The

S&P 500 NYSEARCA: SPY has made an impressive recovery off its March 23, 2020 pandemic lows at $218.26 taking a (-34%) plunge off the Feb. 18

th highs of $339.08. The SPY has set up a perfect storm composed of bullish pup and mini pup formations across the three wider time frames daily, weekly and monthly. The markets are looking past COVID-19 while current economic indicators still wreak of recession. With narratives changing by the day amid growing tensions with China, election uncertainties, the second wave of COVID-19 hotspots threatening rollbacks and political gridlock over further federal economic aid to businesses and consumers, it’s hard to believe the SPY is nearing all-time highs again. Is there a disconnect with reality or is reality simply lagging the markets? Is the SPY faking it to buy enough time for a COVID-19 vaccine to receive an FDA approval?

Nasdaq 100 index Versus S&P 500 index

As impressive as the SPY recovery has been, the Nasdaq 100 index NASDAQ: QQQ surpassed its pre-COVID-19 all-time highs of $237.47 made on Feb. 18th. The QQQ first breached and made new highs on June 5th, retested on June 29th and peaked at all-time highs on Aug. 6th at $274.98. The Nasdaq has been powered by pandemic benefactors in the industries of information technology, biotechnology, internet and e-commerce while the SPY has been bogged down stocks in industries hit worst by the pandemic including travel and leisure, transportation, restaurants, manufacturing and industrials, banking and financials. The QQQ has been pre-dominantly fueled by the FANG stocks; Facebook NASDAQ: FB , Amazon NASDAQ: AMZN , Netflix NASDAQ: NFLX and Google NASDAQ: GOOG .

Narrative Impacts Sentiment Impacts Price

As of Aug. 9, 2020, COVID-19 cases reached 5 million cases in the U.S. and global infections surpassed 12 million cases. The market has shrugged off coronavirus figures, at least the negative ones. The overriding narrative is the Federal Reserve (Fed) put being firmly in place as markets perceive that Fed will come to the rescue with its quantitative easing (QE) infinity programs using COVID-19 relief as justification. In fact, the Fed balance sheet peaked at $4.6 trillion as the unwinding took it down to $3.8 trillion by Q3 2019. However, between Q4 2019 and June 2020, the Fed balance sheet as exploded to over $7 trillion and still rising. Many analysts believe all this liquidity is being pumped into equity markets. The concept of narrative impacts sentiment which moves price can be turned upside down when price gets extreme. Examples of this can be found with stocks like Tesla (NASDAQ: TSLA) , Shopify NASDAQ: SHOP and Zoom Video NASDAQ: ZM .

Fake it Til You Make It

The SPY is a laggard to the QQQ. Could the SPY melt-up be a way of buying time for an FDA approved COVID-19 vaccine? If that happens, the money could rush out of the QQQs and head into the SPY’s lagging epicenter industries like travel and leisure, lodging, consumer apparel, restaurants and transportation. On the flipside, if the QQQ’s peak out first, will money rotate into the SPY or kill off the momentum in SPY and pull it back down as well? Let’s take a look at the SPY charts.

