Social media forum Reddit Inc. NYSE: RDDT made headlines during the 2021 meme stock frenzy as its popular wallstreetbets forum led small investors into shares of GameStop Co. NYSE: GME, fueling its historic short squeeze. The company went public through an IPO on March 21, 2024, rising to a $74.90 peak the following day and falling to a low of $37.35 just a few days later. Shares have stabilized for the time being, especially as a meme stock resurgence appeared to be spawning again on the return of Roaring Kitty or Keith Gill to humanoids.

Reddit operates in the computer and technology sector, competing with social media platform operators like Meta Platforms Inc. NASDAQ: META, Snap Inc. NYSE: SNAP and Pinterest Inc. NYSE: PINS.

Reddit Generates Revenues Through Advertising and Data Content Licensing

Traffic generates revenues for the company which collects most of its revenues from advertisers. However, data content licensing is another revenue stream that Reddit is seeking to grow. In February, Reddit announced its first data content licensing deal with Alphabet Inc. NASDAQ: GOOGL Google to use its content to train its AI models like Gemini. The deal is speculated to be worth $60 million.

OpenAI and Reddit Partnership is a Win-Win Deal

Reddit Today

$170.71 +6.99 (+4.27%) (As of 12/20/2024 05:45 PM ET)

- 52-Week Range

- $37.35

▼

$180.74 - Price Target

- $132.70

A deal with artificial intelligence (AI) developer OpenAI may result in a windfall. On May 16, 2024, Reddit announced its partnership with OpenAI. Enhanced Reddit content will be brought to ChatGPT through access to Reddit’s Data API. This will enable real-time and unique content from Reddit to be featured. Reddit's data would be accessible to OpenAI to help train various AI models. It could enable Reddit to monetize its content through data licensing, especially with other AI and data collection companies.

Reddit will integrate new AI-powered features for content creators, modes and redditors. Reddit will build on OpenAI’s platform of AI models. OpenAI will also become a Reddit advertising partner. Reddit content and information will be used in ChatGPT as it will help more audiences discover Reddit. OpenAI CEO Sam Altman is also a shareholder in Reddit.

