PPG Industries: Blows Past Consensus

PPG Industries (

NYSE: PPG) is evidence of something we've seen brewing in the economy since the late 2nd quarter of 2020. A broad-based systemic economic recovery driven by

high demand at all levels of the supply chains. Demand for goods has been high for the last 12 months due to stimulus spending and stay-at-home activities. That's wiped shelves clean, driven backlogs to record levels, and all been compounded by hiccups in the shipping/freight industry and shortages of microchips. Now, PPG doesn't drive trucks or make semiconductors so why is it doing so well?

What PPG makes, to put it very simply, is

paint and glue. What industry, business, or person doesn't use paint and glue or a product that relies on paint and glue. Simply looking at the company from the housing perspective, the recently reported 20% MoM and 37% YOY gain in housing starts certainly looks good for the paint and glue business. And this is the kind of demand that pent up throughout the economy.

“Looking ahead, we expect overall global coatings demand growth to be broad-based across most of the end-use markets that we supply, including an eventual replenishment of many of our customers’ inventories," says PPG CEO Michael H. McGarry.

PPG Industries Beats And Raises, Shares Up10%

PPG Industries didn't just report

a great quarter it reported a blow-out quarter in which results set a quarterly record and beat the consensus by 540 basis points. The $3.88 billion in revenue is up 14.88% versus last year which is an easy comp that even the company is recognizing. The two-year comp is closer to 27% growth and doesn't include the full re-ramp of some business segments. On a volume basis, the sales grew a smaller 75 but were compounded by a 2% increase in pricing. The company reports rising costs for shipping and input materials that it is working to alleviate.

As for demand, the company also reports broad, increasing demand across businesses. Sales in the Performance Coatings segment grew 16%, the Architectural Coatings 20%, and Industrial by 20%. Some of the sub-segments are still experiencing weakness but the balance is positive and set up to continue growing as those still-impacted end-markets begin to reaccelerate. Moving down to the margins and earnings, the company was able to leverage its sales growth and cost-savings initiatives. The company describes it as "strong leverage" resulting in adjusted EPS of $1.88 or $0.33 better than expected and up 33% from last year.

Looking forward, the company is expecting the strength in business to continue and accelerate. They raised the guidance for the second quarter to a range well above the consensus implying revenue in the range of $4.4 billion or up about 13% from this quarter. EPS should be near $2.15 to $2.20 versus the consensus of $2.04. That should fuel a nice round of analysts upgrades to help keep shares moving higher.

PPG Industries Is On Track For A 49th Consecutive Dividend Increase

PPG Industries just declared its Q2 dividend at the previous rate but there is

a dividend increase on the way. Based on the history the next declaration should come with an increase and it could be substantially large. The company has been increasing for the last 49 years and there is no reason why they won't again. The company's revenue is growing, its earnings are growing, margins came in at a multi-year record, prices are rising, the cash flow is good, and the balance sheet a near-fortress. Based on the five-year CAGR we expect the next increase could be worth 10% to 15% of the current payout or another 0.20% on top of the already safe 1.40% yield.

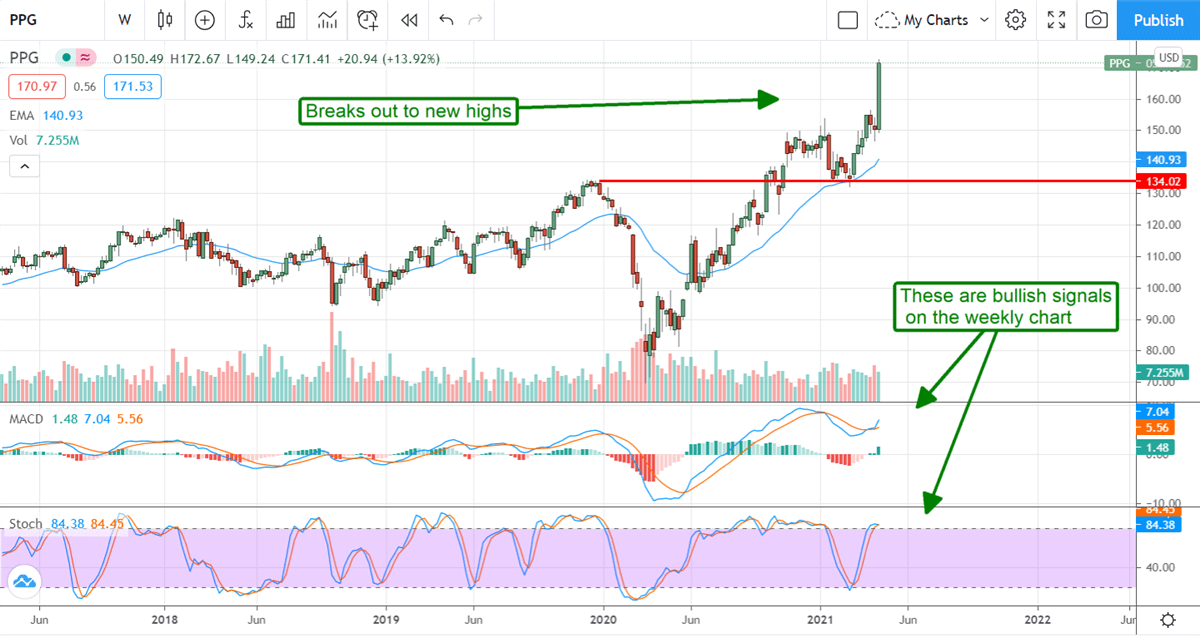

The Technical Outlook: PPG Breaks Out To A New High

Shares of PPG went ballistic on the Q1 news and surged more than 10% at the open. Since then, the stock has been edging even higher into the new all-time high territory and looking fairly strong to us. Based on the results, the outlook, and our view of the economic reopening this stock could easily add another $30 by the end of the summer.

Before you consider PPG Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PPG Industries wasn't on the list.

While PPG Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.