Plant-based meats producer

Beyond Meat NASDAQ: BYND stock is flat on the year compared to the

S&P 500 ASX: SPY index year-to-date performance up +17.7% for 2021. The Company that introduced financial markets to the

plant-based food revolution has become mainstream as its

natural products reach more penetration and brand recognition. With the

pandemic helped the Company expand its target audience due to home diners, the continued penetration in major

food and

restaurant brands and distribution points should help top-line growth. The acceleration of

COVID vaccine should help lift its U.S. food services revenues with were down (-26%) as COVID restrictions dampened in dining room capacity. International food service was down (-44%) due to COVID lockdown and capacity restrictions. Both these segments should she a

rebound as vaccinations spread. Risk-tolerant investors seeking exposure in the plant-based meat category can watch for opportunistic pullbacks in shares of Beyond Meat.

Q1 Fiscal 2021 Earnings Release

On May 6, 2021, Beyond Meat released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings-per-share (EPS) loss of (-$0.42) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.21), a (-$0.21) miss. Revenues grew 11.4% year-over-year (YoY) to $108.16 million falling short of analyst estimates for $112.92 million. The Company ended the quarter with $1.1 billion in cash and cash equivalents with total outstanding debt at $1.4 billion.

CEO Comments

Beyond Meat CEO Ethan Brown stated, “We were pleased to see sequential improvement in our revenue growth and gross margin performance despite continued COVID-19 pressure on our foodservice business. Throughout the first quarter, we remained highly focused on investing in and building out production infrastructure in the U.S., the EU, and China; new product development and commercialization for our strategic QSR customers and retail markets; and research and development in service to our core growth levers of taste, nutrition, and cost. As I look at the foundation, we are putting in place, I have never been more optimistic about Beyond Meat's future as a significant and enduring global protein company. More near-term, we are cautiously returning to the practice of issuing guidance, starting with net revenues, as we have recently begun to see a slow thaw occurring within foodservice both domestically and in certain international markets.” Beyond Meat provided inline estimates as it expects Q2 2021 revenues to come in between $135 million to $150 million versus $141.79 million consensus analyst estimates.

Conference Call Takeaways

CEO Brown set the tone, “We spent the last year investing heavily in our business, establishing infrastructure, personnel, innovation capabilities, partnerships, and product pipeline against our long-term growth and market share objectives. More specifically, we are making a series of investments here in the U.S., in the EU, and in China to be in a position to serve customers and consumers alike and apply increasing pressure on the three key levers of taste, health, and cost that we believe are critical for mass adoption. Making these sizable investments during a period of serious disruption to important segments of our business impacts our operating margin and important metrics such as gross margin through higher fixed overhead. These outcomes are not unexpected and are a direct result of our belief that it makes little sense to limit our ability to capture future growth due to transient pandemic conditions. We will continue to make such investments, and I'm grateful for all of our team members who work so diligently to keep building our foundation through such a tumultuous time.” He detailed the Beyond Meat 3.0 recipe burger patties with half the saturated fat of 80/20 beef, “we are accompanying the 3.0 launch with the announcement of the plant-based diet initiative at Stanford University School of Medicine. We are establishing and funding this five-year initiative to support peer-reviewed clinically significant studies on the health implications of a plant-based diet, including plant-based meat.”

Achieving Price Parity with Animal Meat

CEO Brown detailed the significant focus on creating more conversions by achieving price parity of underpricing animal protein (in at least one products category) by 2024. Much of this comes from scale-driven efficiencies with more localized production and integrated end-to-end production processes. CEO Brown noted, “We are continuing to optimize commercial production at the Pennsylvania plant we acquired late last year and in support of strategic QSR customers in our retail business, we are adding new lines in our Columbia, Missouri facilities.” He also detailed China production, “As recently announced, we've commenced full commercial production at our new facility in Jiaxing, China. This new plant represents our first end-to-end production facility outside of the U.S., coming just one year after our initial entry into Mainland China. I'm extremely proud of our operations team and our China management who worked so hard to achieve the significant milestone despite travel constraints and other COVID-related barriers. We expect the Jiaxing facility to significantly speed our path to market while improving our cost structure and the sustainability of our operations in China.”

