Fast-casual burger joint

Shake Shack NYSE: SHAK stock shares have sold off after its Q3 earnings gap to $101.85 highs. Shake Shack continues to expand in the post-pandemic era opening up 25 company-operated Shacks in 2021, with five alone in in Q3. Company is on track to open 25 new licensed Shake Shacks globally in 2021 as it hit 21 new Shakes so far. Shake Shack plans to open 45 to 50 new

restaurants in 2022 with nearly a quarter with drive-up and walk-up windows known as Shack Tracks. Due to

supply chain disruptions, 2022 is expected to be heavily backloaded. The Company is still in the midst of its digital transformation and investing heavily in an omni channel experience including new website, app updates, and exclusive in-app only menu items to bolster

digital guest engagement, sales, and acquisitions. Like many fast-casual restaurants, Shake Shack is emerging from the pandemic as a more digitally efficient operating organization with strengthened digital

infrastructure. The Company is still experiencing growth with much more room for growth. Prudent investors seeking exposure in the

fast-casual restaurant segment can watch for opportunistic pullbacks in shares.

Q3 FY 2021 Earnings Release

On Nov. 4, 2021, Shake Shak released its third-quarter fiscal 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) loss of (-$0.05) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.06), beating estimates by $0.01. Revenues rose 48.7% year-over-year (YoY) to $193.9 million falling short of $197.47 million consensus analyst estimates. Same store comparable sales grew 24.8% YoY. The Company retained nearly 80% of digital sales in fiscal September from high of fiscal January 2021. Shake Shack CEO Randy Garutti commented, “We are pleased with the positive sales performance seen during the third quarter. This quarter marks our highest revenue quarter ever, with total revenues of $193.9 million and system-wide sales of $298.6 million. We saw benefits to our urban Shacks as more of our guests returned to offices, events, commuting and tourism-based locations. Our suburban Shacks continue to recover and, on average, perform above 2019 levels. As of fiscal September, we had retained nearly 80% of our digital channel sales, compared to fiscal January 2021, even as in-Shack sales return. Sales strength aside, we are not immune to the margin pressures that are still being felt across our industry. Inflation in commodity prices and investments across team members are pressuring our margins. We remain committed to investing in our team members to ensure we are retaining and developing the best talent in our industry, and these pressures are likely to persist for the foreseeable future. Our team is working harder than ever to take care of each other, bring hospitality to our neighborhoods, transform our Shack formats, invest in critical digital infrastructure, and uplift everyone in the Shack community along the way."

Downside Guidance

Shake Shack issued downside Q4 revenue guidance in the range of $193.5 million to $200 million versus $202.06 consensus analyst estimates.

Conference Call Takeaways

CEO Garutti set the tone, “This quarter represented the highest total revenue quarter in our company’s history. With all the noise, it’s easy to overlook that revenue is up 49% this quarter versus the same time last year. In October, we had our highest ever company operated Shack Sales Day hitting just under $3 million. And in the fourth quarter, we expect to surpass $1 billion in system-wide sales for the year, a first for us that is quite a comeback our team is making. Our Same-Shack sales compares continue to improve and are nearly back to 2019 levels on average, most notably exiting fiscal October at down, just 1%. Our hometown of New York, our hardest-hit urban Shacks are leading the way building every day as the energy of offices, events, commuters, and eventually, tourists slowly return. For Shake Shack long-term we believe the balance of urban renewal and the strength and focus of our suburban models will build a solid foundation for the future. None of us knows what’s ahead in this environment, but we’re hopeful this momentum continues. Yet as sales keep climbing back, we acknowledge profitability challenges remain, and there’s a fair amount of uncertainty for the world in the coming quarters. As many industries are shared, we too are experiencing a swift and broad acceleration in the cost of goods and labor pressures facing our business.” He continued, “On the domestic license side, we remain committed to growing our presence across airports, event venues and roadside Shacks in the coming years. We also want to congratulate our friends at the Houston Astros, who once again brought Shack Burgers to fans all season and all the way to a great world series. We’re proud to partner with them and some of baseball’s best as we bring Shake Shack to sports fans in stadiums around the country. While our licensed business continues to benefit from the overall global recovery, conditions do remain volatile and ever-changing. As a reminder, as of fiscal October end, six of our airport locations around the world, we’re still temporarily closed. Many of the pressures we feel here exist similarly across the globe. And we’re working hard with our licensed partners to keep sharing and building Shacks that sustain the test of time in some of the world’s greatest locations. Finally, we’re working continuously to create an uplifting guest experience by elevating everything we do. We’re focused on gathering communities, enriching our neighborhoods, launching great products and driving our brand in new and innovative ways. On the menu front, we’re really excited about our latest LTOs, the Black Truffle Burger and Parmesan Black Truffle Fries, which began as an app-only option to drive digital engagement. This burger feature sauce made with real black truffle oil and is layered with crispy shallots and Gruyère cheese. At $8.99 in most Shacks in our urban markets, this item also pushed the upper envelope to pricing tiers for us. And it’s going to teach us a lot about our opportunities to offer even more premium items down the road.”

