Self-care health and wellness products make

Perrigo NASDAQ: PRGO stock has been recovering well off its $31.22

bottom. The bear market selling seems to have abated as the Company is uniquely positioned to gain during an inflationary cycle as evidenced by its market share gain during the last recession. Fiscal full-year 2022

headwinds are expected to rise by $125 million, up from $80 million.

Inflationary pressures, supply chain disruption, logistics, the

Russia Ukraine conflict in addition to unfavorable FX rate movements are pressuring margins. However, the Company has completed its self-care transformation and is focusing on its “Optimize and Accelerate” initiative driven by gross margin enhancement, supply chain reinvention and

raising prices. Perrigo expects margin expansion in the second half of 2022 making it a second half story play for investors. The Company saw 38% top line growth in the quarter driven by infant formula sales and gained five market share points. It continues to try to meet the overwhelming demand for infant formula to help fill shortages created by a competitor’s product recall. Shares are trading at 17.5X forward earnings with a 2.59%

dividend yield. Prudent investors looking to get in ahead of the second half expansion and a

recession hedge can watch for opportunistic pullbacks in shares of Perrigo.

Q1 Fiscal 2022 Earnings Release

On May 11, 2022, Perrigo released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an earnings-per-share (EPS) profit of $0.33 excluding non-recurring items versus consensus analyst estimates for a profit of $0.42, missing estimates by (-$0.08). Revenues rose 6.4% year-over-year (YoY) to $1.07 billion beating analyst estimates for $1.06 billion. The Company received its first FDA approval for over-the-counter Nasonex with U.S. launch expected in the Fall of 2022. Perrigo CEO Murray Kessler commented, "We delivered another quarter of very strong organic net sales growth as consumer demand driven sales again strengthened sequentially. The categories in which we compete are growing and remain on-trend, and the products in our portfolio that were most disrupted by the pandemic, including cough/cold, have rebounded. The strong performance of our U.S. infant formula business, which benefited from innovation and availability while a competitor experienced quality issues, was also notable."

Fiscal Full-Year 2022 Guidance

Perrigo updated its guidance for fiscal full-year 2022 EPS to come in between $2.30 to $2.40 versus $2.52 consensus analyst estimates, up from its $2.10 to $2.30 prior guidance. The guidance reflect $0.35 from HRA acquisition, offset by $0.10 in unfavorable exchange rate movements, $0.05 halting distribution in Russia, and $0.05 in high interest expense for refinancing. Revenues are expected to grow 8.5% to 9.5%, up from 3.5% to 4.5%. Perrigo is also raising its organic sales growth guidance to 8% to 9% from 7% to 8%. The Company expects 1H 2022 margin compression which should turn into expansion in the second half of the year.

Conference Call Takeaways

CEO Kessler announced that the Company has completed its three-year transformation into a self-care company and moving into the optimizing and accelerating phase. This is driven by three cornerstones including improving its self-care platform through supply chain reinvention, successfully integrating its HRA Pharma acquisition and bolstering its gross margin recovery through pricing and portfolio consolidation. The Company closed its HRA Pharma acquisition nearly two months ahead of schedule for $1.9 billion, a (-$200 million) discount from its originally anticipated cost. HRA grew 21% in 2021 with robust gross margins north of 70%. In the fiscal Q1 2022, EBITDA HRA Pharma rose 77% YoY and expected to be much stronger in the second half of the year. The Russian Ukraine conflict has a (-$0.02) impact on EPS for the quarter which would have been $0.37 on a currency neutral basis. Its nutrition business grew 38% top line driven by infant formula. The Company received FDA approval for OTC Nasonex.

