$27.70 -0.13 (-0.47%) (As of 07/3/2024 ET)

- 52-Week Range

- $25.20

▼

$37.80 - Dividend Yield

- 6.06%

- Price Target

- $35.54

Pharmaceutical giant Pfizer Inc. NYSE: PFE has been trying to enter the weight-loss treatment trend dominated by GLP-1 drug makers like Ozempic and Wegovy makers Novo Nordisk A/S NYSE: NVO and Mounjaro and Zepbound makers Eli Lilly & Co. NYSE: LLY. Pfizer had failed in its previous attempts to create a viable GLP-1 contender.

Pfizer operates in the medical sector. In addition to the incumbents Novo Nordisk and Eli Lilly, it competes with other GLP-1 developers, including Viking Therapeutics Inc. NASDAQ: VKTX, Altimmune Inc. NASDAQ: ALT and Structure Therapeutics NASDAQ: GPCR.

Pfizer Halts Lotiglipron Trials Due to Liver Toxicity Concerns

Pfizer had two promising GLP-1 drugs. However, it ended clinical trials in June 2023 for its second obesity and Type 2 diabetes mellitus treatment, lotiglipron. Lotiglipron was an oral GLP-1-RA contender with a once-a-day treatment that was seen as a viable contender to Ozempic. However, Phase 1 and Phase 2 clinical trial data indicated elevated transaminase enzyme levels, indicating the potential for liver dysfunction. To be clear, none of the enrolled participants reported liver-related side effects, symptoms, or liver failure.

Pfizer Discontinues Danuglipron Trials Due to High Dropout Rates

The company decided to continue forward with its twice-a-day formulation of danuglipron. However, on Dec. 1, 2023, Pfizer discontinued its mid-stage trials of danuglipron due to dropouts driven by high rates of side effects, including vomiting and nausea. Nearly half the patients dropped out at certain dosages due to harsh gastrointestinal side effects. The drug enabled 13% weight loss in week 32, which rivals Eli Lilly's oral drug, which hit 15% in week 36.

Pfizer CEO Hints at 3 Weight-Loss Drugs

During a Semafor event interview on June 24, 2024, Pfizer CEO Alfred Bourla noted that Pfizer is currently working on three weight-loss treatments. Pfizer decided to proceed with a new formulation of danuglipron that would be used once a day as a pill. The company will provide trial data for the once-a-day version of danuglipron in 2024.

Bourla didn't provide much more details, except that the company has two GLP-1 technology drugs and one non-GLP-1 mechanism in the works. The company is determined to get a piece of the medical weight-loss treatment segment.

