Camping and recreational vehicle (RV) dealer Camping World NYSE: CWH stock has been retracing as the post-pandemic reopening trend continues to accelerate with COVID-19 vaccinations. Despite heavy demand still rising, shares have been descending to potential value price levels. The bigger fear of rising interest rates having a dampening effect on seems to be the largest concern with investors. However, the pandemic effect on sculpting a “new normal” of having a mobile office is helping drive demand for small businesses and entrepreneurs. Shares are trading under 6X price earnings making it one of the best value plays in the recreation and camping market. Prudent investors seeking exposure in this segment can watch for opportunistic pullbacks in shares of Camping World.

Q2 FY 2021 Earnings Release

On Aug. 3, 2021, Winnebago released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported a profit of $2.51 per share beating analyst estimates for $2.38 per share by $0.13 per share. Revenues rose 25.4% year-over-year (YoY) to $2.01 billion falling short of the $2.08 billion consensus analyst estimates. Adjusted EBITDA hit a record $333.3 million representing a 51% increase, and adjusted EBITDA margin was 16.2%, up from 13.7% in the year ago same period. The Company repurchased 1.15 million shares at an average of $39.55 under its share repurchase program expiring on Oct. 1, 2022 with approximately $33 million remaining. Camping World CEO Marcus Lemonis commented on raised full-year 2021 guidance, “Our team’s strong performance for the quarter has allowed us to reach a Company high Trailing Twelve-Month Adjusted EBITDA(2) of $831 million. As a result, we are raising our 2021 fiscal year guidance(3) of Adjusted EBITDA of $770 million to $810 million to a revised Adjusted EBITDA of $840 million to $860 million.”

Conference Call Takeaways

CEO Lemonis set the tone, “As we celebrate Camping World and Good Sam's 55th year in business, we continue to be astounded by the insatiable desire that Americans have for experiential travel, exploration of this country and most importantly a community of connection with others, that desire resulted in our company's best quarter in its history.” He detailed, “We ended the quarter with $322 million of cash, consisting of $192 million of cash and cash equivalents and $139 million of cash in our floor plan offset account. Additionally, we had $468 million of working capital with more than half, made up of used RV inventory without a related floor plan financing. And lastly, we have $191 million of real estate without related mortgage financing. With respect to our operational results, we ended June with over 2.2 million Good Sam members. This represents nearly 150,000 additional members compared to June of last year. Heading into this year, we knew there was a huge opportunity with our Good Sam credit card. We made a big shift and brought in a specialized team to focus on this area of our business. We set a goal of 10% annual growth. Year-to-date, our file-size has grown to north of a quarter of a million active account holders, an increase of nearly 19% compared to June of 2020. Our Good Sam RV Valuator tool fuels our growth in the used RV inventory and provides what we believe is a huge competitive advantage. We ended June with nearly 216 million of used RV inventory, more than double Q2 of last year. In the second quarter, we added nine new locations to our footprint. Today, we operate in 187 locations. I couldn't be more excited about our future. We anticipate demand will remain strong in the foreseeable future, as our viewing has become way more mainstream.” CEO Lemonis concluded, “In the second quarter, we added nine new locations to our footprint. Today, we operate in 187 locations. I couldn't be more excited about our future. We anticipate demand will remain strong in the foreseeable future, as our viewing has become way more mainstream. Our team will execute the operational plan to attract the next generation over the years. Expand Good Sam and drive innovation in the industry to reach our internal goal of generating $1 billion of annual adjusted EBITDA. As we continue to work towards that goal. Our trailing 12-month annual adjusted EBITDA as of June 30, 2021 was $831 million. We are now increasing our full-year adjusted EBITDA estimates to between $840 million and $860 million.”

