Pharmaceutical stocks aren't having quite the banner year they've had in the past. Notably, two large pharmaceutical companies recently plunged to 52-week lows on their earnings results. Many factors led to weakness, from normalization for COVID-19 treatments, increased biosimilar and generic competition, spin-off divestments and impairment charges. Investors are in a position to take advantage of market mispricing overreactions or walk away from falling knives. Both stocks have fallen into the proverbial toilet, but is one worth scooping up at these levels?

Pfizer helped spearhead the development of a COVID-19 vaccine during the pandemic with its collaboration with BioNTech AG. The company experienced an unprecedented surge in revenues and profits during and after the pandemic. However, as COVID-19 fell further into the rearview mirror, so did COVID-related revenues as normalization set in. This was also evidenced by its stock price falling from its peak of $61.71 in December 2021 to a low of $29.70 on October 31, 2023.

COVID revenue normalization

COVID-related revenues represented 73% of $53.7 billion of Pfizer's total revenues in 2022. The normalization has swung Pfizer from very profitable green to growing losses. Pfizer recently announced raising prices for its antiviral Paxlovid COVID-19 five-day treatment to $1,390, up from $530, to offset some of the hemorrhaging it's facing.

Hemorrhaging continues

On October 31, 2023, Pfizer reported its Q3 2023 earnings for the quarter ending September 2023. The company reported an EPS loss of 17 cents per share versus consensus analyst estimates for a loss of 8 cents. Pfizer had $5.6 billion of non-cash inventory write-off and other charges, which impacted adjusted diluted LPS by 84 cents. Revenues fell 41.5% YoY to $13.23 billion, missing analyst estimates of $13.34 billion. However, non-COVID-related revenues climbed 10% YoY. Pfizer launched an enterprise-wide cost realignment program, expected to deliver at least $3.5 billion in annual cost savings, with $1 billion to be realized in 2023 and $2.5 billion in 2024.

Reaffirms lowered guidance

Pfizer issues full-year 2023 guidance with EPS expected between $1.45 to $1.65, down from the prior $3.25 to $3.45, versus $2.13. Full-year 2023 revenues are expected between $58 billion to $61 billion, down from $67 billion to $70 billion previous estimate, versus $60.68 billion consensus analyst estimates. Non-COVID operational revenue growth is expected between 6% to 8% versus 2022. The guidance doesn't represent any share repurchases in 2023.

CEO Insights

Pfizer CEO Albert Bourla confirmed that more than 15 million Americans, or 4.5% of the population, have received the updated COVID-19 booster shots as of October 27, 2023. That's significantly less than the 22 million that got the booster during the same period last year. He highlighted the 10% growth of its non-COVID products. In particular, Pfizer's respiratory syncytial virus (RSV) vaccine ABRYSVO contributed $375 million in revenues. Pfizer is still the only U.S. company approved by the FDA with an RSV vaccine.

There are over 80 million adults over 60 eligible for the RSV vaccine. Nurtec, Vydura and Oxbryta contributed $233 million and $85 million in global revenues. Year-to-date (YTD) revenue growth for non-COVID products has been 7% and is on track for 6% to 8% operational growth for the full year. Bourla expects the Seagen acquisition to close by the end of 2023 or early 2024.

Pfizer analyst, ratings and price targets are at MarketBeat. Pfizer peers and competitor stocks can be found with the MarketBeat stock screener.