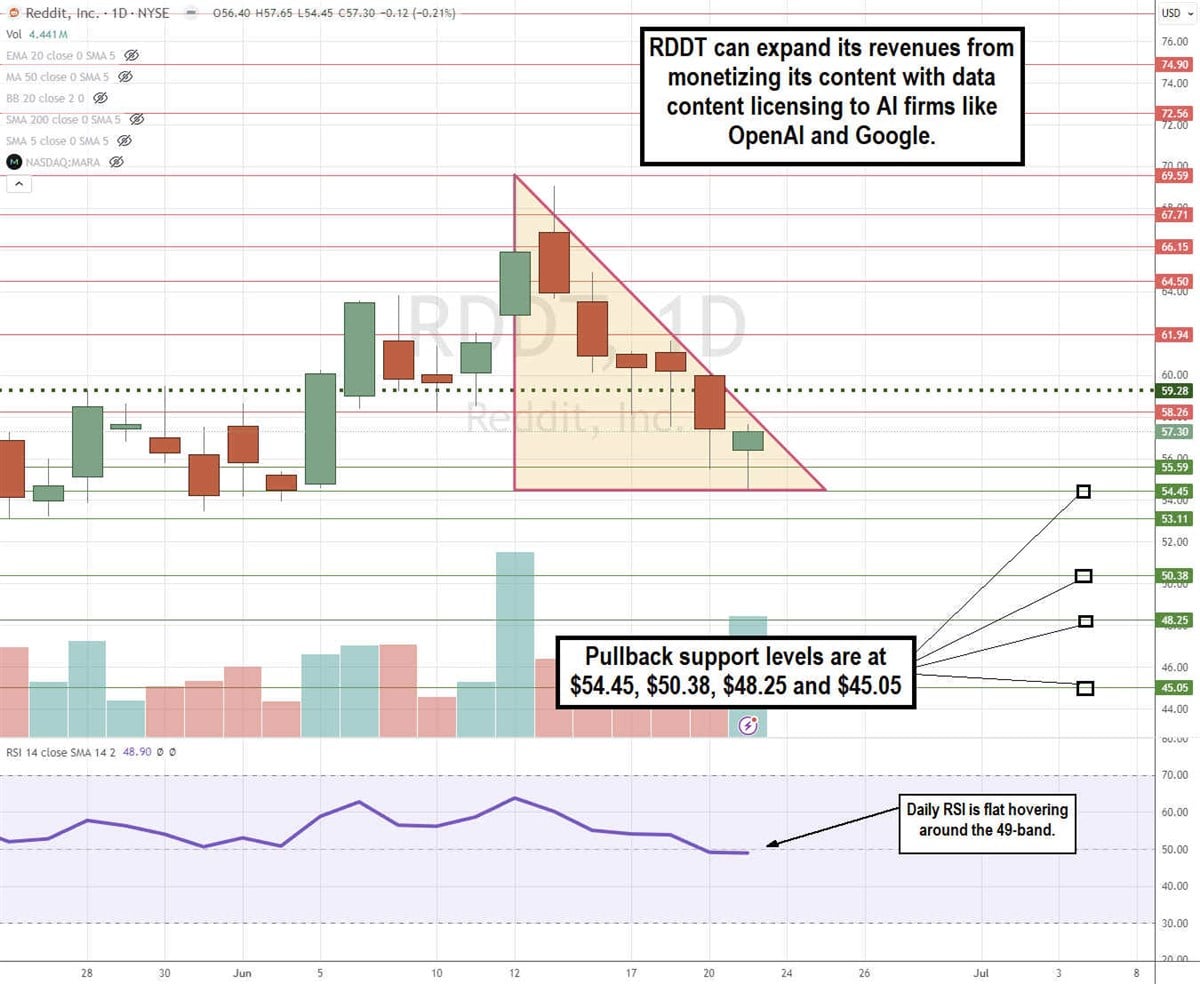

RDDT Stock is in a Descending Triangle Pattern

The daily candlestick chart for RDDT demonstrates a descending triangle pattern. The descending trendline formed at the $69.59 peak on June 12, 2024. The upper trendline was formed by connecting the lower highs on the candlesticks that were met on bounce attempts. The flat-bottom lower trendline formed at $54.45 as it has held many breakdown attempts. RDDT stock is nearing the apex point where a breakout or breakdown can form. The daily relative strength index is relatively flat around the 49-band. Pullback support levels are at $54.45, $50.38, $48.25 and $45.05.

Reddit Improving Adjusted EBITDA While Revenues Are in Hypergrowth

Reddit reported its first earnings report as a publicly traded company on May 7, 2024. The company reported an EPS loss of $8.19 per share, which was actually 56 cents more than consensus estimates. Adjusted EBITDA was $10 million compared to a loss of $50.2 million in the year-ago period.

Revenues surged 48.4% YoY to $243 million, handily beating $214 million consensus analyst estimates. Revenues took a strong spurt in Q1 over Q4 2023, which saw 25% YoY growth. The increase in new users drove this, while ad pricing was softer.

Reddit Metrics are Experiencing Hypergrowth

Reddit grew its daily active users (DAU) to 80 million. Reddit experienced strong growth in the United States, while most of the social media platforms are experiencing a plateau or minor growth. Its monthly active users (MAUs) grew to more than 500 million.

Raising Forward Revenue Guidance for Reddit

Reddit raised its Q2 2024 revenue guidance to $240 million to $250 million versus $227.47 million consensus analyst estimates. Reddit expects to generate an adjusted EBITDA of zero to $15 million. Over 16 analysts started coverage for Reddit after the IPO.

Reddit’s User Base Grew 37% YoY in Q1 2024

Reddit CEO Steve Huffman presided over the company's first earnings conference call. Huffman noted that they will answer questions on the conference call and then a few more on Reddit's subreddit after the call. Reddit's user base grew 37% in Q1 2024, covering over 80 million DAUs and 300 million users weekly. The company's goal is to make Reddit faster, safer and easier to use. Its new web platform, Shreddit, has grown users by 100% and operates twice as fast. The company continues to invest in AI and machine learning (ML) to improve relevance, moderation and engagement.

International Growth with AI and Machine Translation and User Economy Growth

Reddit is using machine translation to unlock its mostly English corpus and grow international users. To motivate users to create content, Reddit is looking to bolster user economy referring to a family of features enabling users to spend and earn money on Reddit.

CEO Huffman elaborated, “Launching soon is a revamped version of user awards and Reddit Gold, which is our virtual currency that enables both of these things. And our developer platform, third party developers will be able to push the boundaries of what subreddit can be, and we're excited with the early progress here. For example, wallstreetbets has livestock tickers for training stocks and a number of sports subreddit have built live scoreboards to track gain.”

Before you consider Reddit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reddit wasn't on the list.

While Reddit currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.