Fitness center operator

Planet Fitness (NASDAQ: PLNT) shares reached all-time highs at $88.77 on Feb. 19, 2020, just before global financial markets got blindsided by the coronavirus black swan. The

S&P 500 (NYSEARCA: SPY)collapsed (-35%) in just under a month underscoring the fastest transition to a bear market in history. Planet Fitness outpaced the SPY by more than double as shares plunged (-73%) tagging lows at the $23.77

Fibonacci (fib) level on March 18

th. The extreme selling triggered a snapback coil to $52.99 in the following six trading days before falling back down to the low $40s. Planet Fitness has taken prudent measures to shore up its customer loyalty and goodwill to ensure a speedy recovery once business reconvenes after the pandemic subsides. Insightful investors and agile traders may consider these opportunistic buy entry levels amid further market turmoil.

Planet Fitness Q4 2019 Earnings Highlights

On Feb. 25, 2020, Planet Fitness reported Q4 2019 earnings of $0.44-per share beating consensus analyst estimates by $0.03-per share. Revenues grew 8.9% YoY to $191.5 million beating analyst estimates of $189.58 million. Franchise revenues grew 29.6% YoY to $73.3 million and same-store sales grew 8.6% YoY. The company lowered its forecasts for FY 2020 of $1.84 vs. $1.90 consensus analyst estimates and revenues of $771.5 million versus $782.5 million primarily due to lower new equipment placements to franchise owners. The company forecast 12% revenue growth for FY 2020, but recently pulled FY 2020 guidance due to uncertainty from the impacts of COVID-19.

An Act of Integrity Ensures Loyalty

Planet Fitness took proactive measures to close all fitness centers amid the COVID-19 pandemic on March 17th and freeze all customer membership billings. As a matter of courtesy and convenience, the company’s actions are an act of integrity that will foster loyalty and goodwill with its 14 million members. It averts an onslaught of potential cancellations while helping to ensure monthly subscription cash flows resume mostly intact when fitness centers re-open and resume operations. Membership plans start as low as $10-per month and turning on the billing is like flipping a light switch for the cash flow to resume.

Promoting In-Home Fitness

Planet Fitness bolstered its mobile fitness app content to promote in-home workouts with free fitness classes during the lockdowns. The company stated it believes the $436 million in cash and financing facility for another $75 million is sufficient to last to the end of the year 2020. Investors worrying about membership retention rates after the coronavirus outbreak resolves should rest assured that the company’s act of integrity galvanized its membership base. It’s unique amongst membership-based services and will reap tangible benefits upon resumption of business.

Can’t Beat $10 a Month

Pundits who argue that members who get acclimated to in-house workouts might cancel their memberships clearly don’t understand the benefits of gyms. The value is derived from a low $10 monthly membership providing access to thousands of dollars’ worth of gym equipment, not to mention the social aspect. Planet Fitness’ membership costs are the lowest priced for a reason. It’s so cheap that the monthly fees go largely unnoticed. Customers would have to pay more to join another gym and pay out a lot more to set-up a home gym.

