PepGen Inc. NASDAQ: PEPG is a clinical-stage biotech focused on developing therapies for rare neuromuscular and neurological genetic diseases like Duchenne muscular dystrophy (DMD). PepGen utilizes its proprietary enhanced delivery oligonucleotide (EDO) platform to create a pipeline of disease-modifying gene therapies.

The company competes with the leader in DMD gene therapies, Sarepta Therapeutics Inc. NASDAQ: SRPT. PepGen shares initially surged 50% and nearly doubled on the release of positive data from Sarepta's Phase 2 MOMENTUM study for SRP-5051. These medical sector companies are pushing the boundaries of healthcare for the 6,000 to 10,000 patients suffering from DMD in the United States and Europe.

Sarepta releases Phase 2 MOMENTUM study data.

On January 29, 2024, Sarepta released data for results from its Phase 2 MOMENTUM study for SRP-5051 (vesleteplirsen). Part B of the trial showed that SRP-5051 led to a mean dystrophin expression of 5.17% with monthly dosing at week 28.

DMD results from mutations in the DMD gene that disrupt the production of dystrophin, a crucial protein for muscular function. The lack of dystrophin results in muscle weakness and degeneration, leading to difficulty walking, falling, and losing control of motor skills, often confining children to wheelchairs. Muscles involved with cardiac and respiratory functions lead to breathing and heart problems, shortening lifespans to 18 to 25 years. Check out the sector heatmap on MarketBeat.

Exon skipping drugs for DMD

Ironically, shares of Sarepta gained just 1.49% the following day, while PepGen shares skyrocketed 50.76%. PepGen's PGN-EDO51 and Sarepta's SRP-5051 are exon-skipping therapies for DMD. This form of therapy seeks to correct the disrupted dystrophin gene by skipping exons (specific non-functional parts) during the mRNA processing, enabling the partial production of the protein. Specifically, both drugs target the exon 51 of the dystrophin gene to skip it and still allow for the production of a shortened but potentially functional protein. The primary goal of exon-skipping therapies is to slow the progression of DMD and improve quality of life.

Delivery mechanism differences

The difference lies in the delivery mechanism. PepGen's PGN-EDO51 uses conjugate delivery, which involves attaching the therapeutic antisense oligonucleotide (ASO) molecule to a carrier molecule to deliver to the targeted cell. SRP-5051 uses Peptide-Phosphorodiamidate Morpholino Oligomer(PPMO) technology. Attaching short peptides to PMOs enables them to penetrate muscle cells better and resist breakdown by enzymes better than traditional PMOs. Sarepta's SRP-5051 is RNA-targeted therapy for DMD. Get AI-powered insights on MarketBeat.

Hopes for an Accelerated FDA approval

Sentiment has improved for the potential of an accelerated FDA approval for its PGN-EDO51 experimental drug. Keep in mind that Sarepta has received accelerated FDA approval for its SRP-9001 (ELEVIDY) treatment for DMD. An accelerated FDA approval is granted to fast-track drugs filling an unmet medical need. They are for serious conditions, and approvals can be based upon a surrogate endpoint.

Wedbush chimes in

Wedbush released research notes indicating that Sarepta's results provide a positive read-through to PepGen's PGN-EDO51 DMD drug candidate. Its Phase 2 topline results are expected in mid-2024. A Wedbush analyst commented, "Preclinical comparisons demonstrate higher levels of exon-skipping/expression with PGN-EDO51 vs SRP-5051, at lower PGN-EDO51 doses. This would seem to bode well on the safety front for PEPG, assuming the clinical results translate." Wedbush maintains an Outperform rating with a $21 price target on PEPG shares.

PepGen analyst ratings and price targets are at MarketBeat. PepGen peers and competitor stocks can be found with the MarketBeat stock screener. PEPG has a 1.53% short interest.

