Global demand for copper is soaring, but does that put suppliers like

Freeport-McMoRan NYSE: FCX, Teck Resources NYSE: TECK and

Southern Copper NYSE: SCCO in a position to rally?

Copper is a crucial component in several areas poised for growth: Electric vehicles, wind and solar power, and the infrastructure to store and transport renewable energy.

But according to a July report by S&P Global, there’s a chronic gap between worldwide copper supply and demand. S&P’s report says this “will have serious consequences across the global economy and will affect the timing of Net-Zero Emissions by 2050.”

The report's authors add, “This study finds that copper supply shortfalls begin in 2025 and last through most of the following decade.”

They cite eight operational challenges that will affect copper producers in the coming years:

- Infrastructure constraints

- Permitting and litigation

- Local stakeholders

- Environmental standards

- Taxes and regulation

- Politicization of contracts

- Labor relations

- Industrial strategies

As you see, there are plenty of obstacles looming, just at a time when demand for copper is increasing and is expected to almost double by 2035.

In addition, according to the report, “Demand from nonenergy transition end markets—such as building construction, appliances, electrical equipment, and brass hardware and cell phones, as well as expanding applications in communications, data processing, and storage—is also expected to continue to grow, rising at a compounded annual rate of 2.4% between 2020 and 2050.”

So considering all the opportunities and challenges, should investors be considering copper producers?

Freeport McMoRan, which is tracked in the S&P 500, is up 6.84% in the past month, but that recent gain obscures the stock’s struggles since April.

Given the strong demand, it’s a little surprising to see the company’s earnings and sales decelerating. In fact, in the most recent quarter, revenue slumped 6% to $5.4 billion. Earnings fell 25% to $0.58 per share.

Investors aren’t too exuberant about the stock at the moment, but they haven’t thrown in the towel, either. The stock is up 3.2% since its report. The company said lower copper prices were the culprit behind the declines.

At this juncture, with the stock trading below all key moving averages, there’s not enough momentum to put the probabilities of a near-term gain in your favor.

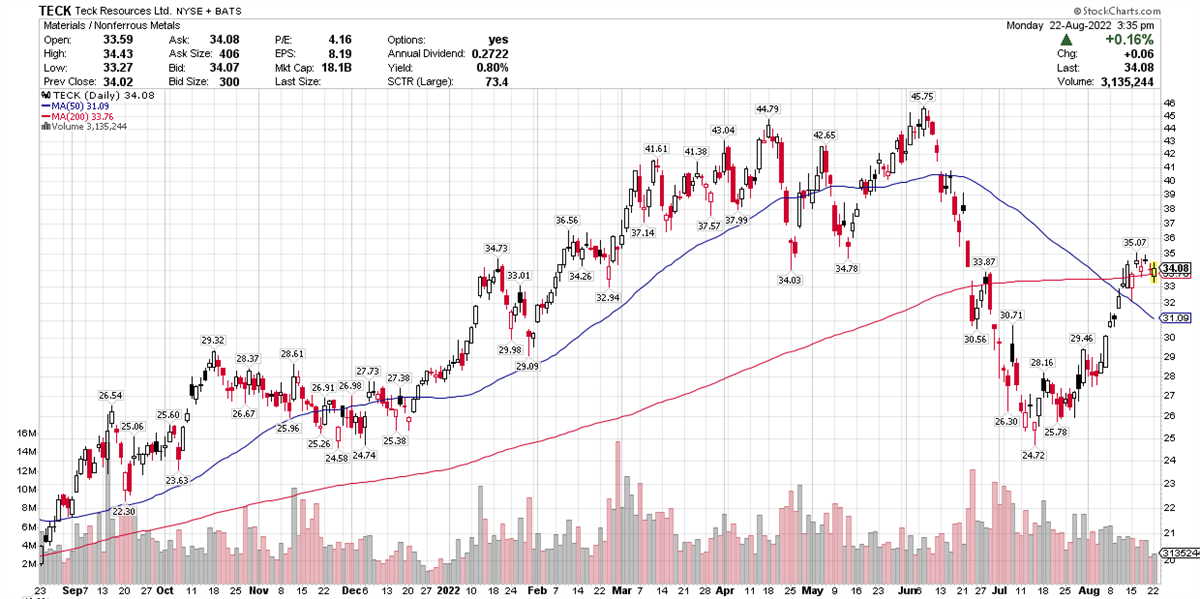

The situation is a little different for Canadian firm Teck Resources. It’s staged a 16% rally so far in August, on the heels of the company’s July earnings report. Revenue grew 126% to nearly $5.8 billion, while bottom-line growth came in at 416%, to $3.25 per share.