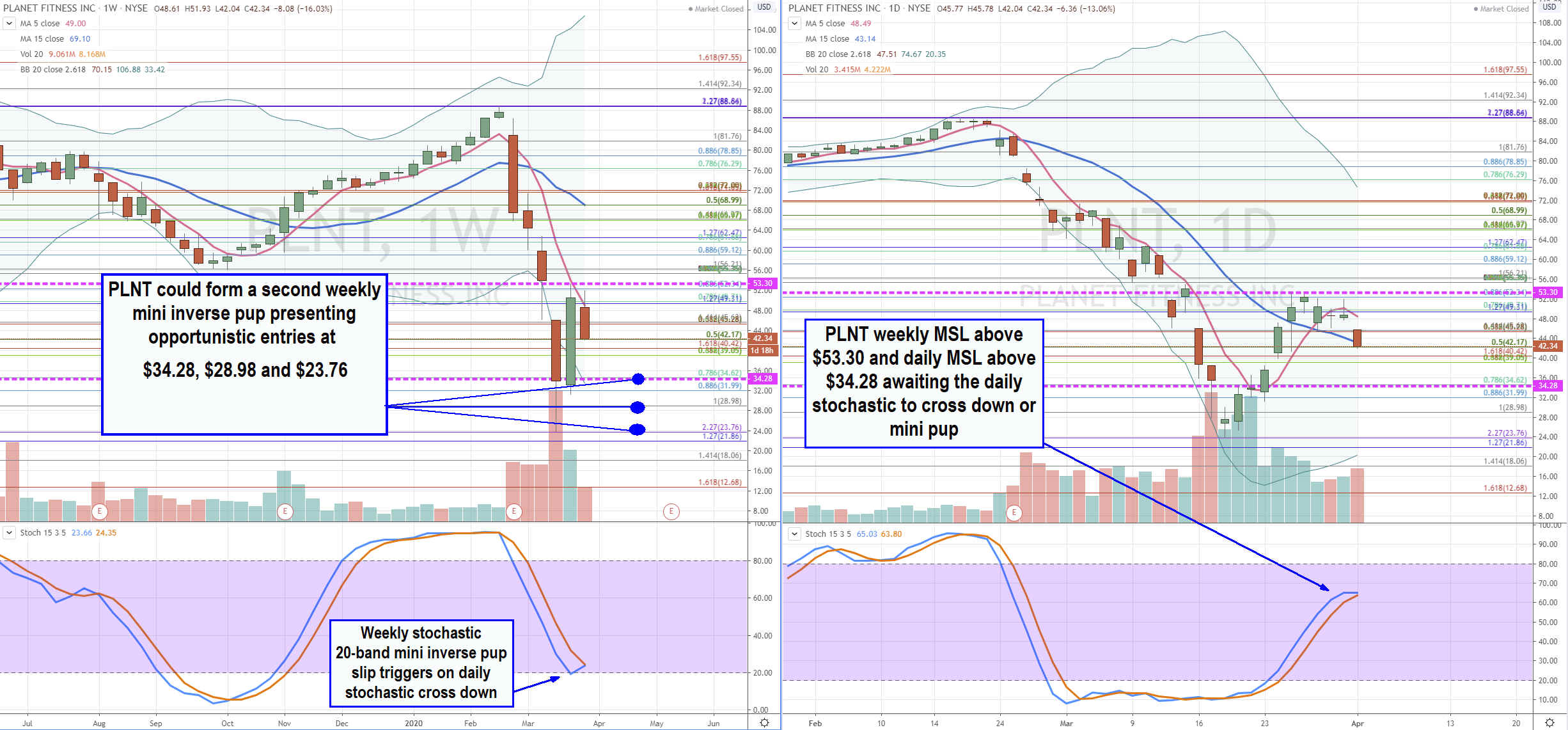

Opportunistic Buy Levels

Using the rifle charts on wider time frames to lay out the playing field suitable for swing traders and investors. PLNT made a dramatic drop from all-time highs to two-year lows in a matter of four weeks. This resulted in a full weekly stochastic oscillation to the 20-band. The weekly chart made a market structure low (MSL) trigger above $53.30 as did the daily chart above $34.28. The weekly stochastic has stalled at the 20-band as shares fell back under the weekly 5-period moving average (MA) at $49.00. The daily stochastic formed a bullish mini pup combined with the MSL trigger above $34.28 to stall out at the $42.17 fib. This sets up one more sell-off when the daily stochastic crosses down triggering the bearish weekly mini inverse pup to the lower Bollinger Bands (BBs) at $33.42 before bottoming out to grind back up again. Under this scenario, opportunistic buy entry levels occur at $34.28 daily MSL, $28.98 fib and $23.76 fib retest of the prior low for a potential double bottom. Nimble traders can scalp these levels and long-term investors may consider a dollar-cost averaging approach with income generation through writing covered calls.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.