There have been plenty of sunny days lately for solar giant

Enphase Energy NASDAQ: ENPH, which has posted outsized earnings growth recently. Below are its returns:

- 1 month: +34.36%

- 3 months: +93.22%

- Year-to-date: +58.97%

- 1 year: +56.73%

California-based Enphase designs, manufactures and sells home energy systems for the solar photovoltaic industry in the U.S. and internationally.

This is a stock with nearly all the hallmarks of a leader. For example, it went public in 2012, so is within the 15-year post-IPO window when stocks are likely to post some of their biggest gains. In addition, it’s notched double-or triple-digit earnings and revenue gains in each of the past seven quarters. The company has turned a profit in each of the past four years, and analysts see earnings growing this year and next.

In late July, Enphase reported earnings of $0.69 per share, handily beating views of $0.54 per share. Revenue came in at $530.20 million, well ahead of expectations for $506.57 million. According to MarketBeat earnings data, Enphase beat both earnings and revenue views in each quarter since February 2019.

Optimism From Clean Energy Bill

Solar stocks as a group got a huge boost from the U.S. Senate’s passage of a bill that would funnel hundreds of billions of dollars into clean-energy projects. For example, the iShares Global Clean Energy ETF NYSEARCA: ICLN, of which Enphase is the largest holding, has been in rally mode recently, outpacing the S&P 500.

The ETF tracks an index composed of global equities in the clean energy sector, making it as good a proxy as any for the sub-industy as a whole.

The ETF’s recent returns are as follows:

- 1 month: 13.01%

- 3 months: 30.29%

- Year-to-date: 7.46%

In addition to Enphase, heavily-weighted solar holdings within this ETF include Solaredge Technologies NASDAQ: SEDG and First Solar NASDAQ: FSLR.

Solaredge, which is in the business of designing, developing and selling solar photovoltaic systems throughout the world, recently bump its head on resistance just below its January 2021 high of $377. That relative inertia comes despite an increase in earnings growth in 2021, with more growth expected this year and next. However, part of the problem is a series of earnings and revenue misses. Solaredge missed analysts’ income expectations in three of the past four quarters.

In the most recent quarter, the company reported earnings of $0.95 per share on revenue of $727.8 million. Analysts had been calling for SolarEdge to report net income of $0.88 per share on revenue of $731 million. After the recent revenue miss, the stock gapped down 19%.

Nonetheless, Wall Street rates the stock a “moderate buy,” according to MarketBeat analyst data. The consensus price target is $358.79, representing a 10.83% upside. That doesn’t seem unattainable in the next 12 to 18 months, particularly if the broad market rallies and/or solar stocks really do get a boost from the clean energy bill.

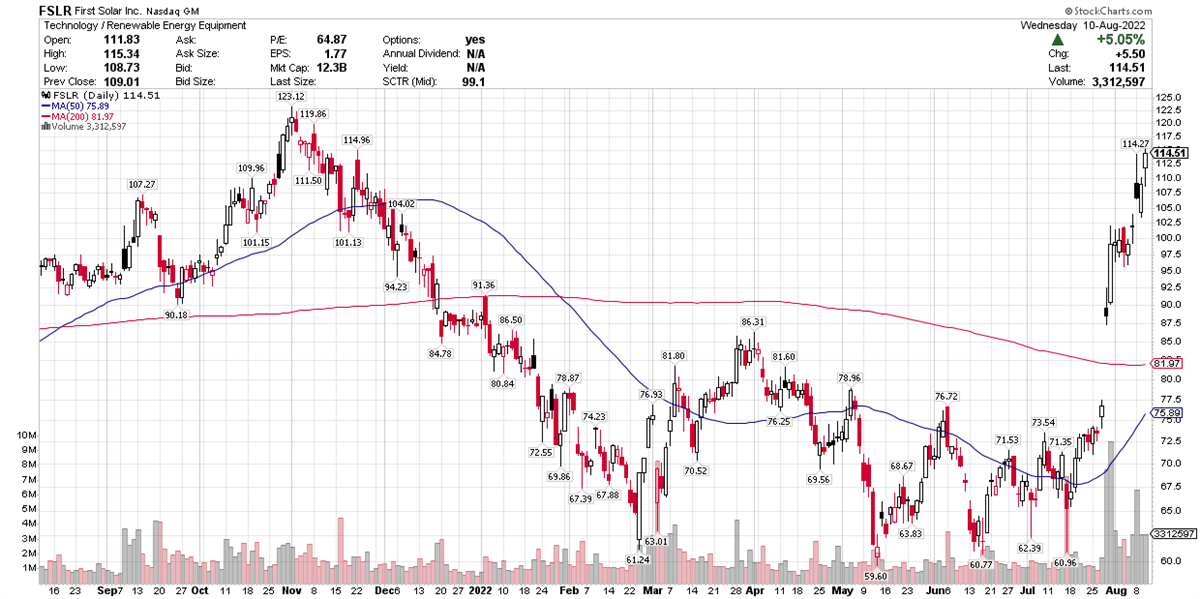

First Solar Beats Expectations

Meanwhile, First Solar is in strong rally mode, rocketing more than 45% last month and more than 16% so far in August. Since reporting earnings on July 28, First Solar is up 49%.

Among highlights from the release:

- Net sales of $621 million

- Net income per share of $0.52

- Earnings guidance was lowered due to legacy systems business asset impairment in Chile, as well as Japanese Yen devaluation

The company manufactures thin-film solar panels. While its results marked year-over-year declines, investors were cheered by better-than-expected results.

Here again, the clean-energy bill is cause for optimism about the company’s prospects. Since the bill was passed, four analysts either upgraded their rating on First Solar, or boosted the price target, according to data compiled by MarketBeat.

While it’s always tempting to jump onboard a stock that’s staging a big rally, it’s important to understand that uptrends end, or, more frequently, take a breather before resuming. Give yourself a system of some type, whether it’s a price target, a stop or a moving average indicator, to evaluate whether it’s time to buy, sell or hold. Otherwise, you’re just guessing, even if a sector or industry is currently in favor, as we currently see with solar power.

Before you consider Enphase Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enphase Energy wasn't on the list.

While Enphase Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.