BYND Opportunistic Pullback Levels

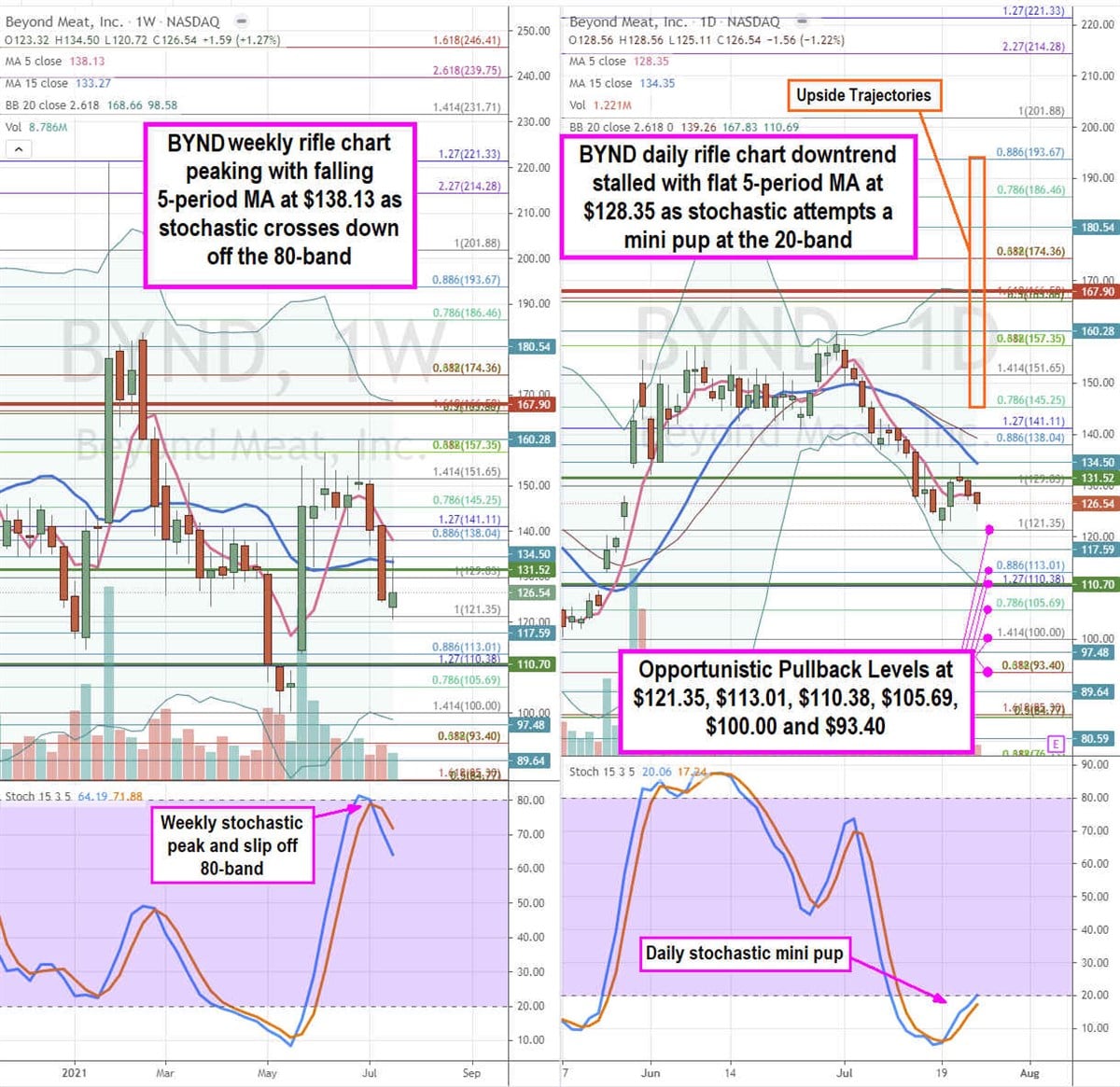

Using the rifle charts on weekly and daily charts can provide a near-term perspective of the playing field for BYND stock. The weekly rifle chart is losing momentum as the 5-period moving average (MA) falls towards its flat 15-period MA at $133.27 after a coil off the $121.35 Fibonacci (fib) level. The weekly stochastic peaked at the 80-band and crossed back down. The weekly lower Bollinger Bands (BBs) sit at $98.58. The weekly market structure high (MSH) sell triggered a breakdown under $167.90. The daily rifle chart is in a make or break as the daily 5-period MA flattens at $128.35 stalling the downtrend as the 15-period MA still falls at $134.35. The daily stochastic is attempting to form a mini pup coil through the 20-band. The daily market structure low (MSL) buy triggers above the $131.52 level. Risk-tolerant investors can monitor for opportunistic pullback levels at the $121.35 fib, $113.01 fib, $110.38 level, $105.69 fib, $100.00 fib, and the $93.40 fib. The upside trajectories range from the $145.25 fib level up to the $193.67 fib level.

Before you consider Beyond Meat, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Beyond Meat wasn't on the list.

While Beyond Meat currently has a Strong Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.