Digital payment solutions provider

PayPal Holdings, Inc. (NASDAQ: PYPL) has been an innovator and disruptor in the payment processing industry. Innovations range from acquiring leading peer-to-peer payment app Venmo, browser extension coupon app Honey to launching PayPal Working Capital utilizing cutting edge adaptive analytics that bypass conventional credit history to extend loans to small businesses. Rather than waiting on hold when contacting a traditional bank call center during business hour, PayPal specialists contact you within a minute to engage in relevant support. Their world-class customer service reps are delegated the authority to fix problems on the spot. Customer loyalty has enabled growth to flourish at a 15% to 20% annual clip. PayPal excels where mainstream banks fall pathetically short. Compare less than one-minute wait times versus 15-minutes or longer wait times with bank call center customer service reps. PayPal becomes a compelling buy at opportunistic price levels.

PayPal COVID-19 Impact Minimal

On Feb. 27, 2020, PayPal reaffirmed Q1 2020 guidance of $0.76-0.78 vs. $0.78 consensus analyst estimates with revenues coming in between $4.78 billion-$4.84 billion vs. $4.83 billion estimates. The Company noted that while business trends remained strong, the international cross-border e-commerce activity has been negatively impacted by COVID-19 by “approximately one-percentage-point reduction”. They also noted that “stronger performance quarter-to-date across our diversified business is partially offsetting this one percentage point negative impact”. Based on this update, the impact is extremely minimal. There is also rumors that PayPal is “in talks with U.S. Treasury” about helping distribute stimulus checks (CARES Act), which would be a boon.

Here’s How PayPal Sets Itself Apart

Without warning, PayPal proactively deferred PayPal Capital Loan repayments for 30-days for small business clients in most affected COVID-19 areas on March 31, 2020. It also waived transfer fees, chargeback fees, as well as deferrals on business loans and cash advances at no additional costs. No muss, no fuss, no red tape. This is why the small business community is rigorously loyal to PayPal. You won’t see mainstream banks doing this. These acts of integrity will have tangible long-term effects in terms of customer trust and loyalty. This fosters the “stickiness” that is critical to cultivating the network effect as PayPal continues to grow its portfolio of products and services worldwide.

Actions Not Words Will Define New Leaders

Companies will bolster or tarnish their reputations during this COVID-19 pandemic. Building goodwill through proactive acts of integrity or fall short on shallow promises purposely complicating the process with red tape. Proactive acts of integrity demonstrated by public companies like Planet Fitness (NASDAQ: PLNT) stepping in front of the coronavirus ripple effects on its customer base by freezing all customer billings galvanize goodwill and loyalty. This is the opposite of companies like Town Sports International (NASDAQ: CLUB) that continued to bill clients and purposely complicated cancellation policies despite closing gyms during coronavirus spread sparking the ire of Attorney Generals in several states.

