Market participants have been facing a tough choice lately regarding the chip and semiconductor industry. As geopolitical tensions arise between the United States and China, especially in the intellectual property sphere, many players in the space find themselves staring down a nasty divorce.

The United States is looking to regain and maintain its global leadership position in being the sole producer of the most advanced chip and semiconductor technologies, using the latest and most efficient engineering methodologies to produce these necessary components for the overall economy. China can be seen as the apple that does not fall far from the proverbial tree, as the nation is also looking to establish itself as a leader in chip manufacturing and engineering.

This clash of titans has escalated into full-blown restrictions on exports and intellectual property concerns from both parties. The United States has slapped chip manufacturing machinery restrictions on China, and China has accused the United States of unfair market practices, as companies like Huawei and Bytedance have been blocked from entering the marketplace. The climax of this conflict seems to be who keeps the closest ties with Taiwan, where Taiwan Semiconductor Manufacturing NYSE: TSM operates and produces most of the world's chips and semiconductors with low labor costs, and which of the two contestants will have access to the engineering and development capacities for the most advanced chips out there.

Warfare on all Flanks

This highly competitive industry can be broken down into three main spaces or markets which the largest players serve. The smartphone and mobile device market, the desktop and laptop market and the networking or data processing equipment market (refer to routers and data centers/cloud computing).

NVIDIA NASDAQ: NVDA has a track record of historically dominating the GPU market, where GPUs greatly enhance artificial intelligence capabilities and graphics on desktop and laptop devices. Intel NASDAQ: INTC is a major player in the x86 and microprocessor space, along with their latest announcement launching the Sierra Forest chip, which will accelerate their operational stance and capacity in aiding the growth of artificial intelligence models relying on data processing, data centers, and cloud computing power by the same extension.

Lastly, the smartphone and mobile device chip market is mainly dominated by Apple NASDAQ: AAPL and Qualcomm NASDAQ: QCOM. These two competitors comprehensively break down an investor's view as to whether the United States or China will come out ahead in this "chip war".

Asia Telecoms? Think Qualcomm

Apple has historically generated most of its revenue from the Western world, including revenue from their iPhones which carry A-chips. On the other hand, Qualcomm is a competing smartphone and mobile device chip firm that derives most (60%+) of its revenue from China, Vietnam, and South Korea.

Qualcomm chips have historically operated in a sort of bubble, landing deals with brand after brand and riding the tailwind of the fastest-growing economies in the world. As Asia wakes up to faster and further economic advancement, more citizens are able to afford better and more powerful mobile devices - namely smartphones - and the dominating Asian phone brands also happen to carry Qualcomm chips.

Phone brands such as Samsung, Xiaomi, Google Pixel, LG, Motorola, Sony, Asus have been sporting Qualcomm mobile chips for quite some time. Whether these chips have attributed to the continued popularity and growing adoption of these phones is up to the users themselves. Still, investors can appreciate the impact they have had on the mobile market.

The Snapdragon 8 Series Processor

A red dragon has historically represented China. Qualcomm chose to launch its newest and most advanced processor to date sporting a red theme and naming it after the spirit creature, perhaps solidifying its ties to the East Asia giant. What is more important, however, is what this new processor will allow its users to accomplish.

The Snapdragon 8 series will include a high-performance CPU along with an advanced GPU, thus giving it the best of both worlds in terms of data capacity and computing power. Additionally, it is the world's first 5G A.I. modem, showcasing a 40-45% improvement in power savings.

Effectively, this new processor will allow smartphones across Asia to access 5G processing speeds and communications, along with extending the desktop and laptop capabilities for data processing and cloud computing. Given that 60%+ of Qualcomm's revenues come from China, the red giant will be pleased to have access to technology that will enhance their plans of chip technology leadership.

Room for Upside?

Qualcomm has showcased just how important the Chinese economy is to its business, as 2021 and 2022 saw 42.6% and 31.7% revenue growth, respectively, coinciding with the reopening of the Asian economy. Despite closing of one of the major economies in the world during 2020, the company only saw revenue contractions of -3.1% with margins as steady as ever; gross margins remained at their historical 57-60% and net margins followed in their 22-26% average range.

When considering Qualcomm's potential today, it is important to note that China has not completed its reopening entirely. The Chinese government has pledged to inject $1.5 trillion Yuaninto its economy, with a focus on infrastructure spending and the consumer sector. As a result, investors may expect further double-digit revenue growth for 2023, along with high net income margins.

As of today, the stock trades at 11.2x its earnings per share, representing a cheap valuation that is further accentuated by the $11 billion USD in share buybacks and dividends paid out to investors during 2022. The company's increase in inventory, from 7.8% of assets to a five-year high of 12.9% of assets, suggests that it is stocking up for a big year and reflects expectations of strong revenue growth from the Chinese reopening.

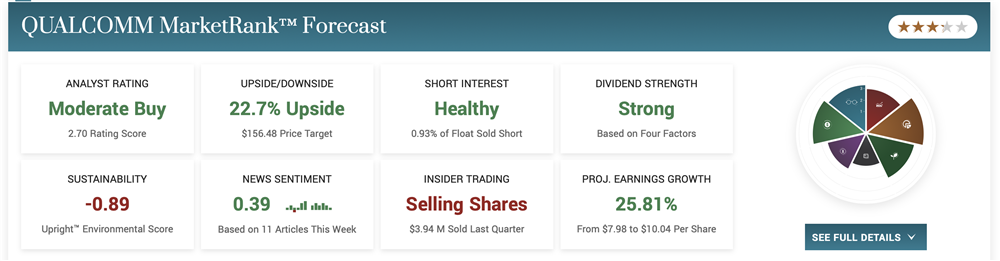

Analysts seem to agree with this tailwind facing Qualcomm, as they have assigned a consensus 22% upside to the stock at these levels. Bullish divergences in weekly RSI and stochastic levels may also point to the stock gearing for a rally in the near future.

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report