indicating a staggering 231% revenue growth projection.

Export restrictions will impact Q4 sales in China

Due to export restrictions, Nvidia anticipates a downturn in sales to specific regions, such as China, which could negatively impact the next quarter's performance. Colette Kress, Nvidia's finance chief, stated the company anticipates a substantial decline in sales to these destinations in the fourth quarter of fiscal 2024.

However, Kress remains optimistic, expecting robust growth in other regions to offset these declines.

Nvidia is engaging with clients in China and the Middle East to secure U.S. government licenses for high-performance product sales. It is also exploring developing new data center products compliant with government policies, but these efforts might yield little results in the upcoming fiscal fourth quarter, according to Kress.

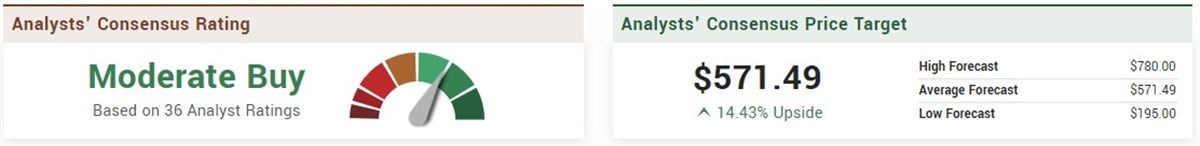

Analysts see a double-digit upside ahead

Analysts strongly prefer Nvidia, elevating its status among the most upgraded and top-rated stocks in the market. Out of 36 analyst ratings, NVDA maintains a "moderate buy" rating, with 32 "buy" ratings and two "strong buy" ratings. Notably, the consensus price target of $571.49 indicates an impressive nearly 15% potential upside, a significant figure given Nvidia's substantial market cap of $1.23 trillion as of the previous trading day's close.

For now, analysts continue to be correct, with shares of NVDA trading higher in pre-market at $505 following its earnings release yesterday. Going forward, and from a technical analysis perspective geared for the short term, it will be important for the stock to base above its rising five-day simple moving average (SMA) if the momentum is to continue to the upside. If the stock breaks below that and its immediate $490 support, a pullback will be underway, with the rising 20-day SMA potentially acting as the first target.

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.