Opportunistic Buy Levels

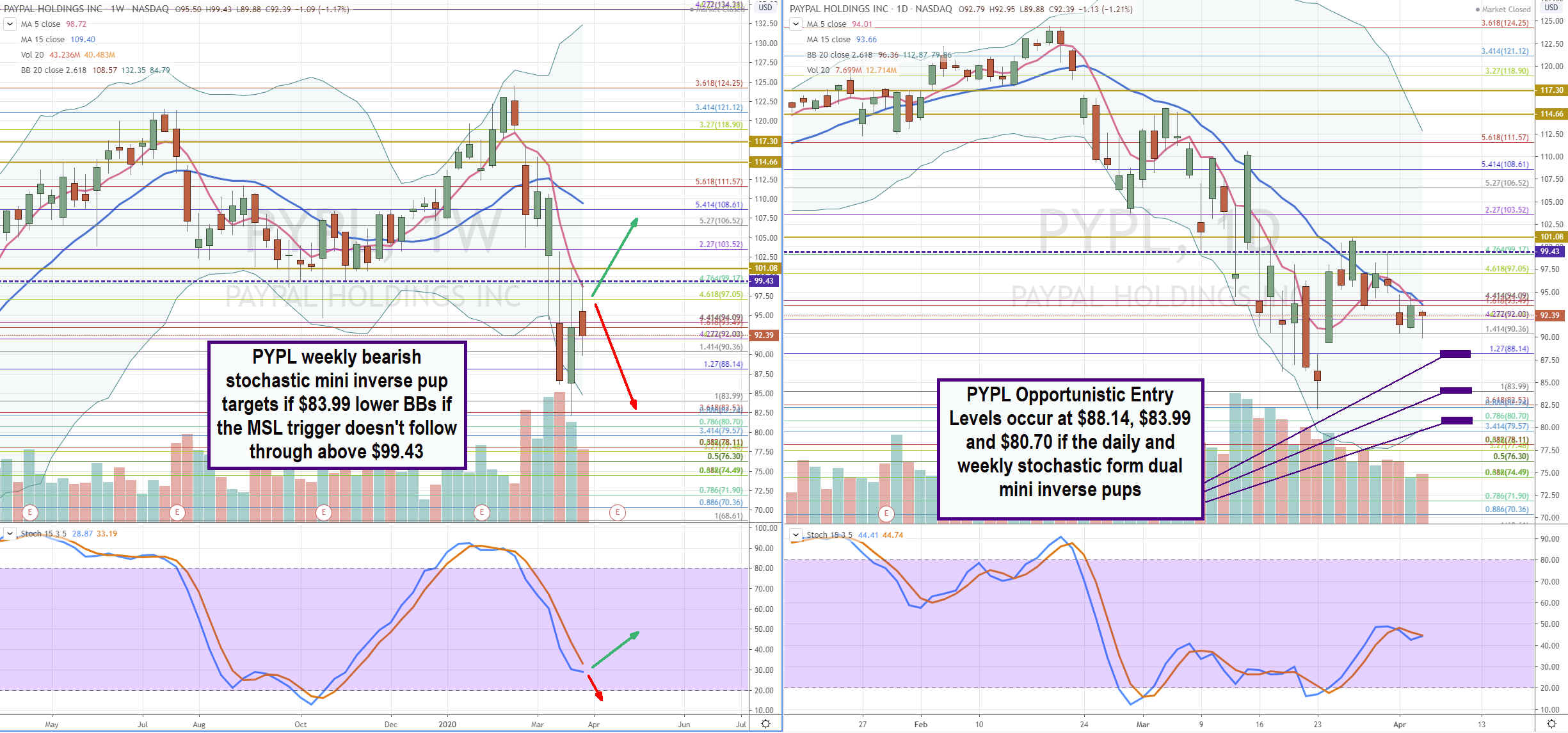

PYPL shares peaked at $124.45 all-time highs on Feb. 19, 2020, just before global financial markets got blindsided by the coronavirus black swan. PYPL proceeded to collapse (-34%) to $82.07 mirroring the (-34%) plunge in the S&P 500 (NYSEARCA: SPY) underscoring the fastest transition into a bear market in history. PYPL coiled to and rejected off $110.10. Using the rifle charts on weekly and daily time frames, we lay out the playing field suitable for swing traders and investors. The PYPL weekly chart formed a market structure low (MSL) trigger above $99.43. The weekly 5-period moving average (MA) rejected the bounce attempt at the $99.17 Fibonacci (fib) level setting up another weekly stochastic mini inverse pup which would target the $83.99 fib level and lower Bollinger Bands (BBs) if triggered. The daily chart has a make or break set-up with the potential to retest the $82.50 fib recent low if the daily stochastic mini inverse pup triggers with potential to the daily lower BBs near $80.70 fib. The combination of the weekly and daily mini inverse pups can trigger a hard rug pull to provide opportunistic entry levels at the $88.14 fib, $83.99 fib and $80.70 fib. Nimble traders can scalp longs off these levels and long-term investors may consider a dollar-cost averaging approach and add income generation through writing covered calls.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.