Consumer footwear and apparel brand

Sketchers U.S.A. NYSE: SKX stock has been recovering but still trades below its pre-

pandemic levels at the start of 2020. As the

vaccine rollout continues to accelerate, consumer apparel should continue to resume its recovery beyond

comfort wear as schools and sporting events continue to reopen. This plays right into the core demographic of Sketcher’s audience. While

social media has garnered a lion’s share of traffic during social distancing periods, there is pent up demand for a return to normal, at least the “new normal”. Sketchers has taken the downtime to beef up its brand through social marketing bolstering eCommerce sales and penetration. As economies recover, shares of Sketchers should ride the wave towards recovery back to its pre-COVID highs. Prudent investors can watch for opportunistic pullback opportunities to consider a position before the recovery accelerates.

Q4 2020 Earnings Release

On Feb. 4, 2021, Sketchers released its fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company reported an adjusted earnings-per-share (EPS) profit of $0.24 excluding non-recurring items versus consensus analyst estimates for a profit of $0.32, missing estimates by (-$0.08). Revenues fell (-0.5%) year-over-year (YOY) to $1.32 billion, meeting analyst estimates for $1.32 billion. Domestic Wholesale revenues rose 1.2% YoY, but China sales rose 29.7% YoY. The Company didn’t provide forward guidance due to pandemic related uncertainty.

Conference Call Takeaways

Sketchers U.S.A. COO, David Weinberg, set the tone, “Throughout the quarter and year, we strategically directed the flow of inventory to markets that were open, delivered a fresh product to consumers and continued to fulfill demand resulting in growth in many key distribution channels.” Comfort and value were the themes in 2020 as a result of stay-at-home activities. Domestic brick-and-mortar stores are expected to continue to be impacted by the effects of COVID-19 through the first half of 2021, but improvement is expected as vaccinations accelerate prompting government restrictions to ease. While the direct-to-consumer decrease from physical stores declined (-7.6%), it was partially offset by the 142.7% increase in the domestic eCommerce channel. The Company ended the quarter with $1.37 billion in cash and cash equivalents, a 66.2% YoY increase. Total inventory was $1.02 billion, a (-5%) decrease YoY. Total debt grew to $735 million on Dec. 31, 2020, compared to $121 million in 2019. This was primarily due to the drawdown of the senior unsecured credit facility in Q1 2020.

Bolstering the Ecommerce Channel

The Company is working to bolster the eCommerce experience and finalizing enhancements to its loyalty program and updating point-of-sales systems to better connect. The eCommerce channel will be a key growth driver moving forward as the Company plans to launch new sites across Europe and South America to provide a better brand experience for customers. Stay-at-home guidelines from the resurgence of the pandemic spread impacted international direct-to-consumer (DTC) business (-4.4%) with reduced hours and temporary closures notably in Latin America, Europe, and Canada. In the U.S., consumer traffic in physical stores fell (-35%) while operating hours fell by (-20%) again from the COVID-19 resurgence lending to government restrictions. As expected, distributor business fell (-57.9%) due to ongoing store closures including the largest distributor which covers the Middle East. The automation of the new 1.5 million square foot China distribution center remains on track for full operations by mid-2021. The expansion of the North American distribution center to 2.6 million square feet is scheduled to completed in 2022. The Company expects COVID-related restrictions to continue to impact the Company through 1H 2021.

UBS Defends SKX

On Feb. 8, 2021, UBS Securities raised its price target on Sketchers to $52 for $48 as it rolls forward valuation to FY23 from FY22. UBS analyst Jay Sole noted that Q4 2020 earnings were diluted by the near -term margin commentary, but the current market environment is “very forgiving”. Sole feels the market will reset its FY21 expectations as valuations are still inexpensive and view it as a “good reopening stock”. As economic recovery and reopening accelerate, Sketchers should also continue to accelerate its recovery.

