Outdoors sporting goods retailer Sportsman’s Warehouse NASDAQ: SPWH stock plunged on the announcement of the termination of its acquisition by Great Outdoors for $18 per share. The retail reopening trend has run its course with most people taking on second COVID-19 booster vaccinations. Fishing, hunting, and camping have seen an unprecedented boost during the pandemic as none of these sports entail much contact and can be done alone. This is why the acquisition by Great Outdoors made sense. Even at $18, the price-earnings ratio would be under 11. Investors have to wonder what convinced Great Outdoors to cancel the acquisition. On the flip side, this can present opportunistic price levels for prudent investors seeking exposure in the outdoor sports segment.

Q3 FY 2021 Earnings Release

On Aug. 3, 2021, Winnebago released its fiscal second-quarter 2021 results for the quarter ending October 2021. The Company reported earnings per share (EPS) of $0.51, falling short of analyst expectation for $0.54, by (-$0.03). Revenues rose 4% year-over-year (YoY) to $401.1 million beating the $389.47 million consensus analyst estimates. Same-store sales (SSS) fell (-1.5%) YoY. Ecommerce sales rose 15% YoY.

Conference Call Takeaways

Sportsman’s Warehouse CEO John Barker set the tone, “During the third quarter, our e-commerce-driven sales growth continued at a rapid pace allowing us to safely serve customers and expand our digital reach. Both in stores and online, demand was elevated across all of our categories. During the quarter, we worked closely with our vendors and provided our customers with inventory levels that we believe were unmatched by our direct competitors. However, we are not satisfied. It is our belief that inventory constraints and not a decrease in demand were the governor of our growth during the quarter. We ended Q3 with improved inventory position compared to Q2 in all departments with the exception of the shooting sports.” He continued, “In addition to hunting, participation in fishing, camping, and hiking continued at an elevated rate throughout Q3 as confirmed by National Parks attendance and hunting and fishing license sales. During this period, we grew our loyalty program to nearly 2.6 million customers and increased our overall email database by 84% year-over-year. We believe we are capitalizing on our best-in-class credit card and loyalty programs, and our expanded database to better engage with customers, which helps us drive traffic in stores and online.”

He concluded, “Finally, I’d like to share some insights on early Q4 trends and results. Overall, total net sales for the fiscal month of November were up approximately 70% compared to prior year. This is a continuation of the sales growth trend we saw in Q3. While firearms and ammunition continue to be in high demand, we’re seeing strong results across all major product categories. This broad-based growth confirms our belief that increased participation in activities like camping and fishing is a sustainable trend. In regards to this past weekend, unlike many retailers, we saw increased foot traffic in our stores during the Black Friday weekend. Additionally, online traffic saw significant increases versus prior year with online demand up triple digits. These results give us optimism that our categories are continuing to grow and that our product assortment and the Sportsman’s Warehouse brand is resonating with customers. Turning to Slide 8. In summary, while there is significant uncertainty surrounding the path of the pandemic and its impact on the economy, we are highly encouraged by the surge of new participants in the activities in which we specialize. The sustained factors impacting our society in 2020 have motivated millions of people to engage or re-engage with the outdoors. We believe Sportsman’s Warehouse is well-positioned to meet this heightened demand, and we’re just beginning to engage with new customers across multiple product categories. We also believe we are strategically positioned to continue to capitalize on meaningful growth opportunities from heightened outdoor activity participation, e-commerce growth, and new store expansion, which we believe will create long-term shareholder value. We look forward to speaking with you again in late March when we report our fourth quarter and full-year 2020 results.”

