Southwest Airlines Today

LUV

Southwest Airlines

$26.37 +0.85 (+3.32%) As of 03:25 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $23.58

▼

$36.12 - Dividend Yield

- 2.73%

- P/E Ratio

- 36.50

- Price Target

- $30.88

The country’s largest regional airline, Southwest Airlines Co. NYSE: LUV, shares are rising as famed activist investor Elliott Management seeks to replace the company's leaders through a proxy war. Elliott made headlines recently after Starbucks Co. NASDAQ: SBUX pulled a coup by hiring Chipotle Mexican Grill Inc. NYSE: CMG CEO Brian Niccol to be its new CEO starting Sept. 8, 2024. The news spiked Starbucks shares by 24%, turning sentiment widely bullish.

Activist investors Starboard and Elliott are largely credited for the surprise move despite Elliott insisting it had no hand in the CEO swap. Investors are hoping that Elliott can pull off another major win for Southwest shareholders in the wake of a potential slowdown in the travel boom.

Southwest Airlines operates in the transportation sector, competing with major airlines American Airlines Group Inc. NASDAQ: AAL, United Airlines Holdings Inc. NASDAQ: UAL and Delta Air Lines Inc. NYSE: DAL.

Elliott Management Enters the Picture

On June 9, 2024, The Wall Street Journal reported that activist investor Elliott Management had made a $2 billion investment in Southwest Airlines stock, taking an 11% stake in the company. Shares spiked 9% on the news, reaching a high of $30.35. Elliott published its materials on June 10, 2024, outlining the steps needed to turn around the struggling airline and reach its fair value at around $49 per share.

On July 3, 2024, Southwest adopted a 12-month poison pill that would trigger upon any entity's holdings, reaching a 12.5% interest in the company.

Southwest Spins Its Wheels as Unit Revenues Decline While Unit Costs Rise

On July 25, 2024, Southwest Airlines reported Q2 2024 EPS of 58 cents, beating analyst expectations by 6 cents. Revenues rose 5.2% YoY to $7.4 billion, beating $7.32 billion consensus estimates. However, revenue per available seat mile (RASM) fell 3.8% YoY, which was an improvement over the earlier forecast of falling 4% to 4.5%. The company benefitted from incremental bookings from other carrier cancellations during severe weather events at the end of June. Cost per available seat mile, excluding fuel and special items (CASM-X), rose 6% YoY.

This indicates that unit revenue fell 3.8% while operating costs rose 6% YoY. This negative trajectory ate into its profitability.

Southwest Reaffirms Its 2024 Forecasts, But CASM-X Looks Troubling

Southwest Airlines Stock Forecast Today

12-Month Stock Price Forecast:$30.8822.54% UpsideReduceBased on 19 Analyst Ratings | Current Price | $25.20 |

|---|

| High Forecast | $42.00 |

|---|

| Average Forecast | $30.88 |

|---|

| Low Forecast | $23.00 |

|---|

Southwest Airlines Stock Forecast DetailsThe company expects RASM to be flat to down 2% in Q3 2024. Available seat miles (ASMs) are expected to rise 2% YoY. CASM-X is expected to rise 11% to 13% YoY in Q3 2024. For the full year 2024, ASM is expected to grow 4% YoY, and CASM-X should rise 7% to 8% YoY. CapEx will be around $2.5 billion. The company announced plans to enhance revenues by replacing its open seating with premium-seating options and adding red-eye flights.

Elliott Management chimed in, stating the attempt was just too little. It hinted at a proxy fight, commenting, “Southwest can do far better, and we look forward to offering our fellow shareholders an opportunity to elect a Board of industry leaders that can return Southwest to best-in-class performance.”

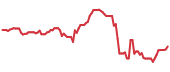

Southwest Airlines stock initially rose 5.5% following its Q2 2024 earnings but drifted lower towards $23.58 by Aug. 5, 2024.

Elliott Management Steps Up the Pressure and Wages War

On Aug. 13, 2024, Elliott publicly stated its intentions to replace 10 members of its 15-seat Board of Directors, including ousting CEO Bob Jordan and Chairman Gary Kelly. Southwest must take three steps to restore its leadership: reconstituting the Board of Directors, installing new leadership, and conducting a comprehensive business review.

The group of 10 nominees was chosen after months of global searching. The list includes four former airline CEOs and six leaders with expertise in hospitality, technology, consumer-focused businesses, regulatory oversight, and labor relations. This is in contrast to the existing Board of Directors, which lacks even a single independent director with airline experience. Elliott Management owns 48,948,500 shares of Southwest Airlines common stock, representing an 11% stake in the company.

LUV Stock Forms an Ascending Triangle

The daily candlestick chart for LUV illustrates an ascending triangle pattern comprised of a flat-top upper trendline resistance at $27.57 and the rising lower trendline comprised of higher lows. The daily relative strength index (RSI) is stalling around the 50-band. Pullback support levels are at $25.77, $24.22, $23.25, and $21.91.

Southwest Airlines analyst ratings and price targets are at MarketBeat. There are 16 analyst ratings on LUV stock, comprised of four Buys, nine Holds, and three Sells. Consensus analyst price targets point to a 7.8% upside at $28.38. LUV stock has a 7.33% short interest.

Before you consider Southwest Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southwest Airlines wasn't on the list.

While Southwest Airlines currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.