Selling a home is expensive. With home prices setting record highs, the typical 2.5% agent listing fee can easily reach five figures. I’ve long thought that there must be a better way. A cheaper way.

Redfin NASDAQ: RDFN has found that way and executed. The online real estate broker charges a commission of just 1.5% for each home sold.

The company pulled it off by turning the traditional brokerage model on its head. Instead of paying its agents a percentage of the total commission, Redfin pays them a salary. With nearly 2,000 salaried lead agents – and growing – Redfin is building a strong presence across the country.

Redfin Offers Customers Other Ways to Sell Their Houses

Typically, a real estate broker sells a customer’s house by advertising it and finding a buyer. The broker doesn’t take much of a role in making the property more attractive, and the buyer tends to be the end-user.

Redfin, however, is offering alternative options for homeowners.

Its RedfinNow service lets customers sell their house to the company for a 7% service fee. Sounds pricey, but this option can be a godsend for a cash-strapped customer who may have just lost their job.

Obviously, this introduces a level of risk for Redfin. What happens if the market crashes? Management is aware of this risk, so Redfin only offers this service under certain circumstances.

Redfin also offers a concierge service; sellers pay a 2.5% listing fee to work with Redfin to make repairs and upgrades. The seller pays foots the bill, but Redfin uses its network to coordinate the work through contractors.

I think the concierge service has a lot of potential because it’s a win-win for Redfin and its customers. Redfin’s customers can leverage the company’s expertise and connections to get a better ROI on their upgrades than they ever could on their own. Redfin pockets the extra 1.5% without taking on any risk, but the customer ultimately ends up paying an average real estate commission for well-above-average value.

Redfin Has Plenty of Room for Growth

Look at the Q3 2020 numbers for Redfin and you’ll see:

- Revenue was down 1% yoy to $236 million.

- Gross profit of $93 million was up 74% yoy.

- Net income was $34.2 million, up from $6.8 million in the same period a year ago.

Gross profit and net income growth look great, but what happened with revenue?

CEO Glenn Kelman explained the disconnect, saying the revenue dip was “due to a pandemic-driven shortfall in the number of RedfinNow homes we could sell. Our RedfinNow business of buying and selling homes has an outsized impact on revenue because we have to account for the entire home value, not just the transaction fees we get from a brokered sale.”

Redfin’s core business recorded revenue growth of 36% yoy in Q3. And the thing is, that revenue growth may not slow down any time soon. Consider that:

- Redfin only has a 1.04% share of the existing home market in the US.

- Customer inquiries for Redfin’s agents or partners agents increased 58% yoy in October, accelerating from a 38% yoy increase in July.

- The company’s website receives nearly 50 million monthly visitors, and it does an excellent job of converting them into customers.

Redfin trades at nearly 9x forward sales, and it has recorded a net loss of around $40 million over the last 12 months, but this is the type of company that can see explosive revenue growth for longer than you expect.

Gross profit over the first nine months of 2020 came in at $152 million, up 45% from the $104.5 million recorded over the first nine months of 2019. Let’s say gross profit grows at a CAGR of 30% for Redfin over the next five years: that would take it to over $550 million by 2025. I’m not making any predictions – it will certainly be higher or lower than that – but I’m just trying to illustrate what’s possible for an industry disruptor that is just getting started.

Best to Hold Off

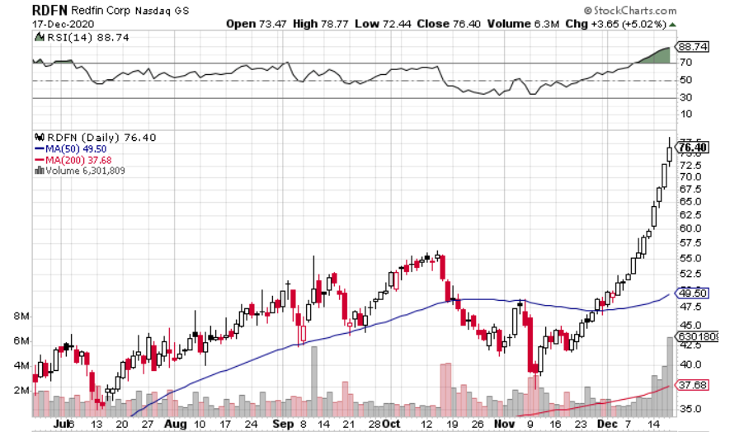

Okay, you may have thought I was going to tell you to buy Redfin as soon as you finish this article, but you may want to hold off because shares are EXTENDED. RDFN plummeted nearly 13% on November 9 on the Pfizer NYSE: PFE vaccine news, but has nearly doubled in the less than six weeks since then.

There are lots to love about this company, but a pullback is almost certainly coming, so look for one of two things:

- A short-term consolidation – think 3-4 weeks – that ends in a convincing breakout.

- A 15-20% pullback that culminates with a strong reversal.

Keep a close eye on Redfin – you don’t want to miss an opportunity to get in.

Before you consider Redfin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Redfin wasn't on the list.

While Redfin currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.