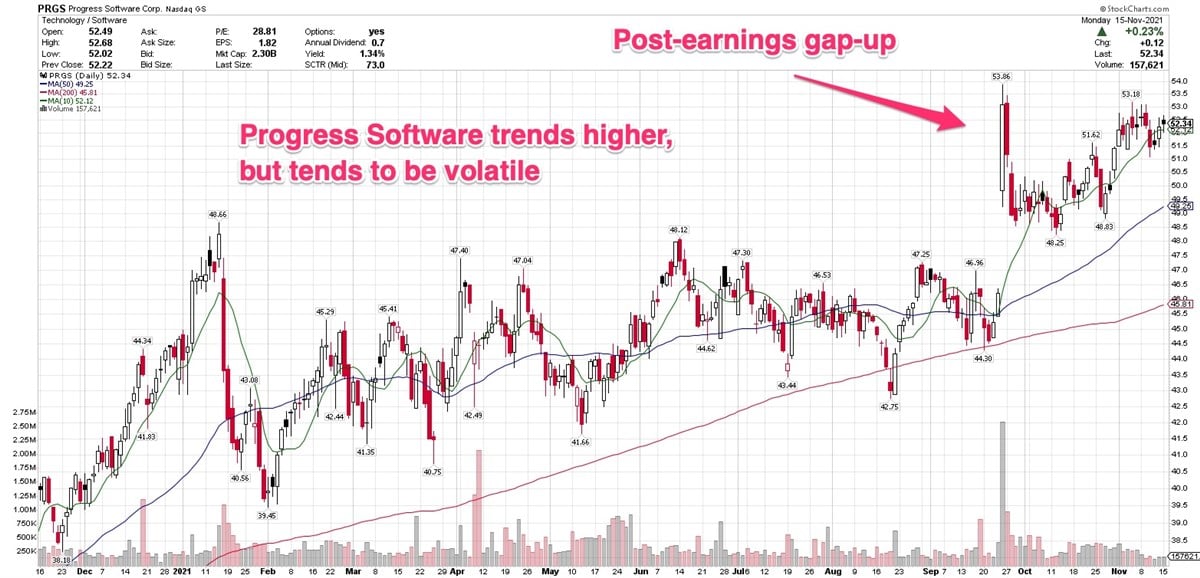

Progress Software NASDAQ: PRGS, which is on the cusp between small- and mid-cap, is getting support at its 10-day line following a 15% gap higher after its last earnings report.

The Bedford, Massachusetts company specializes in software development and deployment platforms for business applications.

Its product offerings include:

- UI/UX tools

- Secure data connectivity and integration

- Digital experience

- DevOps

- Mission-critical app platform

- Digital decisioning

- Secure managed file transfer

- Infrastructure monitoring

It also provides training services.

The company’s software offerings are cloud-based, of course. It serves large- and medium-sized enterprises hailing from a variety of industries internationally.

Licensing, both perpetual and term, is the principal source of revenue.

Progress Software’s current price performance is better than 79% of other stocks in the broader market. Progres advanced 14.90% in the past three months, 16.72% year-to-date, and 33.84% in the past year.

This stock shows some wide intraday and intra-week price swings. That volatility is reflected in its beta of 1.21, indicating that the volatility is higher than the wider equity market.

Progress is forming a cup-with-handle base below its September 24 high of $53.86. The current handle buy point is $53.18, reached on November 4.

The cup-with-handle pattern, one of the more common technical chart formations, allows an earlier entry point than the prior high. It can be a very constructive pattern that often sets up further gains.

Progress is a stock that requires some patience and a strong stomach to hold. It tends to bounce around in a sideways fashion after breaking out of a base. However, a monthly chart reveals that the stock does rise in a fairly orderly fashion over time.

Since rallying out of the Covid decline in early 2020, Progress trended steadily higher until reaching its September peak.

So is this stock a buy?

Perhaps. But if you’re simply looking for exposure to high-growth cloud-based software makers, there are other alternatives. That type of alternative-seeking is a tenet of many mutual funds, which are looking to get into the stock with the best potential for gains, while paying the lowest price.

In the case of Progress Software, the volatility and erratic trade may be off-putting for individual investors. And there’s generally not a need to own a specific area of cloud-based enterprise software in your own portfolio.

As an example, Iowa-based Workiva NYSE: WK offers cloud software to help businesses with compliance and other reporting requirements. Its platform was originally designed to help enterprise customers efficiently file reports with the Securities Exchange Commission. It now offers other services, such as tax reporting software.

This is also a potentially volatile stock, with a beta of 1.37. It’s advanced 18.63% in the past three months, 71.51% year-to-date, and 124.23% in the past 12 months.

Shares gapped up more than 7% on November 4, following a quarterly report that topped analysts’ views on the top and bottom lines, according to MarketBeat data.

That gain helped the stock clear a third-stage base with a buy point above $156.48. A third-stage base can be risky, as it indicates the stock has rallied, experienced some selling, and rallied again multiple times. That can mean institutional investors are waiting for a re-set, in the form of a pullback that undercuts the prior structure low, before jumping back in.

Workiva exceeded analysts’ sales and earnings estimates in each of the past eight quarters.

The bottom line is: I flip through a lot of charts when looking for investment ideas for myself and to share with readers. I frequently find stocks with promising charts, such as Progress Software and Workiva, but digging a little deeper, there’s not always a sound reason to take a flier.

If you hold individual stocks in your investing or trading portfolio, it’s important to diversify by sector, industry, and market capitalization. But it’s not necessary to own small or mid-cap stocks just because they have good charts or good fundamentals. Better to seek out the highest quality stocks with solid estimates. If you choose to own more volatile, thinly traded stocks, be aware that you may get shaken out easily, even if there’s not a news event to drive the downside trade.

Before you consider Progress Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progress Software wasn't on the list.

While Progress Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report