Enterprise data storage solutions provider Pure Storage Inc. NYSE: PSTG stock closed out 2022 with a (-16.5%) loss. Much of the selling in the shares was attributed to the weakening demand for storage chips, as warned by DRAM maker Micron Technology Inc. NASDAQ: MU.

Micron warned of continued demand weakness through the first half of 2023 in its Q3 2022 earnings report. This results in falling flash memory prices which is bad for the producers and suppliers but positive for consumers. Pure Storage is a consumer of memory chips, not a producer.

It provides enterprise storage solutions as a service utilizing the memory chips buys. This makes Pure Storage a winner with improved margins. Pure Storage has been lumped together with storage chip makers and device suppliers like Western Digital Corporation NASDAQ: WDC, and Seagate Technology Holdings plc NYSE: STX and suffer from declining flash memory prices, Pure Storage benefits from the cheaper costs helping to bolster its margins.

Consistently Strong Earnings Again

Pure Storage had a strong Q3 2022 as revenues rose 20% YoY, beating earnings expectations by $0.06. Its subscription service revenues climbed 30% YoY to $1 billion. The Company continues to benefit from the ever-hungry need for mission-critical data storage, access and management through its flash-optimized technology.

Conservative Guidance

The Company issued inline guidance for Q4 2022 of revenues coming in between $810 million versus $812.78 million consensus analyst estimates with a non-GAAP operating margin of 16%. The Company expects longer sales cycles due to the uncertain economic climate as companies curb spending.

What Sets Them Apart From Big Competitors

During the Q3 2022 conference call, Pure Storage was asked how it diverges itself from industry peers like NetApp Inc. NASDAQ: NTAP, Nutanix Inc. NASDAQ: NTNX, and even Dell Technologies Inc. NYSE: DELL, who aren’t seeing comparable strength in their demand. CEO Charlie Giancarlo points out that its core strategy is to drive all Flash data environments in the data center with modern software capabilities and management abilities.

They make all vendors develop a software stack focused on the benefits of a Pure semiconductor versus refilling with SSDs in a disk-oriented architecture. This enables less power, space, cooling requirements, and labor while offering more reliability and performance than competitors. CEO Giancarlo stated, “The combination of Pure's Evergreen offerings, best-in-class power space and cooling, and operating simplicity results in significantly lower operating costs for enterprise customers.”

He also added that the Company is relentless in its ability to grow accounts, “Finally, I'll mention that once we penetrate an account, our ability to expand in that account is very large because of the improved experience that our customers have.” The Net Promotor score is the most important number for the Company. It reflects its customer’s positive experience, enabling it to realize broad expansion capabilities once an account is acquired.

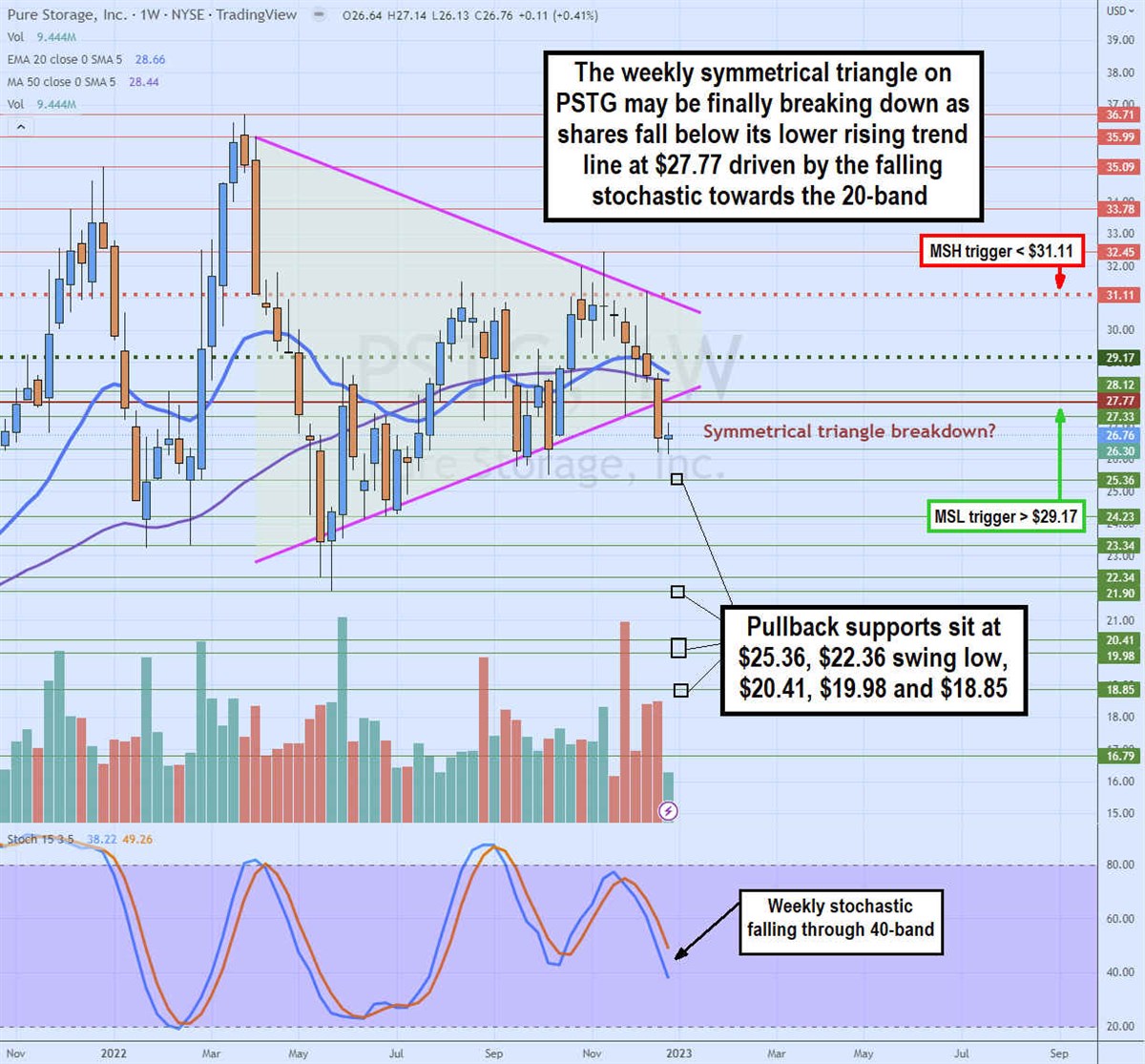

Weekly Symmetrical Triangle Breakdown Commences

PSTG stock has been chopping in a weekly symmetrical triangle formation since the beginning of 2022. It made its high of $36.71 in March 2022 and its low of $21.90 in May 2022. Since then, it has been making lower highs and higher lows with an ever-tightening trading range to form a breakout through the upper trend line above the $31.11 market structure high (MSH) sell trigger or below the lower trend line under $27.77.

It appears the breakdown has begun dramatically with a large red candle. The weekly stochastic rejection of the 80-band on its Q3 2022 earnings report appears to be giving bears the advantage as it falls towards the 20-band. Shares attempted a bounce off the $26.30 level but are having difficulty reclaiming the weekly lower trend line as it continues to climb by the week, making it even tougher to bounce. Pullback support areas for dip buyers to consider at $25.36, $22.36 swing low, $20.41, $19.98, and $18.85.

Before you consider Pure Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pure Storage wasn't on the list.

While Pure Storage currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.