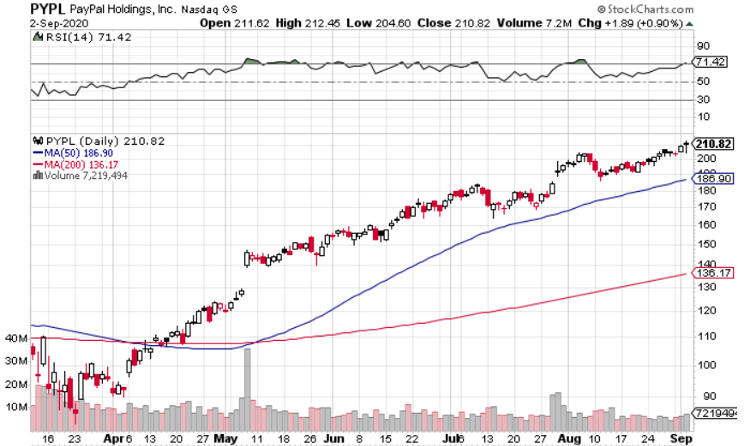

PayPal NASDAQ: PYPL has been a constant presence on the all-time high lists since May, and it looks set for more of the same in September.

After spending the month of August range-bound between around $186 and $204, shares have set all-time highs in each of the first two days of September.

PayPal has been one of the biggest pandemic winners, benefiting greatly from the shift to e-commerce and contactless payments.

The electronic payments giant is coming off a record quarter – but isn’t resting on its laurels.

A Record Q2 2020

PayPal reported record numbers in Q2, beating earnings and revenue expectations. Here are some of the highlights:

- Total payment volume (TPV) of $222 billion was up 28% yoy, even greater than the 18% yoy growth in Q1.

- Reported a record 21.3 million net new active accounts.

- Transactions on PayPal checkout experiences grew 40% yoy.

- Venmo’s TPV increased 52% yoy to $37 billion.

In addition to the blockbuster Q2, PayPal raised its guidance for the second half of 2020:

“Our updated full-year outlook is a significant raise relative to our prior guidance for revenue, earnings, and free cash flow. For the back half of the year, our overall expectations are the TPV and revenue will perform in line with the second quarter with 30% volume growth, and 25% revenue growth on a currency-neutral basis. We also believe non-GAAP EPS will grow approximately 25% on a spot basis in both Q3 and Q4, based on the strong leverage we're are seeing, and our investment plans. As a result of these expectations for the full year on a currency-neutral basis, we now expect TPV to grow in the high 20s percentage range, and revenue to grow approximately 22%.”

PayPal Isn’t Resting on Its Laurels

Earlier this year, PayPal launched in-store payments via QR code, which facilitate contactless transactions.

On the Q2 earnings call, CEO Dan Schulman talked about PayPal’s progress on that front:

“For instance, we are working with CVS Pharmacy to enable PayPal and Venmo QR codes for payment at their cash registers, and we expect a full national rollout to their 8,200 stand-alone store locations by the end of the year. Our merchants and our consumers want us to expand in-store, and we will not let this opportunity pass us by.”

And just a few days ago, PayPal introduced a new installment credit option for its users, dubbed “Pay in 4.”

The service will allow customers to pay for its purchases, interest-free, over four separate payments.

“Pay in 4” will compete with similar services from Klarna, AfterPay, Affirm and others. However, unlike with some of the other services, merchants won’t have to pay more to add the offering – it will be included with the merchant’s existing PayPal package. And after the initial payment, “Pay in 4” will automate the remaining three payments, decreasing the chances of forgotten payments and late fees.

Growth at a Reasonable Price

PayPal is trading at around 56x forward earnings and 11.6x forward sales.

That looks a bit steep at first glance, but this is a company with a history of growth – and more to come.

Over the past five years, PayPal has routinely seen revenue growth of 15-20% annually. While the growth rates from the pandemic don’t look sustainable, PayPal is projected to see revenue growth of around 18-19% in each of the next two years. And EPS is expected to grow even faster, at nearly 22% in each of the next two years.

Chart is Extended… But Don’t Split Hairs Over Entry Point

In a perfect world, you would get a nice 3-month base followed by a convincing breakout.

But PayPal is an excellent value in the low $200s, so I wouldn’t insist on a perfect entry point.

The fact of the matter is, the most dynamic stocks in the market aren’t going to move sideways for a few months. PayPal has become a dominant player in the payments industry and shares look to have more room to run.

So I’d overlook the average volume on the September moves to all-time highs and the cross-over into overbought territory on the RSI, and look to pick up some shares now.

I usually recommend placing a stop-order within 10% of your purchase price. With PayPal, a stop below the 50-day moving average would be just a little more than 10%.

That said, the 50-day moving average is quickly climbing. So unless PayPal quickly plummets 25+ points – which is unlikely – you can move that stop-order up over time. And lower your downside even more.

Before you consider PayPal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PayPal wasn't on the list.

While PayPal currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.