Square NYSE: SQ has had extremely high volatility in 2020 - even by pandemic-era standards. Before the pandemic hit, Square looked to be on the verge of all-time highs. But in less than a month, shares of the mobile payment processor went from $87 to $32.

Now, just three months later, shares have more than tripled from the lows and sit at all-time highs just above $100 a share.

Square has shown that it can thrive in the “new-normal” environment we find ourselves in. But is the stock overvalued and overbought? Or is it just getting started?

An Omnichannel Solution

There are a lot of mobile payment processors out there. But few can match the comprehensive solutions that Square offers merchants.

The fintech company accommodates business loans, payroll needs, industry-specific point-of-sale-solutions, and more.

Square is commonly known as a top-notch solution for small businesses, but 52% of its sales came from businesses with more than $125,000 in annualized gross payments in Q1 2020. This diversification allows Square to integrate itself into small businesses before they grow (and give Square higher revenue), while also landing plenty of big fish.

Square has shined for businesses during the pandemic, handling close to $1 billion in PPP loans.

The real beauty of Square is its high switching cost, one of the most powerful moats against competitors. Though Square is an excellent solution today and has a great track record as an innovator, it’s nice (for Square) that merchants can’t easily switch if they find a better or cheaper solution.

And Square is not just a fintech solution for merchants; its Cash App has made its way to millions of individuals’ smartphones.

Cash App

Cash App has experienced incredible growth. It had around 15 million users in 2018, but now has around 24 million. In Q1 2020, profits from the app were up 115% yoy.

CEO Jack Dorsey had this to say during the Q1 2020 earnings call:

“We think the ecosystem strategy is so strong. We're not just a peer-to-peer app. We're not just a stock purchasing app. We're not just a bitcoin app. We have everything in one. And everything that is interesting in terms of how I think about my own personal finances and spend my money is all in one simple straightforward app that we will continue to make better and add more adjacent features that complement some of these critical needs that people are telling us they have.”

Square has been committed to adding those adjacent features, purchasing website host and builder Weebly in 2018 and enabling customers to create their own digital storefronts.

The ability to purchase bitcoin and stocks is a godsend to all of the retail investors managing portions of their own money.

Cash App’s performance has been strong of late, benefiting from the effects of the coronavirus in some ways. People started using the app for fundraising, donations, and online tipping. And a sizable number of people opted to have their stimulus checks directly deposited to the Square App, leading to Square’s highest-ever direct-deposit volume in April.

Valuation

Square has a price-to-sales ratio of more than 8x and trades at around 158x earnings.

The company will almost certainly continue to grow quickly for at least the next few years. And earnings will grow as a percentage of sales as the company matures. But can Square grow enough?

According to Grand View Research, the mobile payment market is expected to grow by nearly 20% annually through 2025. If Square simply grows at that rate, its $100 billion in annual payments would turn into nearly $250 billion by then. Square’s position as an industry leader and all-in-one solution could allow it to grow at an even faster rate.

All that said, it’s impossible to accurately project Square’s revenue in five years and a future operating margin estimate would be even harder to quantify.

Of course, some of the best investments have been companies like Amazon NASDAQ: AMZN and Netflix NASDAQ: NFLX. These were companies that always looked pricey but just kept growing year-after-year. Square’s superior solutions, innovation, and high-growth industry give it a real chance to make today’s market cap look cheap in five years.

Technicals

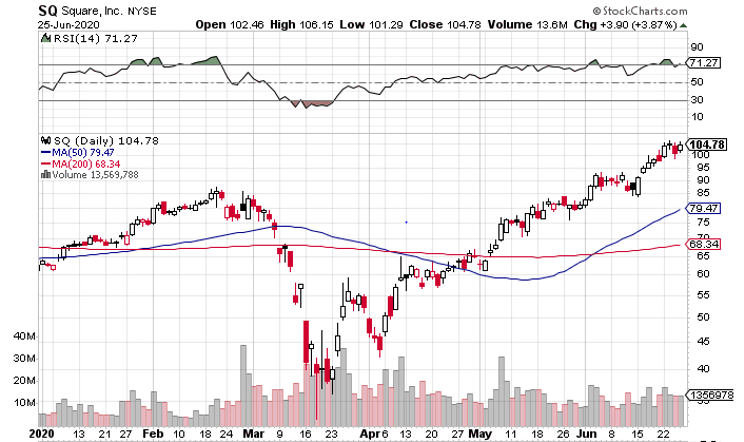

Shares are definitely extended at current levels after more than tripling in three months. And along the way up, it hasn’t put in a solid base. Since March, shares haven’t paused for more than a couple of weeks before marching higher.

I would look for one of the following two scenarios before getting into Square:

- Wait for a pullback to the low $90s. That number is a retest of the breakout point from a mini-base it made just above its previous 52-week high. In this scenario, the 50-day moving average could get a lot closer to $90 by the time it gets there.

- Look for consolidation in the low $100s. If the stock forms a tight base on light volume for a month and then breaks out on big volume, it could have the juice for another leg up.

The Verdict

For now, you should sit tight on Square and give it a chance to digest its massive gains. When an attractive entry point presents itself, I’d consider getting in, but with a small percentage of your portfolio.

It’s too risky to sink a lot of money into Square, but it’s a good idea to expose yourself to its high upside. A small investment in Square has a solid chance of paying off handsomely.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here