SKX Opportunistic Pullback Levels

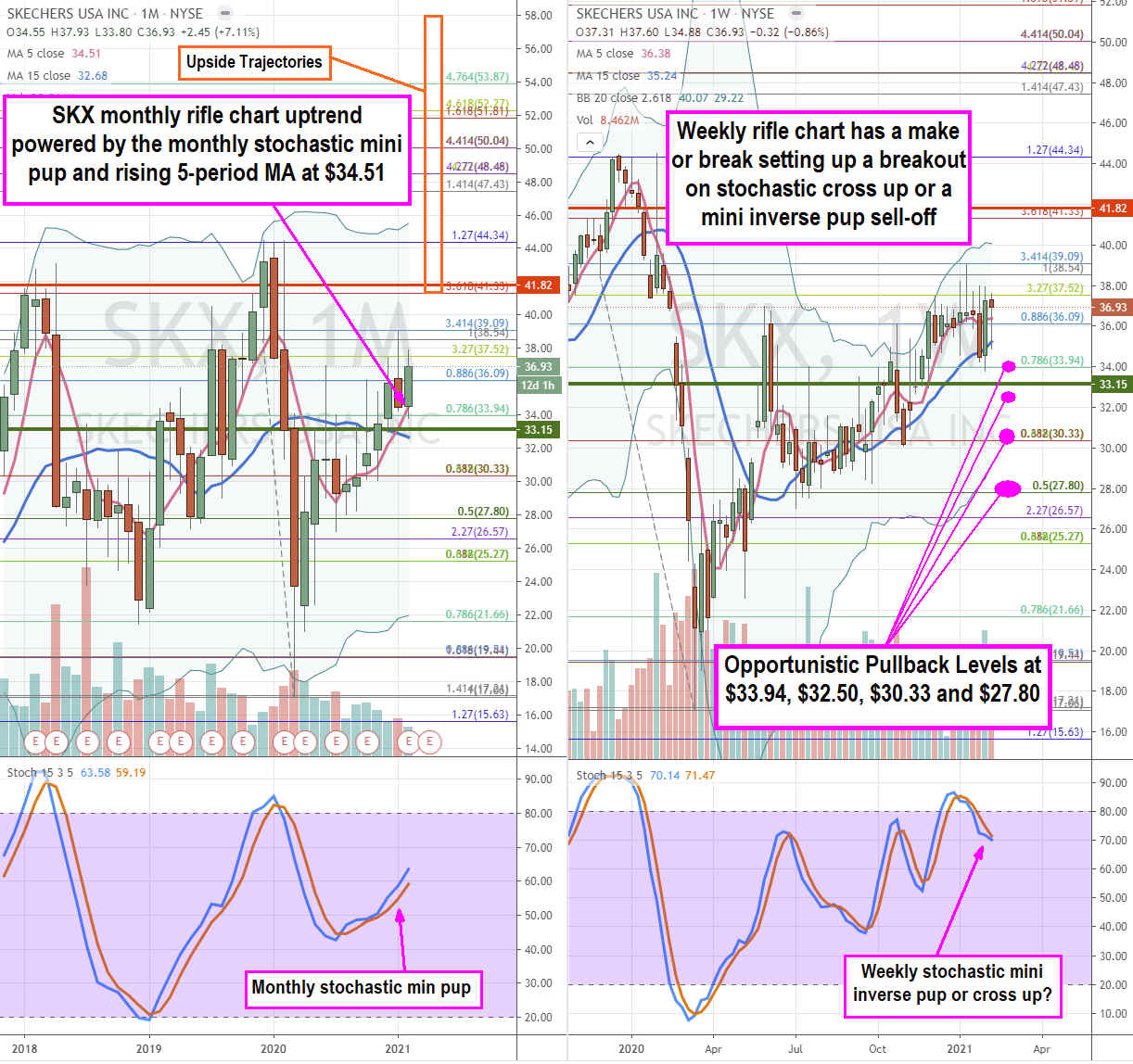

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for SKX stock. The monthly rifle chart has a steady grinding uptrend powered by the stochastic mini pup with a steadily rising 5-period moving average (MA) at $34.51. The monthly upper Bollinger Bands sit at $45.48. The $33.94 Fibonacci (fib) level has been a previous resistance level that finally broke out on the most recent monthly market structure low (MSL) buy trigger above $33.15. The weekly rifle chart has been in a choppy pup breakout uptrend that is stalling with a flat 5-period MA at $36.38 while the weekly stochastic has crossed down below the 80-band with a potential mini inverse pup. This sets up a weekly make or break. The bullish breakout can form if the weekly stochastic can cross back up to trigger another pup breakout as the 5-period MA rises. The bearish case would have the weekly stochastic mini inverse pup continue to fall lower causing the weekly 5-period MA to cross under the 15-period MA to form a breakdown. Prudent investors can watch for opportunistic pullback levels at the $33.94 fib, $32.50 sticky 2.50s, $30.33 fib, and the $27.80 fib. The upside trajectories range from the $41.33 fib upwards to the $58 price level. Keep in mind, there is a weekly market structure high (MSH) sell trigger at $41.82 that the bears will try hold down making it a key breakout price level.

Before you consider Skechers U.S.A., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skechers U.S.A. wasn't on the list.

While Skechers U.S.A. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.