Many miners are involved with multiple metals and commodities. That’s the case with Teck, which cited strong prices for steelmaking coal. A weaker Canadian dollar also helped. However, like many companies in many industries, Teck faced rising costs in areas including fuel, transportation, labor and other line item expenses.

The stock has been consolidating since June, and appears to be forming the right side of its current base. According to MarketBeat analyst data, Wall Street has a “moderate buy” rating on the stock.

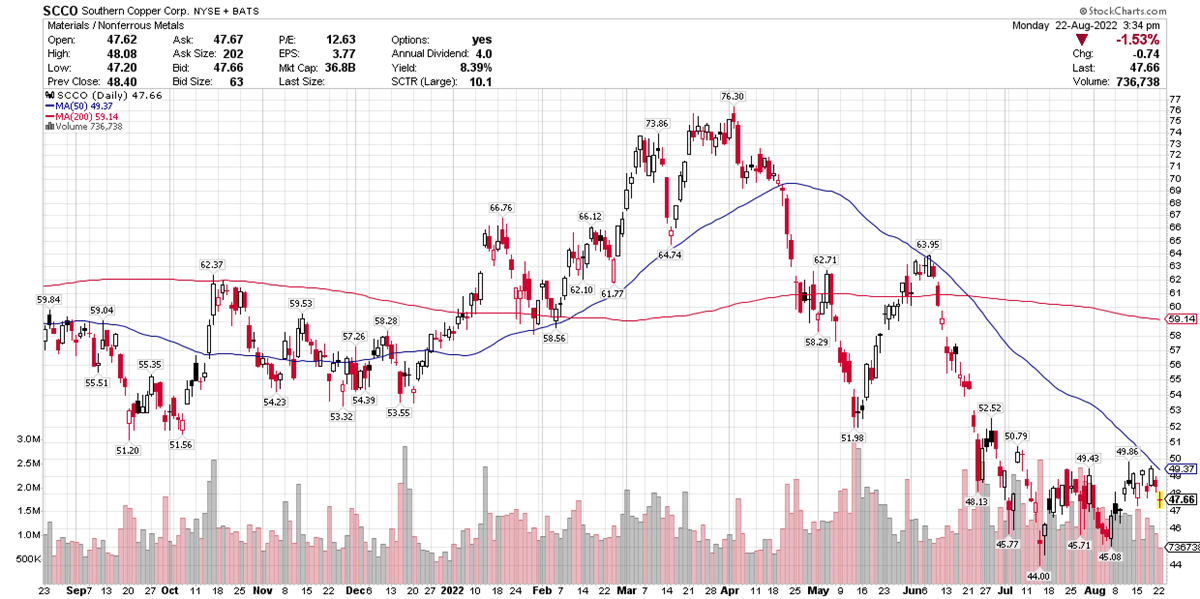

Southern Copper is underperforming the broad market by a wide margin. It’s posted a year-to-date decline of 16.71%, but a fractional gain in the past month.

The company posted earnings in late July. Revenue declined 20% to $2.3 billion. Earnings were up 3% to $1.25 per share. There’s been deceleration on both the top- and bottom lines in recent quarters.

Southern Copper’s current dividend yield is a healthy 8.26%, giving investors at least some relief while the stock languishes.

So where does this leave investors if they want exposure to an industry that could benefit from higher demand in the coming years? Especially when there are a limited number of suppliers?

At the moment, we’re not seeing the heightened demand for copper that’s predicted. This is one of those situations where industry sales may indeed ramp up dramatically, but we’re not seeing it yet. It’s tempting to nab a promising stock ahead of its big run-up, and it appears investors have plenty of time to make a play on copper before an epic rally.

Before you consider Freeport-McMoRan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freeport-McMoRan wasn't on the list.

While Freeport-McMoRan currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report