Little-known wellness and functional beverage company Safety Shot NASDAQ: SHOT captured headlines and imagination this week as its stock surged higher on exceptional volume. The small-cap company saw its stock rise triple-digits before falling dramatically on Wednesday but remains green on the week as of Wednesday’s close.

The immense volatility experienced in its shares resulted from several factors: a fresh announcement by the company, technical factors impacting the supply and demand of shares, a short report, and lastly, a response by the company to the short report.

So, as one might imagine, there’s a lot to unpack with shares of SHOT, as the drink maker has garnered intense attention as of late. With a lot going on behind the scenes, it’s worth taking a closer look at the company to see whether shares of the company have overshot the mark or if it’s just getting started.

What is Safety Shot?

Safety Shot is a wellness and functional beverage company that researches and develops over-the-counter products and intellectual property. The company’s product pipeline includes Photocil to address psoriasis and vitiligo; JW-700 to treat hair loss; JW-500 for women's sexual wellness; NoStingz, a jellyfish sting prevention sunscreen; and JW-110 for the treatment of atopic dermatitis/eczema. The company primarily sells its products through third-party physical retail stores and partners.

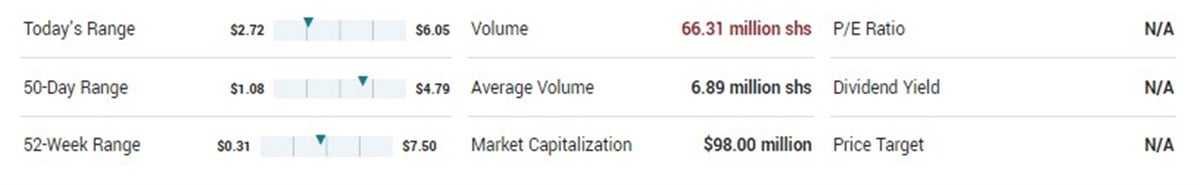

The company’s stock, SHOT, has an average volume of 6.89 million shares, and currently, the company has a market capitalization of just under $100 million. As of the close on Wednesday, shares were trading in the middle of its 52-week range, between $0.31 and $7.5.

Shares SHOT higher this week

Safety Shot shares surged higher this week after the company announced the West Coast launch of Safety Shot, the first patented beverage on earth that helps people feel better faster by reducing blood alcohol content and boosting clarity.

CEO Brian John said, “We are super excited to have people try Safety Shot. We have given out thousands of Sample Cans and run hundreds of BAC tests already and have proven that trying Safety Shot is believing in Safety Shot.”

The announcement brought in exceptional trading volume for shares of Safety Shot. On Monday, the stock traded over 23 million shares. Tuesday saw the stock trade over 77 million shares; on Wednesday, it traded over 66 million shares. An incredible amount traded, considering its average daily volume is just over 6 million shares.

Even more impressive, and what undoubtedly played a significant role in volatility and price movements, was the volume traded relative to the float of SHOT. SHOT has a free float of 21 million shares, meaning that the float could have rotated almost nine times between Monday and Wednesday. Add short sale activity and buy-ins to that intraday, and the ingredients for a short-lived short squeeze exist.

Those factors likely played a more prominent role in the price appreciation than the company announcement.

SHOT responds to short report

A short report from Capybara Research sent shares of SHOT tumbling on Wednesday. Capybara made several claims about the beverage maker, including claims about the company’s founders and questioning the legitimacy of its flagship product.

Safety Shot quickly responded to the short report, calling the information malicious, defamatory, and inaccurate. The company said it plans to take legal action against the short seller and highlighted lawsuits filed against Capybara Research regarding potentially fraudulent articles published about other companies.

Before you consider Safety Shot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Safety Shot wasn't on the list.

While Safety Shot currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.