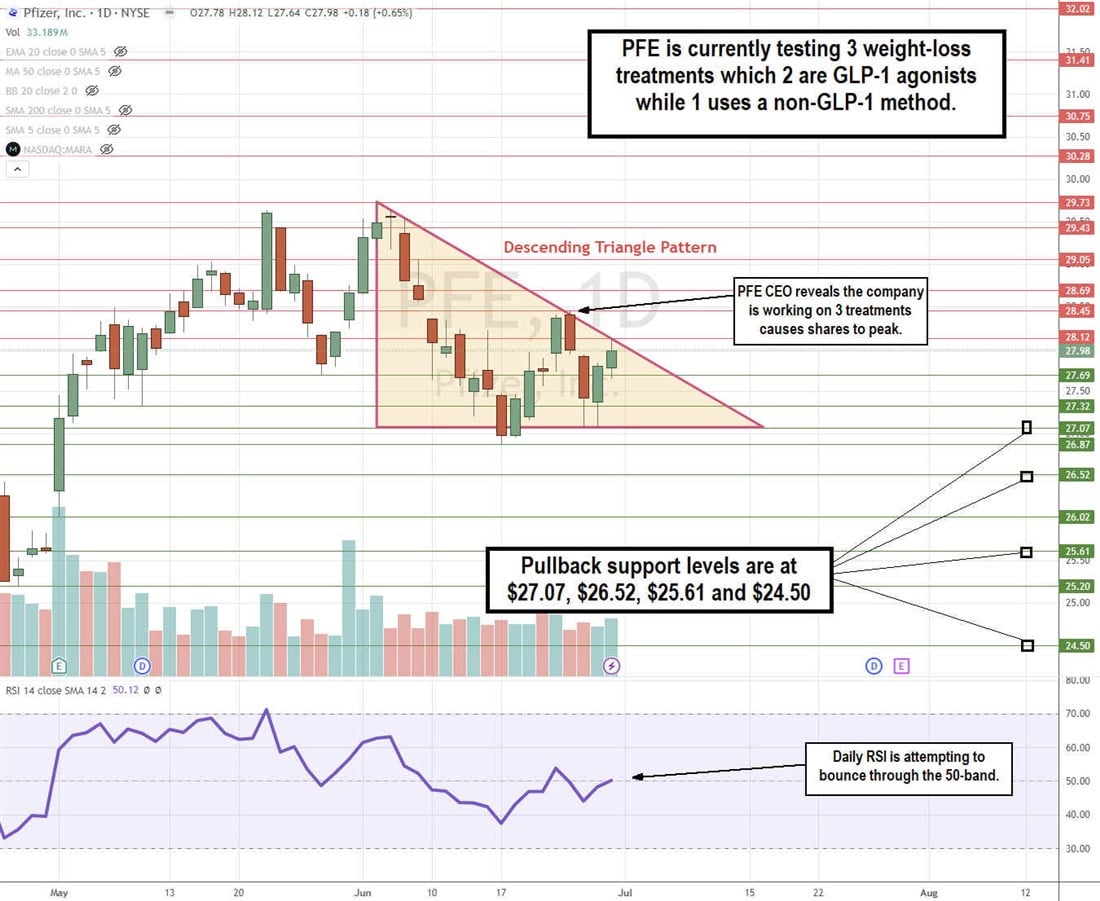

PFE Stock Continues to Chop in a Descending Triangle Pattern

The daily candlestick chart for PFE indicates a descending triangle pattern. The news of Pfizer testing three weight-loss drug candidates peaked out its second attempt to break out of the triangle range at $28.45, as shares again fell to retest the flat-bottom lower trendline at $27.07. The descending trendline started at the $29.73 swing high on June 4, 2024, as shares tested the flat-bottom lower trendline four times thereafter. A third test of the descending trendline is underway at $28.12. The daily relative strength index (RSI) illustrates a bounce attempt at the 50-band. Pullback support levels are at $27.07, $26.52, $25.61, and $24.50.

Pfizer's Recovery from COVID-19 Revenue Decline: Q1 Performance and Future Outlook

- Overall MarketRank™

- 4.94 out of 5

- Analyst Rating

- Hold

- Upside/Downside

- 28.4% Upside

- Short Interest

- Healthy

- Dividend Strength

- Strong

- Sustainability

- -2.68

- News Sentiment

- 0.71

- Insider Trading

- N/A

- Projected Earnings Growth

- 15.55%

See Full Details Pfizer has been experiencing a steep decline in COVID-19-related revenues. The decline has been the primary driver of its falling revenues. Its Q1 2024 EPS was 82 cents, beating consensus EPS estimates by 31 cents. Revenues continued to fall 19.5% YoY to $14.88 billion, still beating the consensus estimates of $13.87 billion. The expected decline of its COVID-19 drugs Comirnaty and Paxlovid revenues were the key drivers for the fall. Non-COVID revenues climbed 11% YoY. The company is trying to recover from the normalization of COVID-19 revenues as it becomes more routine, like the flu shot.

Despite the revenue decline, Pfizer is on track to deliver at least $4 billion in net cost savings for 2024. The company reaffirmed its full-year 2024 revenue guidance of $58.5 billion to $61.5 billion and raised its adjusted diluted EPS guidance to $2.15 to $2.35, up from previous estimates of $2.05 to $2.25 versus $2.21 consensus estimates.

Pfizer CEO is Upbeat About Non-COVID-Related Performance

CEO Bourla was bullish on the company's non-COVID performance in Q1 2024. The company increased revenue from several commercial launches and acquired products from its Seagen acquisition. Robust YoY growth occurred for several of its key in-line brands, including the Eliquis, Prevnar, and Vyndaqel family of medicines. Oncology revenue contributions were strong from Xtandi, Padcev, Adcetris, and Ibrance.

Dr. Bourla concluded, “Overall, I am encouraged by a well-executed quarter, setting the tone for the year. Pfizer’s commercial leadership is focused on data-driven opportunities across several key growth brands, both in the U.S. and internationally, and we intend to build on this positive momentum in the quarters ahead.”

Pfizer analyst ratings and price targets are at MarketBeat. The consensus analyst price target of $35.86 implies a 28.15% upside.

Before you consider Pfizer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pfizer wasn't on the list.

While Pfizer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.