$158.19 -5.51 (-3.37%) (As of 09/6/2024 ET)

- 52-Week Range

- $104.33

▼

$230.63 - Dividend Yield

- 2.15%

- P/E Ratio

- 21.26

- Price Target

- $210.63

Equities across the board are starting to soften after months of gains, making it a good time to go bargain-hunting. Many of the stocks that have enjoyed triple-digit percentage gains this past year are also facing some of the heavier selloffs. Qualcomm Incorporated NASDAQ: QCOM, a semiconductor tech stock, for example, is in the middle of a 20% drop after a 120% rally.

The bears will say that everyone is finally realizing how overly reliant the market has become on a few big stocks, particularly those related to artificial intelligence (AI). However, the more optimistic investor will see this as a potential buying opportunity and will be on the lookout for discounted stocks. Qualcomm is one such stock that’s been flagged as a potential bargain, so let’s jump in and take a closer look.

Qualcomm's Bullish Performance Inspires Analyst Optimism

- Overall MarketRank™

- 4.99 out of 5

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 33.1% Upside

- Short Interest

- Healthy

- Dividend Strength

- Strong

- Sustainability

- -0.89

- News Sentiment

- 0.49

- Insider Trading

- Selling Shares

- Projected Earnings Growth

- 10.15%

See Full DetailsThere are a couple of reasons to be excited about Qualcomm. First, they’re performing well as a business and have been delivering earnings reports that have smashed analyst expectations. Their Q2 numbers, for example, were strong across the board, while management’s forward guidance was considerably higher than expected.

Seeing earnings beats of this nature is one of the most compelling signs that a stock is performing well and that any subsequent harsh drop might be overdone. Investors will get a fresh look at Qualcomm’s performance when the company delivers its Q3 numbers next week, but for now, there are no reasons to think it won’t be similar to last time.

Several analysts have picked up on this theme over the past week, reiterating the bullish outlook on Qualcomm stock and even increasing their price targets. These kinds of optimistic calls, both during a 20% drop and ahead of an earnings report, speak volumes to their level of conviction in the buying opportunity here.

Qualcomm Is a Top Pick in the Semiconductor Industry

Take the team over at Susquehanna, for example. They reiterated their positive rating on Qualcomm last week and gave the stock a boosted price target of $250. The Robert W. Baird team echoed this on Tuesday of this week and did the very same thing. Considering Qualcomm shares closed at $181 last night, these refreshed price targets point to an attractive upside of almost 40%.

In a note to clients, Baird named Qualcomm as a top pick from the semiconductor industry, pointing specifically to the company’s bullish exposure to AI and strong market demand for its products. Similarly, Susquehanna also sees strong end-user demand driving sales beyond current forecasts, to the extent they were bullish enough to raise a price target on a falling stock right before its earnings report.

Qualcomm's Attractive Technicals

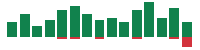

For those of us on the sidelines, there’s also the technical side to consider. Like many other equities in recent weeks, Qualcomm stock was, by many measures, starting to look a little frothy. Take its relative strength index (RSI), for example. In June, it was giving a reading of 82, indicating extremely overbought conditions. For context, anything above 70 on the RSI is considered overbought, while anything below 30 is considered oversold.

So, with Qualcomm shares having been extremely overbought just a few weeks ago, it’s perhaps no surprise they’re experiencing a correction. But the slide has been so steep that the stock is now verging on oversold levels. With a current RSI of less than 36, Qualcomm's RSI would only take one or two more red days to indicate extremely oversold levels. If that happens, don’t be surprised to see buyers swooping in en masse, as this will be simply too good an entry opportunity to miss.

Before you consider QUALCOMM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QUALCOMM wasn't on the list.

While QUALCOMM currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.