SPWH Opportunistic Price Levels

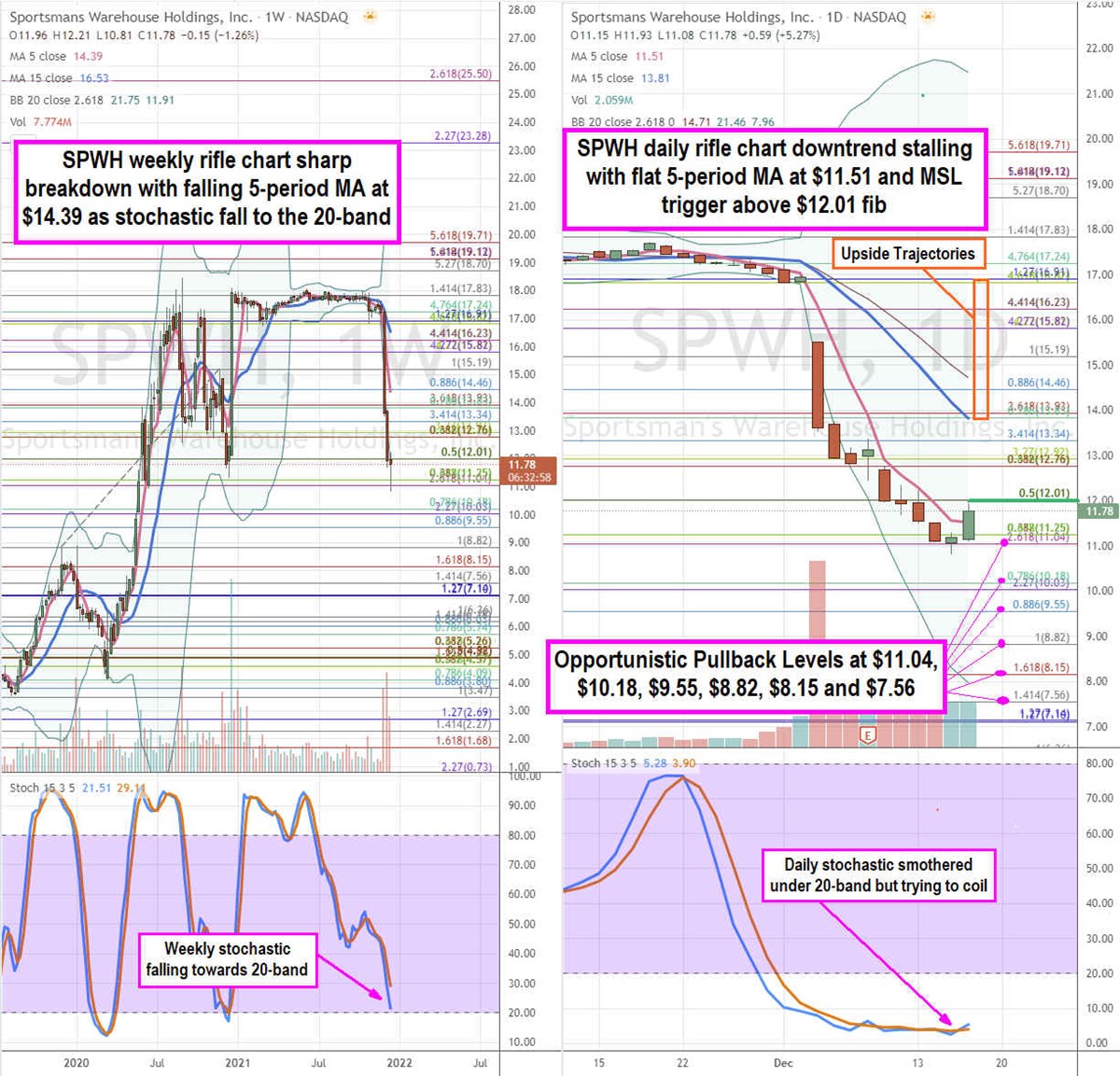

Using the rifle charts on the weekly and daily time frames provides a broader view of the landscape for SPWH stock. The weekly rifle chart is based around the $17.83 Fibonacci (fib) level before collapsing on the announcement. The weekly rifle chart downtrend has a falling 5-period moving average (MA) at $14.39 followed by the 15-period MA at $16.53. The weekly stochastic has a mini inverse pup nearing the 20-band with weekly Bollinger Bands (BBs) at $11.91. The daily rifle chart downtrend is stalling with a flat 5-period MA at $11.51 with 15-period MA at $13.81. The daily market structure low (MSL) buy triggers on a breakout through $11.78. The daily stochastic is compressed under the 10-band but attempting to coil. Prudent investors can watch for opportunistic pullbacks at the $11.04 fib, $10.18 fib, $9.55 fib, $8.82 fib, $8.15 fib, and the $7.56 fib level. Upside trajectories range from the $13.83 fib up to the $16.91 fib level.

Before you consider Sportsman's Warehouse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sportsman's Warehouse wasn't on the list.

While Sportsman's Warehouse currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.