End-to-end used car e-commerce platform

Shift Technologies, Inc. NASDAQ: SFT stock went public through a SPAC reverse merger with Insurance Acquisition Corp. on Oct. 13, 2020. Shares sank after briefly peaking at $12.75 and are underperforming the

S&P 500 index NYSEARCA: SPY. Incidentally, the Company has been growing quickly as a result of the

pandemic. The competition amongst used car ecommerce platforms range from pure digital like

Carvana NASDAQ: CVNA to brick and mortar dealerships expanding their omnichannel presence like

CarMax NYSE: KMX. Shift purchases acquires used vehicle inventory through acquisition markets and even online consumers and sells them through its platform. It’s currently operating in six U.S. regions but expanding by an average two markets annually. The onset of

COVID-19 vaccine distribution should also accelerate the return to normalcy. Risk-tolerant investors seeking exposure to a

disruptive used car sales model can consider gaining some exposure at opportunistic pullback levels.

Q3 FY 2020 Earnings Release

On Nov. 11, 2020, Shift released its fiscal third-quarter 2020 results for the quarter ending September 2020. The Company reported an adjusted earnings-per-share (EPS) loss of (-$0.64) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.23), missing estimates by (-$0.24). Revenues grew by 31% year-over-year (YoY) to $59.9 million. Adjust GPU was up 89% and total unit sales up 34% YoY selling 4,046 units comprised of 2,946 ecommerce units and total wholesale units were 1,100, an increase of 35% and 31% respectively. Gross profit rose to $3.7 million or 6.2% of revenue, up from (-$0.09). Gross profit per unit grew to $1,265 compared to negative gross profits per unit of (-$391) YoY. Net loss grew to (-$23.3 million) versus (-$19 million) YoY. Cash and cash equivalents totaled $18.4 million at the end of the quarter. The Company raised its Q4 2020 revenues to a range of $72 million to $75 million, representing a YoY growth rate of 163% to 174%.

Q3 Conference Call

Shift Technologies Co-CEO, George Arison, stated how COVID-19 accelerated a digital transformation for consumers that was already underway, “Our business was built to support this consumer behavior. So, unlike our traditional retailer, we didn’t have to shut down in your lockdown period or create new capabilities to be able to sell in a touchless way in a new shopping environment.” COVID has accelerated the demand for their offering as evidenced by moving nearly 1,000 units per month. The platform’s technology-driven, consumer-centric approach has earned it a 70 net promotor score, well above traditional auto retailers. They are able to source vehicles locally and resell them within the same region.

The Shift Model

Arison claims the Company’s model has superior benefits including inventory acquisition, onboarding and sales, with fewer average days to sell and unique test driver offering. Potential car buyers can request a test drive and a Shift employee will deliver the car to the prospective buyer to test for seven days or 200 miles, “no questions asked”. They can expedite the car purchase process in less than two hours from start to finish. Trade-ins and sales are handled online, and an associate comes to the buyer to evaluate, offer and pick up the car. Shift owns all its inventory, unlike middlemen platforms. Cars are certified and repaired in its five reconditioning facilities located throughout the California and Oregon markets. More reconditioning facilities are expected to launch in their newest markets of Seattle and Austin. If the buyer is out of the region, then the car is shipped to the buyer. All Shift certified cars pass a 150-point inspection. The “CapEx lite” approach to opening new markets starts with methodically and efficiently acquiring inventory in the region first, then establishing hubs and launching recondition centers. This is what Austin and Seattle are currently undergoing. Prudent investors that want exposure into an early stage data-driven used car platform undergoing expansion can monitor shares for opportunistic pullback price levels.