SPY Price Trajectories

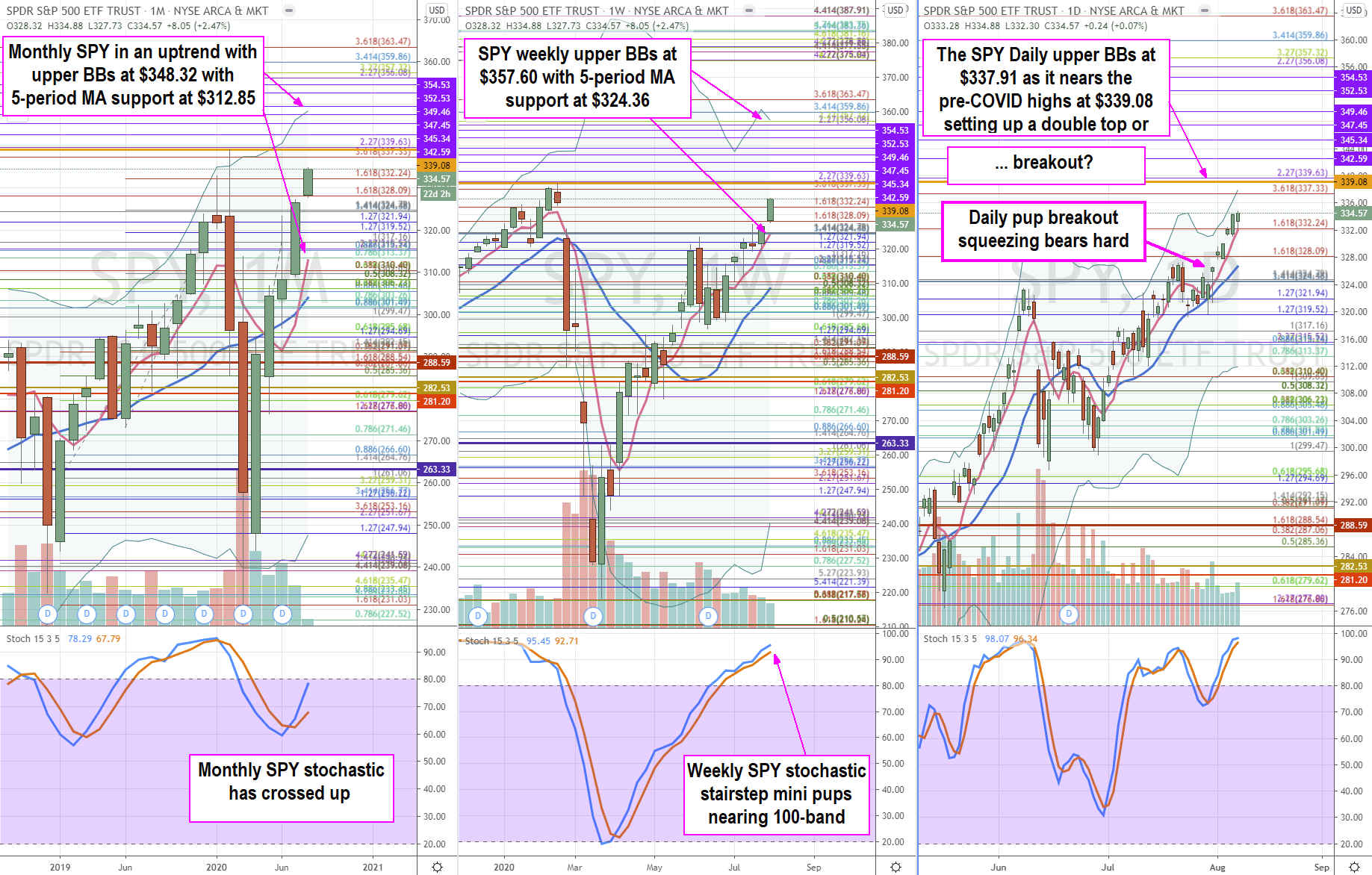

Using the rifle charts on monthly, weekly and daily time frames, we lay out the full near-term to longer-term playing field traders and investors. The monthly stochastic has crossed back up triggering a breakout with upper Bollinger Bands at $348.32 with the 5-period moving average (MA) support at $312.85. The weekly stochastic has been in a bullish stochastic mini pup since triggering the market structure low (MSL) above $263.33. The oscillation stretched through the 80-band and formed three stairstep mini pups with 5-period MA support at $324.36. The daily rifle chart also triggered a high band mini pup with 5-period MA support at $337.91 with upper BBs just shy of prior highs at the $339.08. This level will either be a double top or a springboard towards the upside trajectories of the $339.63 gatekeeper Fibonacci (fib) level, monthly and upper BBs at $348.32 and $357.60. If the daily stochastic peak out, then watch for the weekly and monthly 5-period MA supports to test before making another attempt to break prior highs. Rather than hard spikes, the bulls are best positioned during low-vol melt-ups that keep bears complacent and frustrated. Ultimately, the market will unveil the disconnect as time runs out triggering a fallout or an FDA vaccine approval rockets the SPY higher as the laggard sectors see panic buying.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.