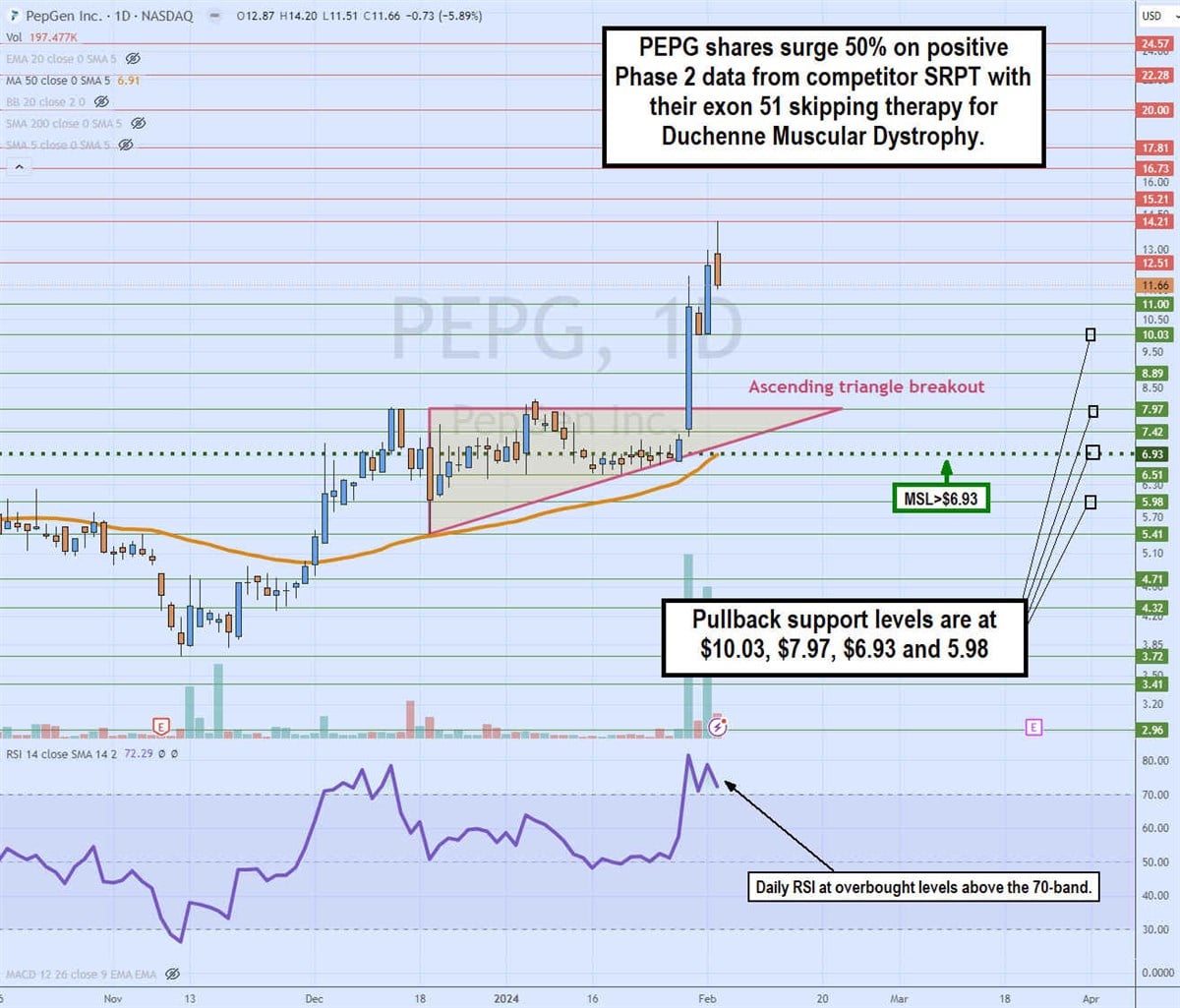

Daily ascending triangle breakout

The daily candlestick chart on PEPG illustrates a daily ascending triangle breakout pattern. The flat-top upper trendline resistance was at $7.97 versus the ascending lower trendline that commenced at $5.41 on December 19, 2023. The trading channel continued to compress as the daily market structure low (MSL) buy triggered the breakout through $6.93. The daily MSL trigger also overlaps with the rising daily 50-period moving average (MA) support. The massive volume surge occurred on January 30, 2023, on the SRPT Phase 2 clinical trial data as sentiment surged for PEPG's exon 51 skipping DMD therapy PGN-EDO51, which is due to report its data in mid-2024. The daily relative strength index (RSI) spiked through the overbought 70-band level. Pullback support levels are at $10.03, $7.97, $6.93 and $5.98.

Before you consider PepGen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PepGen wasn't on the list.

While PepGen currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.