Image processing semiconductor maker

Pixelworks NASDAQ: PXLW stock has awoken in mid-2021 as shares spiked to multi-year highs. The maker of chips that improve image and video visual quality used in projectors and mobile phones is experiencing strong

tailwinds as the

reopening is shaping up to be a strong post-

pandemic tailwind. The recovery in high-end projector end markets was evidenced in its Q2 2021 earnings report. Despite the

global chip shortage, the Company has strong

supply chain partners and sees further acceleration in its mobile and projector business with very strong bookings.

Prudent investors looking for a low-priced semiconductor recovery play can watch for opportunistic pullbacks in shares of Pixelworks.

Q2 FY 2021 Earnings Release

On Aug 10, 2021, Pixelworks released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported non-GAAP earnings-per-share (EPS) loss of (-$0.05) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.07), a $0.02 beat. Revenues grew 51.1% year-over-year (YoY) to $14.05 million. Mobile revenue increased sequentially to record highs driven by expanded adoption of both hardware and software-based visual processing solutions. Projector revenues rose over 100% sequentially and 30% YoY reflecting a rebound in the consumer end markets.

CEO Comments

Pixelworks CEO Todd DeBonis commented, "We had a solid and very busy second quarter, highlighted by revenue growth of over 50% on both a sequential and year-over-year basis.” He continued, "Mobile revenue set another quarterly record, as we continued to gain increased traction across an expanded number of OEMs and launched models during the first half of the year. Also, in the second quarter, our projector business benefited from a significant market recovery as well as increased demand, with revenue more than doubling from the first quarter. Consolidated gross margin also expanded significantly in the quarter to above 50% and contributed to sequential and year-over-year improvement in our bottom-line results. Additionally, as announced today we have completed a series of actions as part of a broader strategic plan designed to accelerate Pixelworks' future growth and success by transforming our existing Shanghai R&D center (PWSH) into a profit center. This will enable us to enhance the focus of our mobile, projector, and video delivery businesses on their global center in Asia, increasing our ability to access capital, ecosystem partners, customers, and key talent. In conjunction with these efforts, we have secured commitments for significant capital investments in PWSH from a combination of private equity, strategic partners, and our current employees in China. Longer-term, we intend to continue to take steps to qualify PWSH for an initial public offering on the STAR Market in China. We believe a listing in China will provide expanded access to future potential growth capital at what could be meaningfully higher valuations than what Pixelworks trades at today in the U.S. This plan will also allow Pixelworks to increase the focus on its TrueCut business, as well as other licensing opportunities.” CEO DeBonis continued, "Overall, we have executed well during a dynamic and supply-constrained environment. Our team's aggressive and ongoing efforts to secure committed capacity from both our foundry and backend packaging partners has been effective and enabled us to support a large majority of the product demand from our customers. We've also expanded our pipeline of mobile design-ins on next-generation smartphones across both existing and new tier-one mobile OEMs. In July, we taped-out our seventh-generation visual processor for Mobile, which we will be sampling with select customers in the third quarter. Looking to the second half of the year and into the first half of 2022, we have strong bookings from a combination of mobile and projector customers. The magnitude of our growth will depend on continued execution from all areas of the organization and support from our supply chain partners."

