Retail e-commerce and cryptocurrency platform

Overstock (NASDAQ: OSTK) shares have rallied nearly 1000% off its COVID-19 pandemic lows of $2.53 on March 18, 2020. The stock embodied a perfect storm of narratives as the pandemic beneficiary from online retail sales and a cryptocurrency play rallying with bitcoin. The Company also highlighted the 120% April sales growth year-over-year (YoY) which further propelled shares to YTD highs. With the top players in the retail e-commerce space pulling up the lower-tiered stocks, Overstock shares were pulled up riding the same momentum providing investors an opportunity to take profits before the liquidity and volume dry up again.

Q1 2020 Earnings Release

Overstock released its Q1 2020 earnings on April 30, 2020. The Company reported a loss of (-$0.40)-per share beating a single analyst estimate of (-$0.63)-per share by +$0.23-per share. Revenues were $351.6 million beating analyst estimate of $332.3 million, but down (-4.4%) YoY. The Company stated they saw a surge in online retail sales by 120% in April YoY and new customer growth of 65% year-to-date (YTD). They also indicated they were #5 on the list of the top U.S. Home Furnishings Online Brands behind Target (NYSE: TGT), Walmart (NYSE: WMT), Wayfair (NASDAQ: W) and Amazon (NASDAQ: AMZN) at the top of the list.

E-Commerce Momentum Peaking

The share price explosion can be attributed to being lumped in for the momentum ride up fueled by the online e-commerce retailer surge momentum lead by Wayfair and Shopify (NASDAQ: SHOP) . Like many of the pandemic plays, companies benefiting from stay-at-home isolation mandates, Overstock’s acceleration of online furniture sales will likely be short-lived. Even the Company can’t provide visibility in regard to sustaining the top-line growth in the legacy e-commerce business. Sustainability is questionable at best as cities relax isolation restrictions and re-open for business. The other justification for the inflated share prices may rest in their blockchain portfolio of projects.

Blockchain Hype and Hope

Overstock reported there was little to no disruption at tZERO and subsidiaries or any of the Medici Ventures blockchain companies. Perhaps, because there was not much activity to disrupt in the first place. Overstock has been investing in blockchain through Medici holding stakes in 18 blockchain projects/companies generating little to no revenues. The tZero is an alternative trading system (ATS) in the same vein as ARCA, ISLD, INCA and various dark pools. However, tZero aims to enable trading beyond securities but also digitized assets ranging real estate to private companies. Assets would need to be tokenized. In collaboration with BOX Digital, tZero is seeking SEC approval to operate the Boston Security Token Exchange (BSTX) which would enable trading in digital security tokens. As of April 1, 2020, the SEC has delayed approval for further review. The Company is distributing Preferred A-1 shares as a dividend to be paid out on May 19th. The only catch is that these shares trade exclusively on the tZero ATS, which is currently only accessible with an account at Dinosaur Financial Group. Convoluted, to say the least. While the hyped scenario sounds grand, the reality is that any ATS requires an abundance of liquidity and participants to be relevant. SEC approval is highly doubtful based on its prior enforcement against initial coil offerings (ICOs). Investors holding OSTK shares may want to cash out or trim down holdings while shares are still floating on hype and hope, before reality and gravity set in.

