Having bounced up 35% from the multi-year lows they plunged to in the wake of SVB’s collapse, investors would have been thinking Charles Schwab Corporation’s NYSE: SCHW stock was getting back to normal. Certainly, that was the opinion of the Marketbeat team and some of the Wall Street heavyweights at the time.

But in the fortnight since their shares have lost much of their elasticity, the stock is suddenly looking quite heavy. Yesterday saw shares drop another 5%, remaining 30% lower than before the recent financial crisis .

Initial Concerns

The concern at the time of the initial drop was that Schwab was equally exposed to higher interest rates by its cash sorting habits. These caused much of the damage to SVB, so you can understand why investors were keen to get their money out. But the snap back in the following sessions suggested the fears of contagion were overblown. This week’s weakness however suggests otherwise. Let’s dive in and see if the fresh concerns are justified or if this could be one of the great buying opportunities of the year.

The catalyst for yesterday’s drop was a downgrade from the team at Morgan Stanley, who cut their rating on Schwab stock from Overweight to Equalweight. They cited continuing uncertainty around interest rates and the knock-on effect this will have to cash-sorting trends. In a note to clients, analyst Michael Cyprys summarized why this is considered a headwind for Schwab; with the Fed continuing to raise rates, Schwab customers are moving cash out of sweep accounts into money market funds at a rate of $20B per month, which is double the amount Morgan Stanley had previously been modeling. In a note to clients, Cyprus wrote that "this means Schwab earns less from monetizing cash, which will hurt earnings on top of higher funding costs”.

It’s a long way from being a full-blown bank run, like the one that took down SVB and almost toppled First Republic, but the fresh uncertainty around which way the Fed will move next is too much for the Morgan Stanley team to confidently hold their Overweight rating going into the next earnings report. Cyprys made this clear when he wrote that "while clients aren't leaving and Schwab has other sources of liquidity, earnings face more pressure than we had expected".

Longer Term Potential

This was a risk that the team at J.P. Morgan wrote off last week, when analyst Kenneth Worthington wrote to clients that Schwab has “virtually no risk from a bank-type run." At the same time, Worthington did flag the current uncertainty as a risk to the company’s coming earnings reports, so it’s fair for investors to treat this as a serious headwind.

When the longer-term opportunity is considered though, is $50 or thereabouts really a fair price for Schwab’s stock right now? This is the same price the stock was at towards the end of 2020, and where it spent much of 2018. Its revenue and profits have doubled in the years since then, and while the coming quarters might be a bit tougher than expected, it’s hard to see that as a reason why shares should have to live with the SVB inspired 30% haircut.

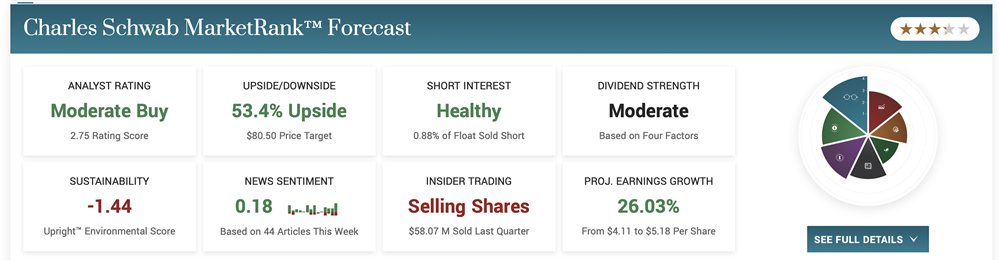

Remember, it was only two weeks ago that the team at Citi were upgrading their rating on Schwab stock to a Buy on the back of the drop. Analyst Christopher Allen wrote at the time that the pullback was opening up a “compelling entry point” and we’re inclined to agree. Our MarketRank Forecast has the stock rated as a Moderate Buy with more than 50% upside to be had from where shares closed on Thursday. Investors might have to pinch their noses a little for the next earnings report, but the long term opportunity remains impressive.

Before you consider Charles Schwab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles Schwab wasn't on the list.

While Charles Schwab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.