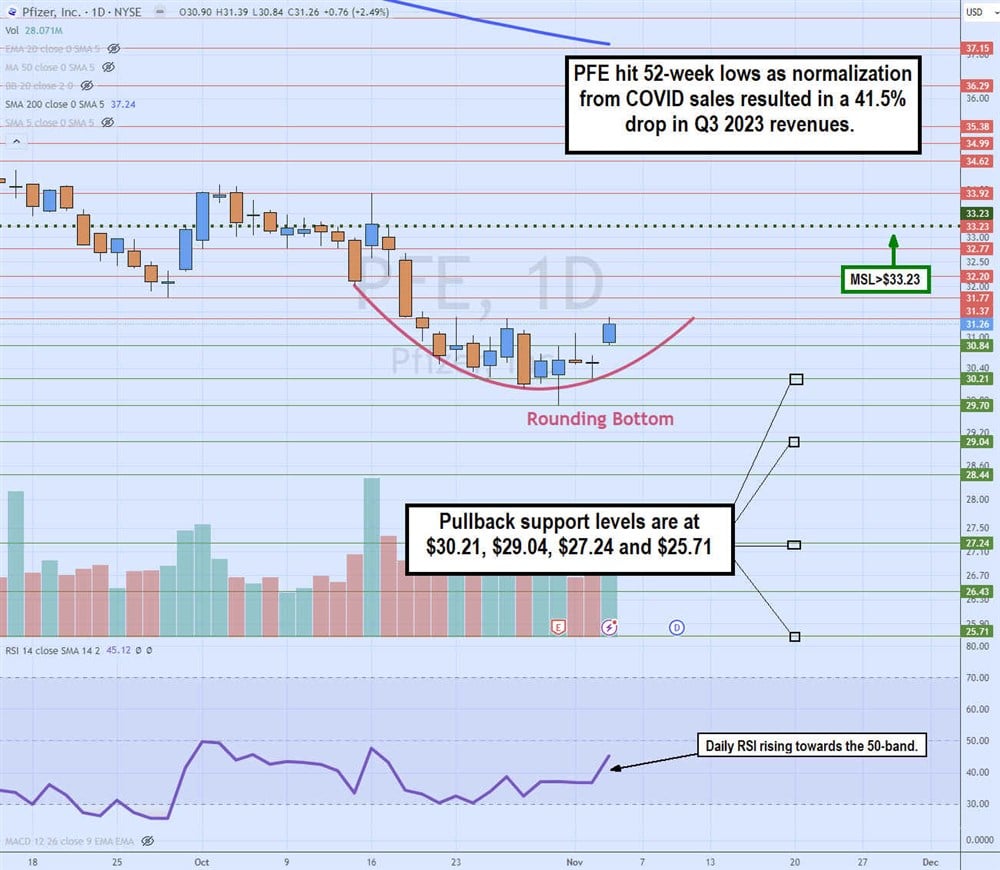

Daily Rounding Bottom

The daily candlestick chart on PFE illustrates a potential rounding bottom pattern. The pattern can be choppy as it progresses towards the daily market structure low (MSL) trigger at $33.23. However, this could be a dead cat bounce that will resume its downtrend as a bear flag breakdown. The daily relative strength index (RSI) is bouncing towards the 50-band. It's crucial to watch how the rounding bottom plays out and if PFE falls sharply under the curved support line. Pullback supports are at $30.21, $29.04, $27.24 and $25.71.

Headquartered in Paris, France, Sanofi is a global healthcare company operating through three divisions: Pharmaceuticals, Vaccines and Consumer Healthcare (CHC). The company is experiencing mixed results from its portfolio of medications. Dupixent remains its top drug for inflammatory disorders as a monoclonal antibody. It's been approved for treating eczema, asthma and chronic rhinosinusitis with nasal polyps (CRSwNP). This drug generates over $3 billion in annual sales, growing at 32.8% YoY.

Play to Win strategy spin-off

Sanofi has embarked on its Play to Win strategy, which seeks to boost research and development investment in its drug pipeline while delivering up to $2 billion in cost savings. The savings will be allocated to fund innovation and growth drivers. It plans to spin off its Consumer Health segment into a separate publicly traded healthcare company in Q4 2024.

Q3 2023 Earnings Report

On October 27, 2023, Sanofi reported Q3 2023 EPS of $2.74. Revenues fell 4.1% YoY to $12.85 billion versus $12.48 billion consensus analyst estimates. Specialty Care revenues rose 13.5%, driven by Dupixent and ALTUVIIO, offsetting the impact of Aubagio generic competition in the U.S. Stable vaccine sales fell 0.6%. General Medicines core assets grew 3.1%, but non-core assets declined 32.9% due to its diabetes treatment, Lantus. CHC sales rose 4.6%, driven by digestive wellness and allergy categories. Sanofi confirmed full-year 2023 EPS guidance of mid-single digit growth versus $4.38 consensus analyst estimates.