CWH Opportunistic Price Levels

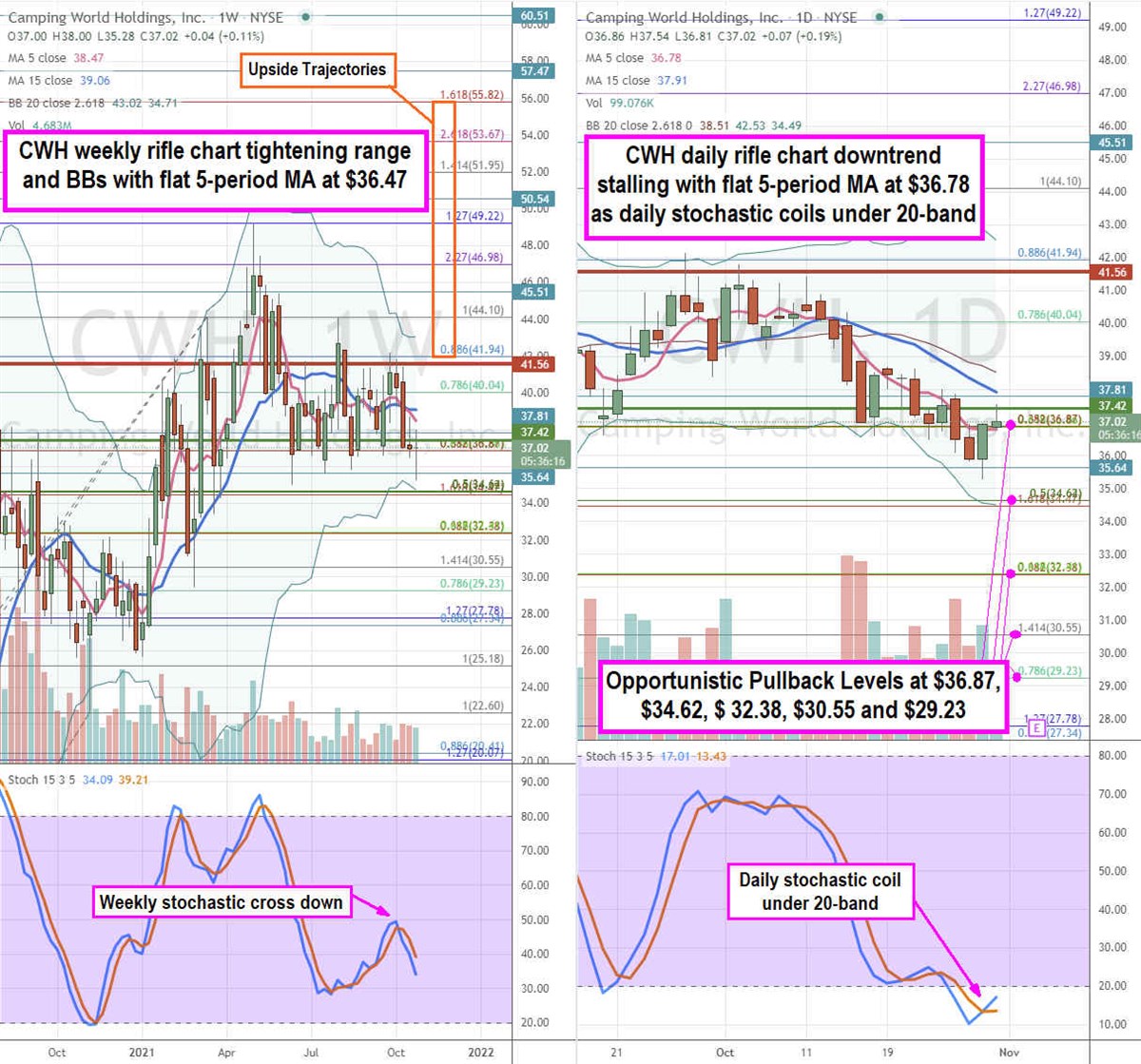

Using the rifle charts on the weekly and daily time frames provides a broader view of the landscape for CWH stock. The weekly rifle chart has been in a tightening trading range with Bollinger Band (BBs) compression between the $43.02 weekly upper BBs and the $34.71 weekly lower BBs. The weekly 5-period moving average is starting to breakdown at $38.47 as the weekly stochastic crosses back down with the $38.87 Fibonacci (fib) level acting as near-term support test. The weekly formed a market structure high (MSH) sell trigger under $41.56. The daily rifle chart has been in a downtrend but stalling out at the $36.87 fib level support as the daily 5-period MA goes flat at $36.78 and daily stochastic attempts to coil back up under the 20-band. The daily market structure low (MSL) buy triggers on a breakout through $37.42. Prudent investors can watch for opportunistic pullbacks at the $36.87 fib, $34.62 fib, $32.38 fib, $30.55 fib, and the $29.23 fib levels. Upside trajectories range from the $41.94 fib up to the $55.82 fib level.

Before you consider Camping World, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camping World wasn't on the list.

While Camping World currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.