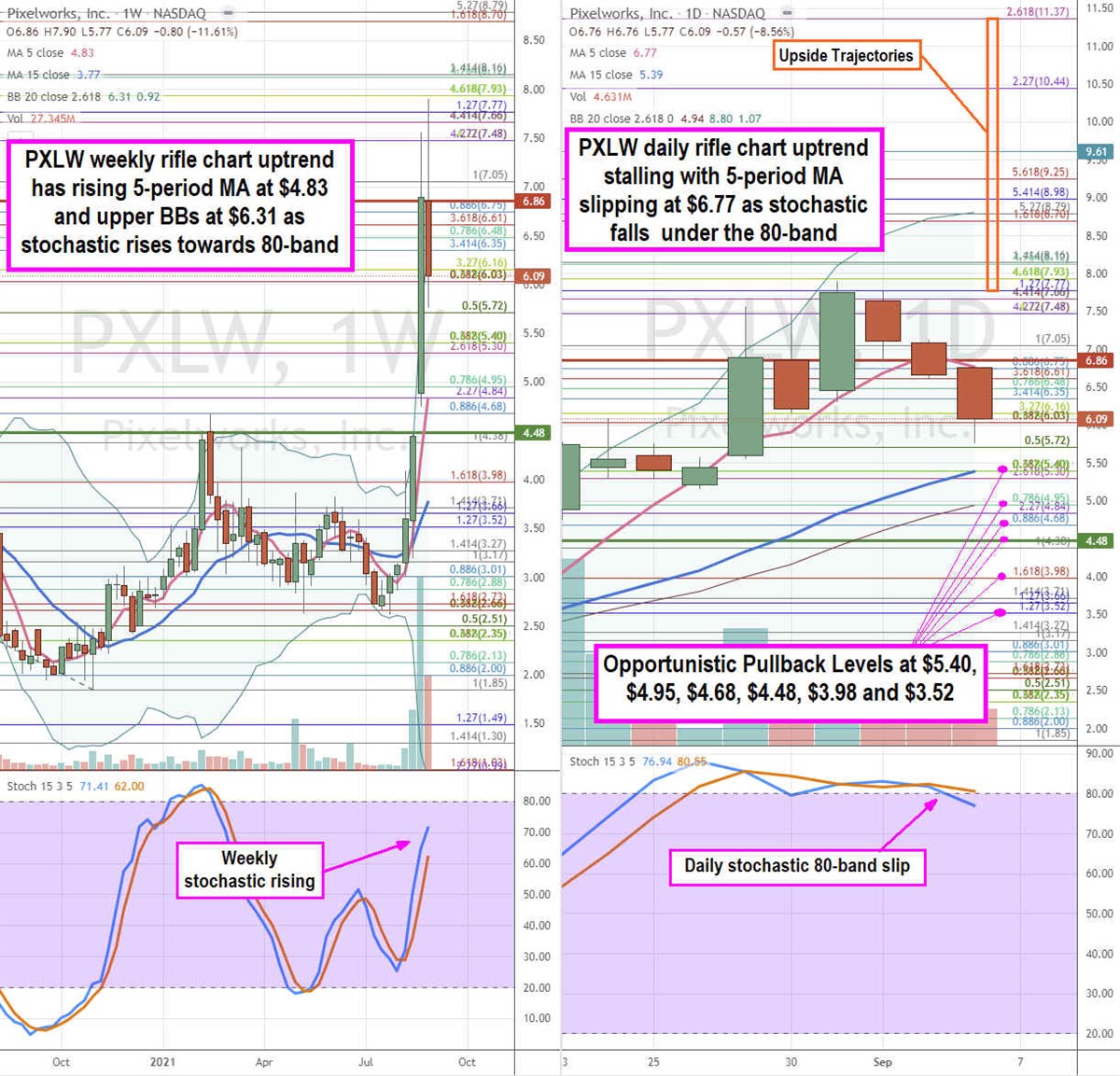

PXLW Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the price action playing field for PXLW shares. The weekly rifle chart spiked ferociously as the 5-period moving average support is rising at the $4.84 Fibonacci (fib) level. The weekly 15-period MA is rising at $3.77. The weekly stochastic has a mini pup rising through the 70-band as shares fall back under the weekly upper Bollinger Bands (BBs) at $6.31. The daily rifle chart uptrend is stalling as shares fell under the 5-period MA support sloping down at $6.77 for potential channel tightening to the 15-period MA at $5.39. The daily market structure low (MSL) buy triggered at the $4.48 breakout. The daily stochastic has fallen under the 80-band which can further add selling pressure for the channel tightening. Prudent investors can monitor for opportunistic pullback levels at the $5.40 fib, $4.95 fib, $4.68 fib, $4.48 fib, $3.98 fib, and the $3.52 fib. The upside trajectories range from the $7.77 fib up towards the $11.37 fib level.

Before you consider Pixelworks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pixelworks wasn't on the list.

While Pixelworks currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.