PRGO Opportunistic Pullback Levels

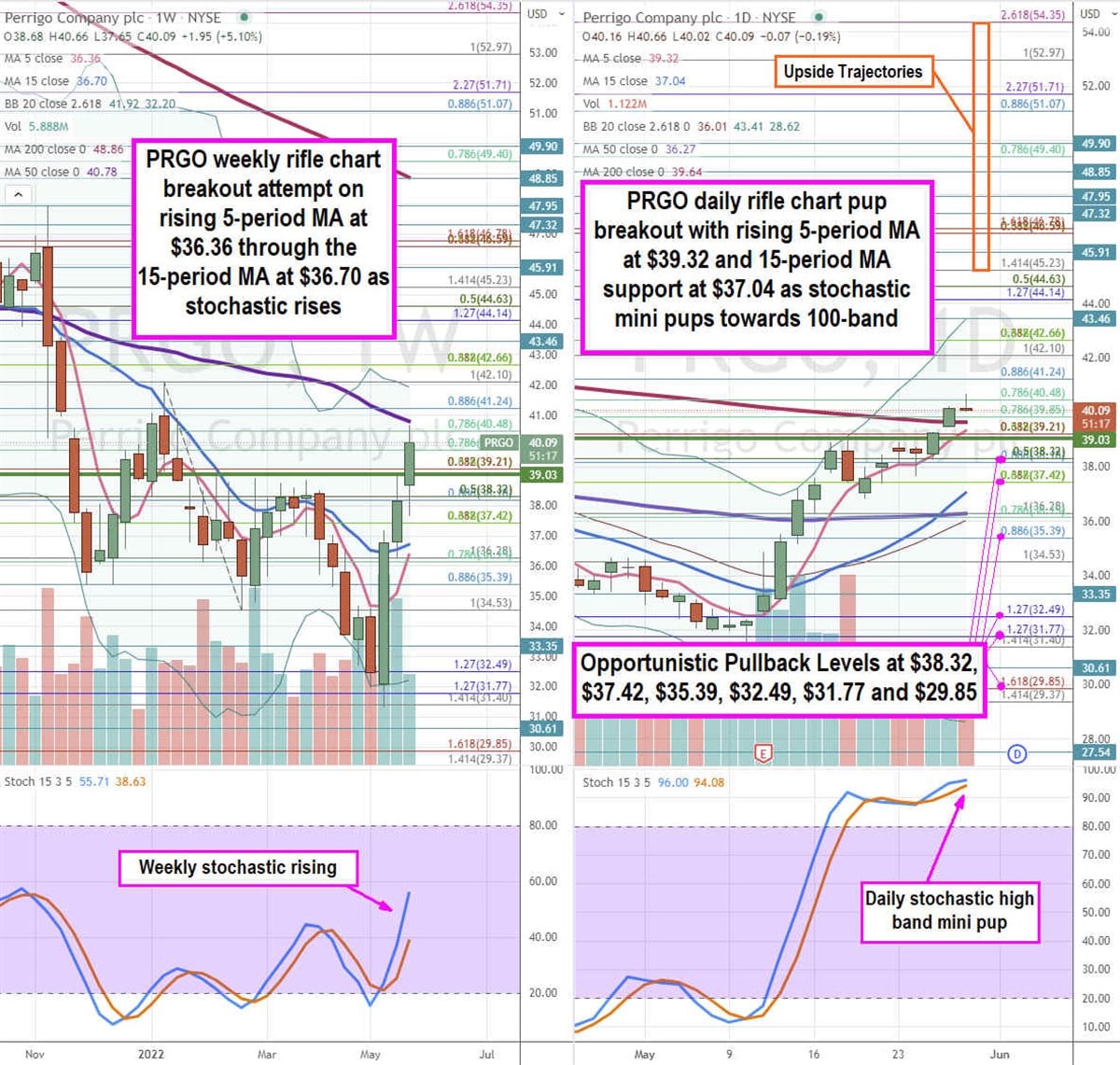

Using the rifle charts on the weekly and daily time frames provides a broader view of the landscape for PRGO stock. The weekly rifle chart bottomed near the $31.40 Fibonacci (fib) level to stage a rally. The weekly rifle chart is attempting to breakout with a rising 5-period moving average (MA) at $36.36 and 15-period MA at $36.70 with weekly lower Bollinger Bands (BBs) curling up at $32.20. The weekly 50-period MA is falling at $40.78 and weekly upper BBs at $41.92. The weekly 200-period MA is falling at $48.86. The weekly stochastic is rising towards the 60-band. The weekly market structure low (MSL) buy triggers on a breakout through $39.03. The daily rifle chart uptrend has a rising 5-period MA at $39.32 with a rising 15-period MA at $37.04. The daily 200-period MA sits at $39.64 and 50-period MA at $36.27. The daily upper BBs sit at $43.41. The daily stochastic is attempting a high band mini pup at the 96 band. Prudent investors can watch for opportunistic pullbacks at the $38.32 fib, $37.42 fib, $35.39, $32.49 fib, $31.77 fib, and the $29.85 fib level. Upside trajectories range from the $45.23 fib up towards the $54.35 fib level.

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.