SHAK Opportunistic Pullback Levels

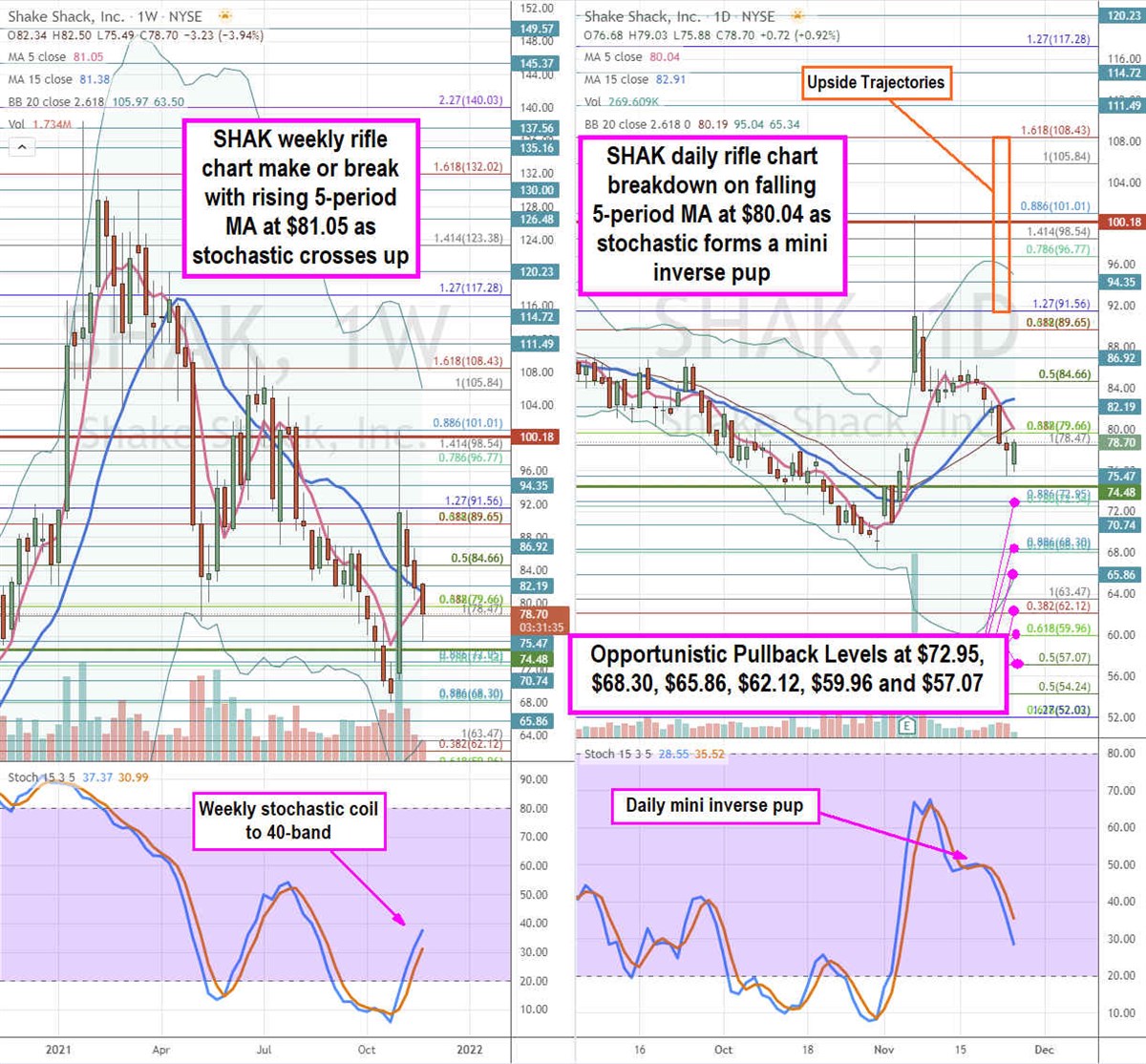

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for SHAK stock. The weekly rifle chart peaked near the $101.01 Fibonacci (fib) level on the recent earnings reaction gap. Shares have since been pulling back, causing the rising 5-period moving average (MA) support to overshoot at $81.05. The weekly stochastic bounced through the 20-band as it stalls near the 40-band. The weekly is attempting to uptrend on this make or break as long as the stochastic continues higher and the 5-period MA can crossover the 15-period MA at $81.38. The daily rifle chart has a downtrend with a falling 5-period MA at $80.04 as the stochastic forms a mini inverse pup oscillation down. Bulls will need to defend the market structure low (MSL) buy trigger at $74.78, but the daily lower Bollinger Bands (BBs) are at $65.86. Prudent investors can watch for opportunistic pullback levels at the $72.95 fib, $68.30 fib, $65.86 fib, $62.12 fib, $59.96 fib, and the $57.07 fib. Upside trajectories range from the $91.56 fib up towards the $108.43 fib.

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.