It’s Time To Buy These Two EV Stocks

The rise of SPACs has driven a frenzy in the market and created a bubble that is bursting for names like Lucid Motors (NYSE:CCIV) and Workhorse Group (NASDAQ:WKHS). In the one case, speculation on the potential merger of Lucid and its SPAC target had investors flooding into that market while on the other, hopes for a significant deal with UPS had money flooding into Workhorse Group. Now, in the wake of what has turned out to be bad news, shares of both EV companies are trading at more attractive levels. Investors need to remember that, although a bubble has burst, these two companies are still high-probability wins for EV investors.

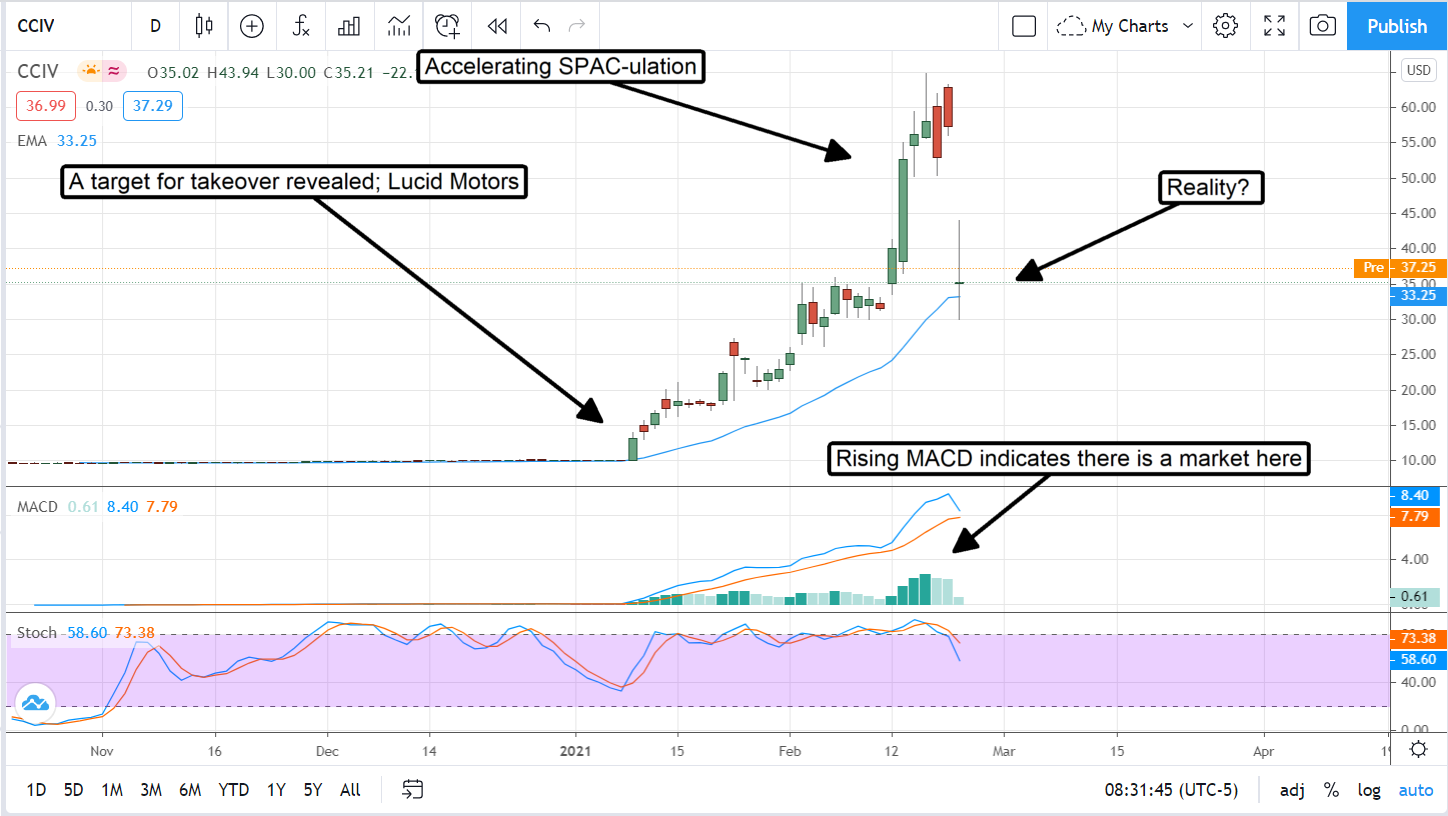

Lucid Motors Inks Deal With Churchill Capital Corporation IV

Lucid Motors announced a long-awaited deal with Churchill Capital Corporation IV early this week confirming what many in the market already knew would happen. Lucid Motors is the most visible competition for Tesla in terms of U.S.-centric EV pure-plays and expected to deliver its first vehicles late in 2021. The company’s founder and current CEO are both former Tesla employees.

The deal is worth $11.75 billion which by itself is enough to tank the market. Speculation as late as a week or two before the announcement had the valuation closer to $15 billion which is quite a wide margin. The transaction will give Lucid some $4.4 billion in net cash including $2.2 from Churchill Capital and $2.2 from fully committed private equity (PIPE). The PIPE money is priced at $15 a share which is another significant factor in the decline in Churchill Capital IV share prices. Money from the deal is intended to help expand the Arizona manufacturing facility.

"CCIV believes that Lucid's superior and proven technology, backed by clear demand for a sustainable EV, make Lucid a highly attractive investment for Churchill Capital Corp IV shareholders, many of whom have an increased focus on sustainability,” CCIV Chairman and CEO Michael Klein said in announcing the deal.

Shares of CCIV fell nearly 40% by the end of the session following the announcement and may fall further. The key technical level now is near $30 and investors should expect it to be tested. If the $30 level holds up as support we can expect this stock to at least trend sideways if not begin moving higher to retest the recent high. If support at $30 fails to hold up the next target for support is near $25 and $20.

Workhorse Does Not Get The UPS Deal

Investors in Workhorse Group have been hoping for a deal with UPS that has failed to bear fruit. The deal could have been worth as much as $6.5 billion over the next decade but UPS decided to go with another manufacturer. That is bad news for Workhorse Group and it certainly has shares down but there is something to consider. The UPS deal was far beyond Workhorse’s current capacity. The company already has enough order to keep it fully occupied over the next year and orders keep coming in.

What this means for share prices is a return to reality. Share prices are down nearly 50% but appear to be bouncing off of major support. This major support is near the $16 level and where price action was in the weeks before the UPS deal even became a possibility. With production already underway and ramping, we expect this stock to bounce back strongly by the end of 2021.

Before you consider Workhorse Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workhorse Group wasn't on the list.

While Workhorse Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.