Photomask products maker

Photronics NASDAQ: PLAB stock has surged to all-time highs on its latest earnings results. The makers of photomasks used in integrated circuits and flat panel displays is benefitting from the

reopening trend and

supply chain disruptions. Demand for photomasks has been bolstered by the necessity of chip

suppliers to boost inventory. By shrinking the size of chips, each wafer can generate more chips which pumps up demand for photomasks. The offset to the demand is the

China and U.S. trade tensions as Photronics has a large exposure in China. Prudent investors seeking a benefactor from the global

chip shortage can watch for opportunistic pullbacks in shares of Photronics.

Q4 FY 2021 Earnings Release

On Dec. 8, 2021, Photonics released its fiscal fourth-quarter 2021 results for the quarter ending October 2021. The Company reported non-GAAP earnings-per-share (EPS) loss of $0.33 excluding non-recurring items versus consensus analyst estimates for a profit of $0.25, a $0.08 beat. Revenues grew 21.4% year-over-year (YoY) to $181.03 million beating consensus analyst estimates for $175 million. The Company expects fiscal Q1 2022 revenues between $178 million to $186 million and net income between $0.27 to $0.34 per share. Photronics CEO Peter Kirlin commented, “Photronics achieved a fourth consecutive year of record revenue, as demand for our design-driven products accelerated and we fully ramped new flat panel display capacity. We made strategic investments in 2021 that have positioned us to achieve organic growth as market trends such as the increase in demand from Asia foundries and the adoption of advanced display technologies in mobile applications have driven the market higher. Past investments in targeted technologies are paying off, as margin expansion is accompanying top-line growth,” added Kirlin. “We are generating gross and operating margins already at the high-end of the three-year target model we presented last year, and our strong cash flow enables us to invest in the business while we also return cash to shareholders as part of our disciplined capital allocation. With strong end market demand, solid balance sheet, broad geographic presence, and a team with a proven track record, we are excited about our future and optimistic we can deliver on our long-term target model objectives.”

Conference Call Takeaways

CEO Kirlin set the tone, “Over the last few years, our investment strategies have been focused on mounting a geographic expansion into China, while exploiting the technology inflection from LCD to AMOLED in advanced mobile displays. Beyond these longer-term secular trends, we are now capitalizing on another rapidly growing sector in the IC market, mainly in China and Southeast Asia, that is now being referred to throughout the industry, as you know, I would say "legacy foundry." We've been speaking about this for the last several quarters, as growing demand for masks versus relatively fixed supply has placed pressure on capacity, providing us with very rare pricing leverage. These photomask technologies have been in production for many years, with a particular focus on the advanced end of the mainstream, a range that spans roughly from 40 to 90 nanometers. Demand for these nodes is tight across the entire photomask industry. For us as well as for our competitors. While at the same time, more and more IC capacity is being installed, which leads us include the favorable pricing will be just sustainable. Demand is particularly strong in China and Taiwan. And along with our JV partner, we are investing now in the expansion of our facility in Taiwan, while adding capacity across the region to meet this growing demand. We believe this is a unique opportunity that will play out over the next several years, and we are positioning ourselves to capture the lion's share of the growth that we see in this segment. We see several drivers of growth in the legacy foundry sector. First, on the demand side, Moore's Law has essentially come to a halt for most logic applications, with 28 nm being the last node where incremental economic benefit was achieved by moving to the next smaller node. There are very few applications that justify the cost of design, develop and manufacture at the very leading edge of 10 nm and below.” He concluded, “In summary, there are several catalysts across our business to drive sustainable growth of photomask demand for both IC and FPD well into the future. We have made investment decisions in the past that enabled us to benefit from these trends, propelling us the outstanding performance we achieved in the fourth quarter and throughout the full year of 2021. We have the widest range of technology and unparalleled global footprint that enables us to respond quickly to dynamic market and any customer requests. Record revenue, expanding margins and strong cash flow position us to continue to make prudent investments that we believe will allow continued growth. I am very proud of the entire team and what we're able to achieve this year, and I'm optimistic that 2022 will be even better.”

