Electronic and digital gambling products supplier

Scientific Games (NASDAQ: SGMS) is an often overlooked player in the gambling and lottery industry. The diversified portfolio of gaming-related products ranges from casino management systems, slot machines, video lottery terminals, electronic table games to digital sports betting and wagering solutions to instant lottery products and mobile gaming platforms. The company designs, creates and supplies exclusive government-sponsored lottery products worldwide and set to ride the sports betting wave in the states. SciPlay enables mobile gameplay of their high-quality digital portfolio of free-to-play games enjoyed by millions of people daily. The coronavirus pandemic has discounted shares to bargain levels worth watching for opportunistic entries.

Liquidity for Pandemic Survival

Liquidity is one of the biggest concerns with investors as casino lockdowns in Las Vegas has shuttered gaming revenues. Scientific Games has carries $8.86 billion in debt with an upcoming interest payment due in upwards for $92 million for Q2 2020. The company has $200 million in cash, but uncertainty surrounds the cash flow situation as revenue streams are virtually frozen. On April 14, 2020, the company alleviated liquidity concerns with a press release documenting cost-cutting measures that will trim $100 million in costs for Q2 2020. They cut capex to $210-$240 million from $300-$330 million. Measures include job cuts and furloughs along with expense trimming. The company has also drawn down $480 from revolving credit facilities in addition to the $200 million cash on hand. The 82% owned SciPlay business has $130 million cash in hand with a $150 million revolver credit facility and no debt. The company has access to $960 million in total liquidity.

Q4 Fiscal Year 2020 Earnings Results

In the Q4 21019 earnings presentation, Scientific Games outlined its goal to reduce net debt leverage to -5.5X from 6.8X as of Dec. 31, 2018. They are the market leader in domestic wallet share with new games rising to the top of the charts. SGMS is the only provider with a one-stop solution of leading platform and content for partners across the three major verticals in the wagering space enabling a positive and seamless player experience. Scientific Games is the leader in North America iGaming. The side play business saw a 29% YoY growth around $400 million. The company supplies “nearly every lottery on the planet” across product lines. The high-margin instant lottery products added $2 billion to the top line. The company was awarded a seven-year iLottery contract launched in Pennsylvania.

Driving Digital Growth

The digital segment of platforms saw an adjusted-EBITDA grow 75% with momentum specifically in the sports and iGaming segment. The company has teamed up with the nation’s largest nascent U.S. sports betting platform, Fan Duel, as its supplier of online and sportsbook technology. SGMS technology is at the core of Flutter’s betting platform. Flutter is FanDuel’s parent company. Digital platforms and gaming is a high margin driver moving forward.

Shaping the Restart Narrative

Las Vegas is set to restart business in May 2020 and casino properties are eagerly planning to resume operations in phases. Wynn Resorts (NASDAQ: WYNN) took measures to outline the restart operations process as they await a launch date. Las Vegas Sands (NYSE: LVS) referenced the China template of properties slowly improving in Macao. With the U.S. about eight-weeks behind China, investors can envision a timeline of business resumption.

Opportunistic Entry Levels

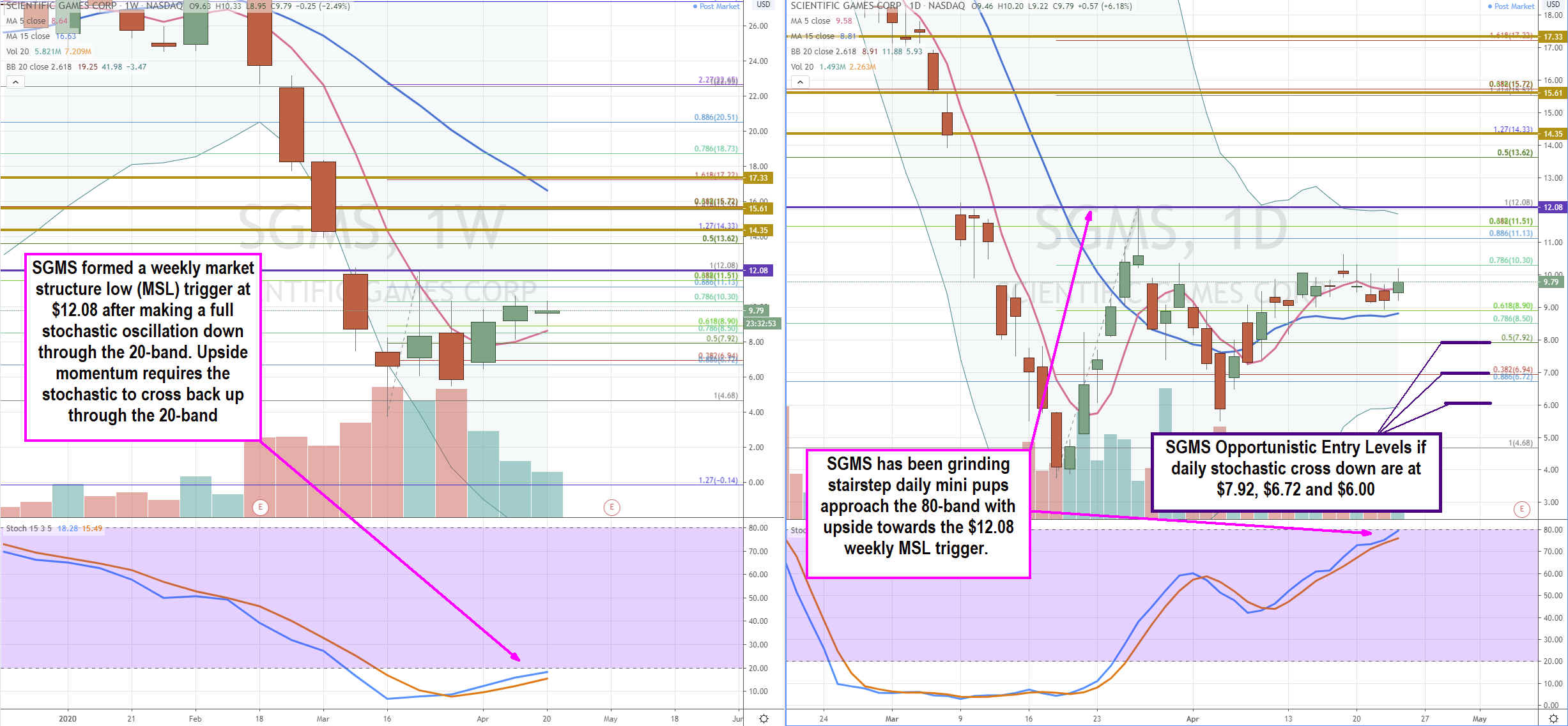

Using the rifle charts on weekly and daily time frames to lay out the playing field is suitable for swing traders and investors. The weekly market structure low (MSL) buy triggers above the $12.08, which would be chasing at this point with the high band daily stochastic. While there is a potential daily seed wave pattern with upside at the $14.35, $15.61 and $17.33 fib extensions, the daily stochastic peak and cross down provides better pullback entry levels. There are three opportunistic pullback entries at $7.92 Fibonacci (fib) level , $6.72 fib and $6.00 daily lower Bollinger Bands (BBs). Traders can use these and in-between fib levels to scalp reversions utilizing intraday time frames. Swing traders can scale for overnight to multi-day holds on converging daily/60-minute stochastic. Longer-term investors may consider a pyramid sizing dollar-cost averaging approach with a covered call strategy to buffer downdrafts.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.