SFT Opportunistic Pullback Levels

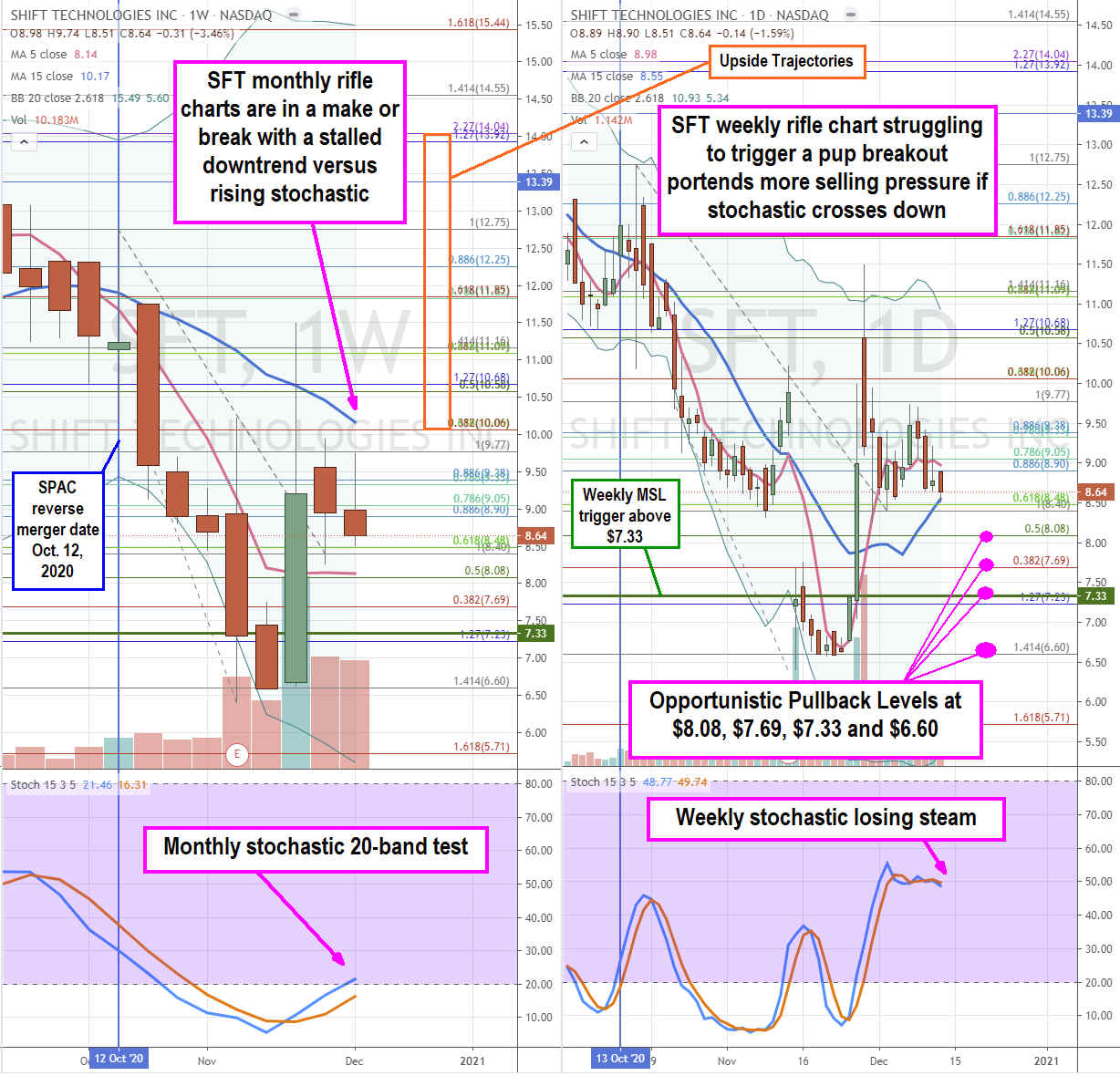

Using the rifle charts on weekly and daily charts can provide a near-term perspective of the playing field. The weekly rifle chart has a make or break trading between the weekly 5-period moving average (MA) at $10.17 and the 5-period MA is near the $8.08 46 Fibonacci (fib) level. The weekly stochastic is trying to crossover up through the 20-band. The daily rifle chart formed a market structure low (MSL) trigger above $7.33. The daily rifle chart is trying to uphold a pup breakout attempt but is steadily losing steam, which implies a potential mini inverse pup sell-off that can provide opportunistic pullback levels at the $8.08 fib, $7.69 fib, $7.33 daily MSL trigger and the $6.60 fib and prior lows. Since the shares have gone public recently, it carries a lot of volatility on thinner liquidity. The best defense is attaining low-cost entries in a scaled approach with a fraction of risk capital as the model is still losing money offset by double-digit sales growth. Upside trajectories range from the $10.06 fib to the $14.04 fib.

Before you consider Shift Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shift Technologies wasn't on the list.

While Shift Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.