Shares of Snowflake Inc. NYSE: SNOW, a cloud-based data storage, computing, and analytics company, have been impressive lately, with its stock rising almost 50% over the previous three months.

Over the previous year, its stock has risen close to 40%, steadily climbing over the months and now trading near the upper region of its 52-week range. The tech company saw its market cap soar to $67.8 billion in that time. It has a relative strength index (RSI) of 64.78, indicating that the stock is not in overbought territory.

Moreover, from a technical analysis perspective, the stock is gearing up for a higher timeframe breakout as it consolidates above crucial moving averages near a critical breakout level.

So, with many market-leading tech names trading at 52-week highs, fresh from breaking out, let's look at Snowflake shares, a name potentially setting up to join in on the action.

What is Snowflake?

Snowflake Inc. is a cloud-based data storage, computing and analytics company known for its non-centralized business model since 2021. Operating globally, it offers the data cloud, a suite of tools enabling clients to centralize data, enhance analytical capabilities and facilitate information sharing.

The company has demonstrated impressive growth potential, driven by its robust product roadmap in the data cloud software sector. Forecasting a yearly revenue growth rate exceeding 30% until 2029, Snowflake has notably increased its share of enterprise customers within a sizable and expanding market while consistently enhancing profitability.

In 2023, the company's stock surged by 38%, outperforming the S&P 500 index. Snowflake's latest quarterly earnings, reported on November 29, revealed earnings per share (EPS) of 25 cents, surpassing the consensus estimate by nine cents, with revenue of $734.20 million, exceeding analyst projections.

With an estimated earnings per share of 18 cents for the upcoming quarter and a history of consistently beating EPS estimates, Snowflake should continue its strong performance. While the company has not officially confirmed its next earnings release date, it may come March 6, based on previous reporting patterns.

Analysts like the stock

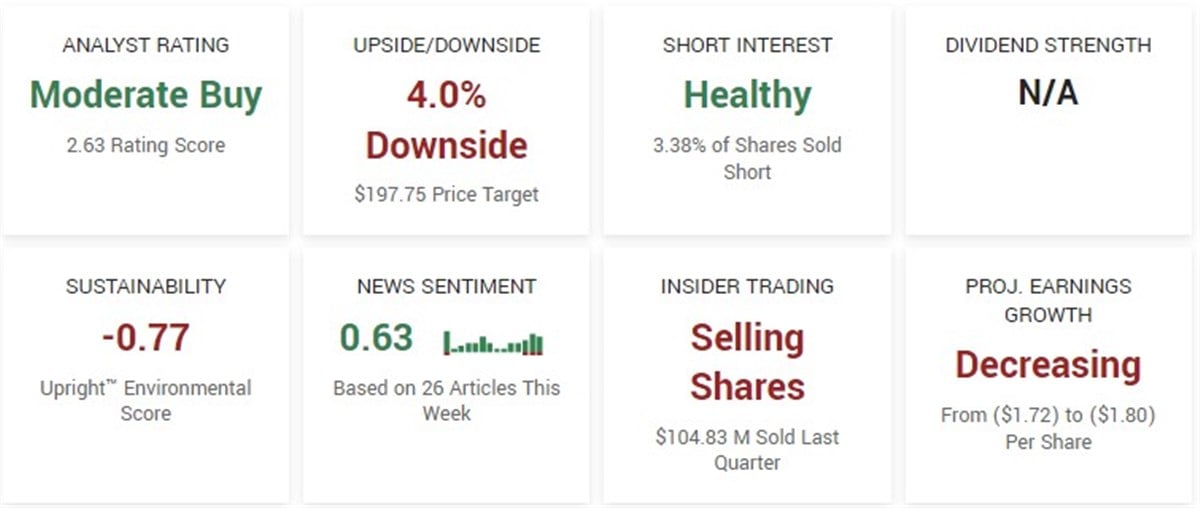

Snowflake has landed itself a spot on the most-upgraded list, a list of companies that analysts have upgraded most frequently over the previous ninety days. So, it should be no surprise that SNOW has a "moderate buy" rating based on 27 analyst ratings. Of the 27, 19 have rated the stock as a "buy," six as a "hold" and just two as a "sell."

Most recently, Truist Financial boosted its target on SNOW from $210 to $230, and JMP Securities reiterated its "market outperform" rating with a $212 price target.

The stock currently has a consensus price target of $197.75, forecasting a slight downside. The high forecast is $250, and the low estimate on the name is $105.

Shares trading above significant resistance

Earlier in the week, shares of Snowflake traded above a critical area of resistance, near $204. This level has stood firm as resistance since 2022 and acts as a potential inflection point and shift in momentum for the stock.

As the stock is trading above its key moving averages and a significant resistance zone, investors and traders alike will want to see the stock turn this zone into newfound support. If SNOW can successfully base above the previous resistance, a higher timeframe momentum shift might occur, and the stock could likely experience sharp upward momentum during the quarter.

Before you consider Snowflake, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snowflake wasn't on the list.

While Snowflake currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.