PLAB Opportunistic Pullback Levels

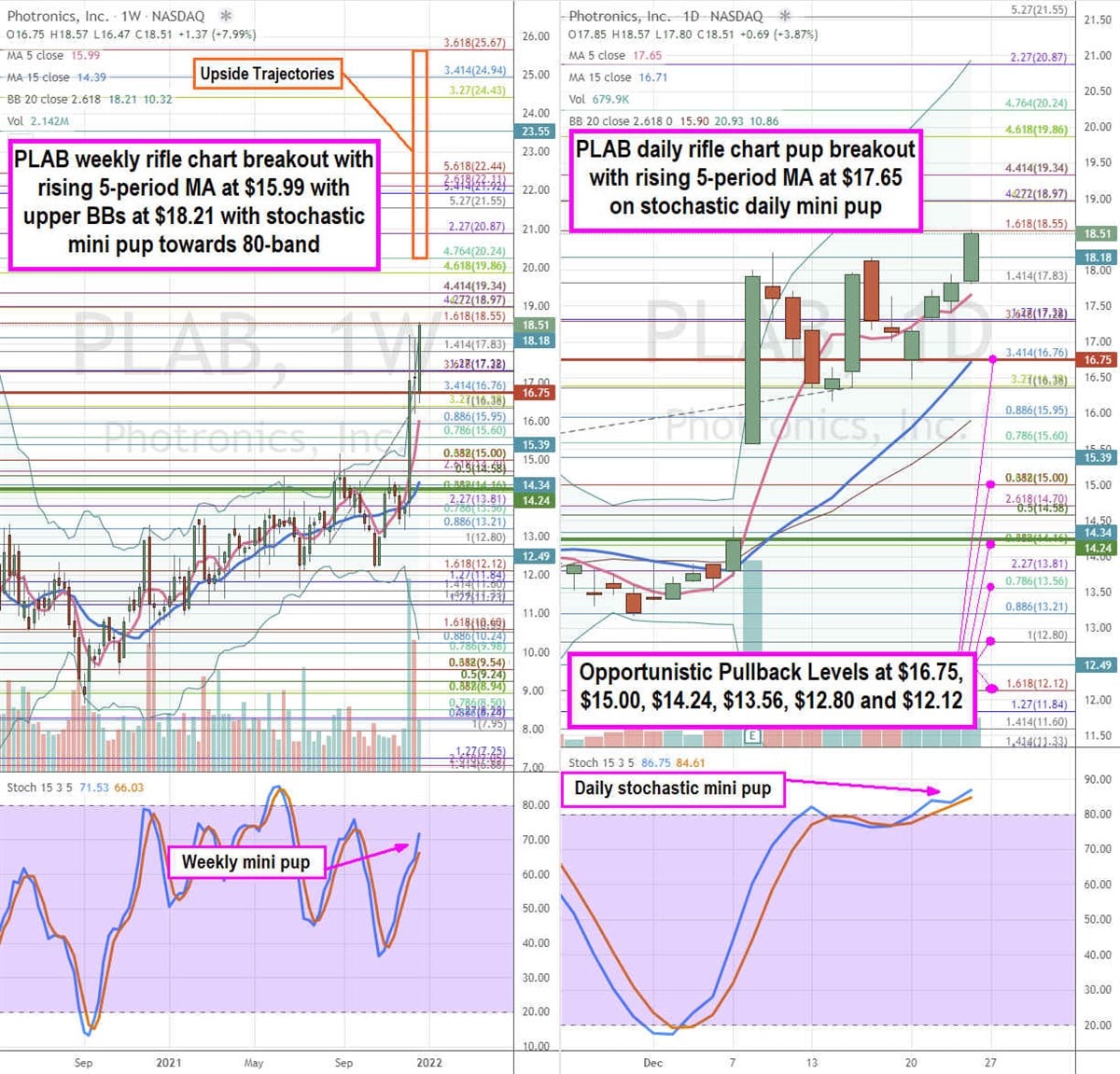

Using the rifle charts on the weekly and daily time frames provides a precision view of the price action playing field for PLAB shares. The weekly rifle chart peaked at the $18.55 Fibonacci (fib) level. The weekly rifle chart uptrend has a rising 5 period moving average (MA) at $15.99 powered by the weekly stochastic mini pup heading towards the 80-band. The weekly upper Bollinger Bands (BBs) sit at $18.21. The weekly market structure low (MSL) buy triggered on the breakout through $14.24. The daily rifle chart formed a pup breakout with a rising 5-period MA at $17.65 powered by the stochastic mini pup above the 80-band. The daily upper BBs sit near the $20.87 fib level. Prudent investors can monitor for opportunistic pullback levels at the $16.75 daily MSH trigger, $15.00 fib, $14.24 fib, $13.56 fib, $12.80 fib, and the $12.12 fib level. Upside trajectories range from the $20.24 fib level up towards the $25.67 fib level.

Before you consider Photronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Photronics wasn't on the list.

While Photronics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.