CEO Insights

Sanofi CEO Paul Hudson commented on the spin-off of its CHC unit, "It allows Sanofi to become a pure play by a pharma Company. We'll be more agile and more focused on our key areas of strength. At the same time, it allows Sanofi CHC to be in a better position to pursue its business strategy, resourcing and capital allocation." Dupixent continues to show impressive growth, with 750,000 patients taking the treatment. The company agreed with Janssen Pharmaceuticals to develop and commercialize a first-in-class treatment for extra-intestinal pathogenic E.coli (ExPEC), as the number of cases is rising in an aging population.

Sanofi analyst ratings and price targets are at MarketBeat.

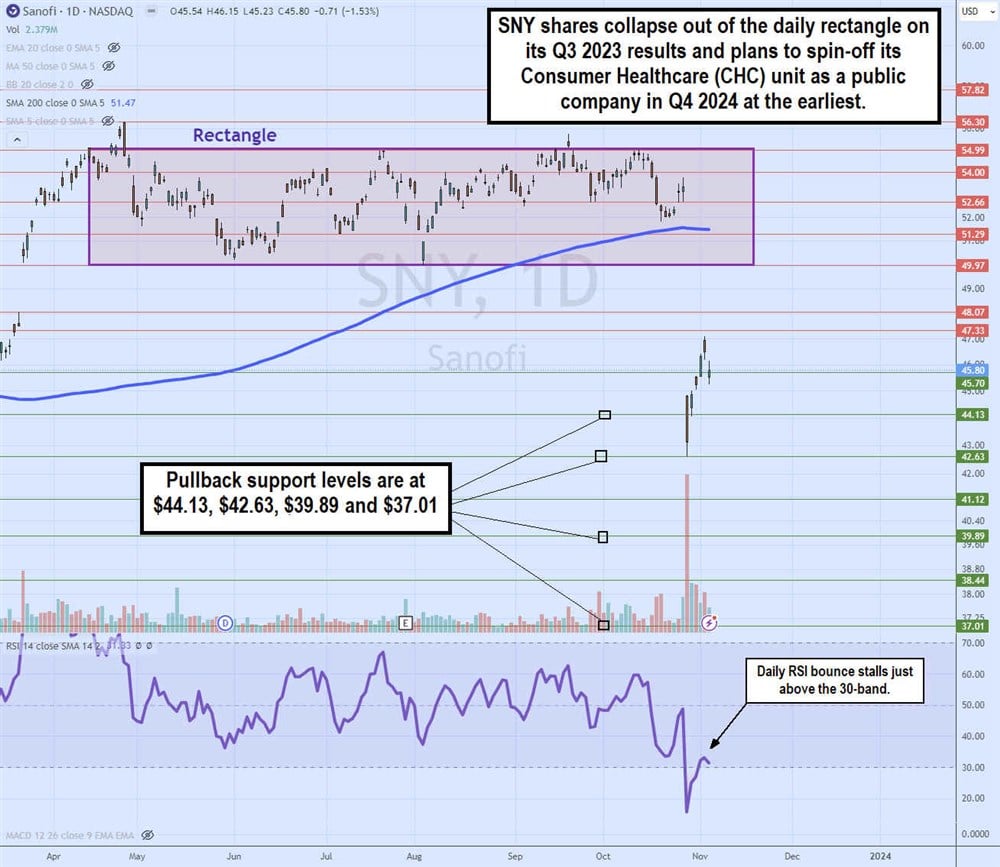

Daily rectangle breakdown

The daily candlestick chart for SNY illustrates the rectangle trading range it's been encompassed within since April 2023. The upper range resistance was at $54.99, and the lower range support was at $49.97. Two breakout attempts, both fizzled out after a day or two. The daily 200-period moving average rose to $51.47 before the earnings release. Shares collapsed on a hard gap down on its Q3 2023 earnings report and CHC spin-off announcement. Normally, a spin-off announcement tends to result in a gap-up, but the abandonment of its 2025 profit and margin forecast made investors nervous, fearing earnings dilution.

Before you consider Pfizer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pfizer wasn't on the list.

While Pfizer currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report