OSTK Trajectory Levels

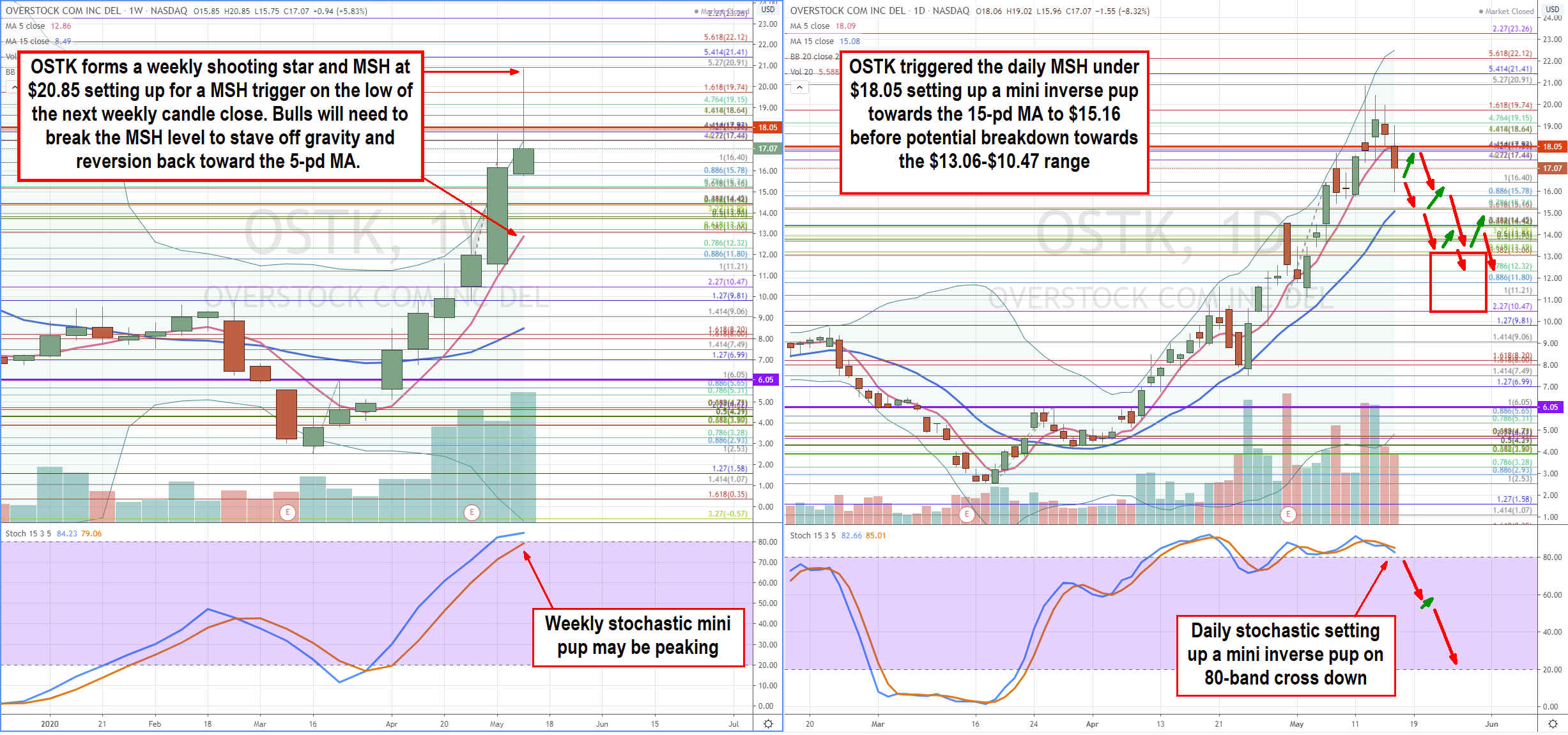

Using the rifle charts on the wider time frames including the weekly and daily to lay out the playing field is suitable for swing traders and investors. The weekly market structure low (MSL) triggered above $6.05 on April 6th powered a six-week rally of higher highs on a stochastic mini pup peaking with a shooting star weekly candle close setting the market structure high (MSH) price at $20.85. This week’s candle close will set the weekly MSH trigger, which will be the weekly candlestick low. The daily MSH triggered on the $18.05 breakdown on May 17th as the daily stochastic formed a mini inverse pup with the 5-period moving average (MA) overlapping the trigger. The initial downside trajectory is the $15.16 Fibonacci (fib) level which overlaps with the daily 15-pd MA. Further overshoots may push shares to the weekly 5-period MA near the $13.06 fib for a bounce on the weekly mini pup. Ultimately, the daily make or break will determine if shares head back down to the $12.32 to $10.47 monthly 15 and 5-period MA/fib range supports or muscle back up towards the $23.26 gatekeeper upside fib. Traders can play coils off each overlapping fib/moving average bumper, but investors may want to take advantage of the lofty share prices to unwind positions before the momentum evaporates.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.