Global auto parts maker

Stand Motor Products NYSE: SMP stock has been on a tear as the demand for automobiles is stripping

supply. The leading maker of automotive replacement parts is experiencing accelerated growth due to the post-

pandemic reopening, global

chip supply shortage leading to a shortage of new

automobiles amidst unprecedented demand. The Company is expanding their original equipment (OE) business with two key accretive acquisitions. Their acquisition of Trombetta is powertrain neutral which makes their parts work on both conventional and

electric vehicle (EV) powertrains helps expand Standard’s footprint in mechanical and electronic power switching devices. They also acquired Stoneridge Inc., a high-tech emissions sensor producer. Prudent investors seeking exposure in the bolstering

automobile parts market can watch for opportunistic pullbacks in shares of Standard Motor Products.

Q3 Fiscal 2021 Earnings Release

On Oct. 28, 2021, Standard Motor released its fiscal third-quarter 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) profit of $1.32 excluding non-recurring items versus consensus analyst estimates for $1.10, a $0.22 beat. Revenues rose 7.7% year-over-year (YoY) to $370.1 million beating analyst estimates for $342.64 million. Standard Motors CEO Eric Sills commented, "We are very pleased with our second-quarter results as the strong sales trends we have been experiencing for the last three quarters continued unabated. While our sales finished the quarter 38% ahead of 2020, last year's second quarter was dramatically affected by the pandemic. Yet we were also 12% favorable to the comparable quarter in 2019. We set records in earnings, with non-GAAP diluted earnings per share from continuing operations up 142% in the quarter, and up 37% vs. the second quarter of 2019. Our overall year-to-date performance was very strong, with sales and earnings up 23% and 135% respectively vs. last year. However, although market conditions remain robust, comparisons to 2020 will become more challenging. 2020 was a year of two halves – the first half was severely impacted by pandemic-related lockdowns, while the second half set records as the market surged. We believe that going forward a comparison to a more normalized 2019 is more appropriate.”

Conference Call Takeaways

CEO Sills set the tone, “This year, things shifted forward a bit. We began seeing very strong POS early on in the year, which suggested that the purchases intended to load shelves were selling through, and this trend has continued. We saw early heat in many parts of the country. And when combined with the return of miles driven and the associated vehicle maintenance, we enjoyed a record-setting quarter for sales, up nearly 50% from last year and up over 25% compared to 2019. Customer sell-through has remained very high with elevated summer heat in much of the country, we believe we are in for a good third quarter. However, similar to Engine Management, here too, we are facing difficult third quarter comparisons to 2020, which was up 25% from '19 and was far and away the biggest third quarter we had ever had in Temperature Control. Overall, gross margins dipped slightly from the first quarter.” He continued, “For the last several years, we have been growing our penetration in the OE space. And while we do have a certain amount of passenger car OE, our efforts have been more in niche areas, specifically heavy-duty and commercial vehicles, where product life cycles tend to be longer, technology tends to be more stable and price pressures tend to be less. This year, we have made 2 acquisitions in this arena, both previously announced. On our first quarter call, we discussed the acquisition of a high-tech emission sensor product line from Stoneridge Inc., which we are in the process of integrating into existing SMP locations. Then at the end of May, we made a larger acquisition. We acquired Trombetta, a worldwide leader in mechanical and electronic power switching and power management devices, generating about $60 million in annual sales.” CEO Sills concluded, “We believe that this acquisition takes us to the next level in this OE space. When combined with previous activities, including organic business wins such as our compressed natural gas injection program and other acquisitions, such as the Pollak deal in 2019, we have grown this business to an annual run rate of around $250 million. We now have the critical mass to be a significant supplier and are excited to see where we can take it. And to reiterate, we believe that this channel is highly complementary to our core aftermarket business from the product and technology standpoint as well as from an engineering and production.”

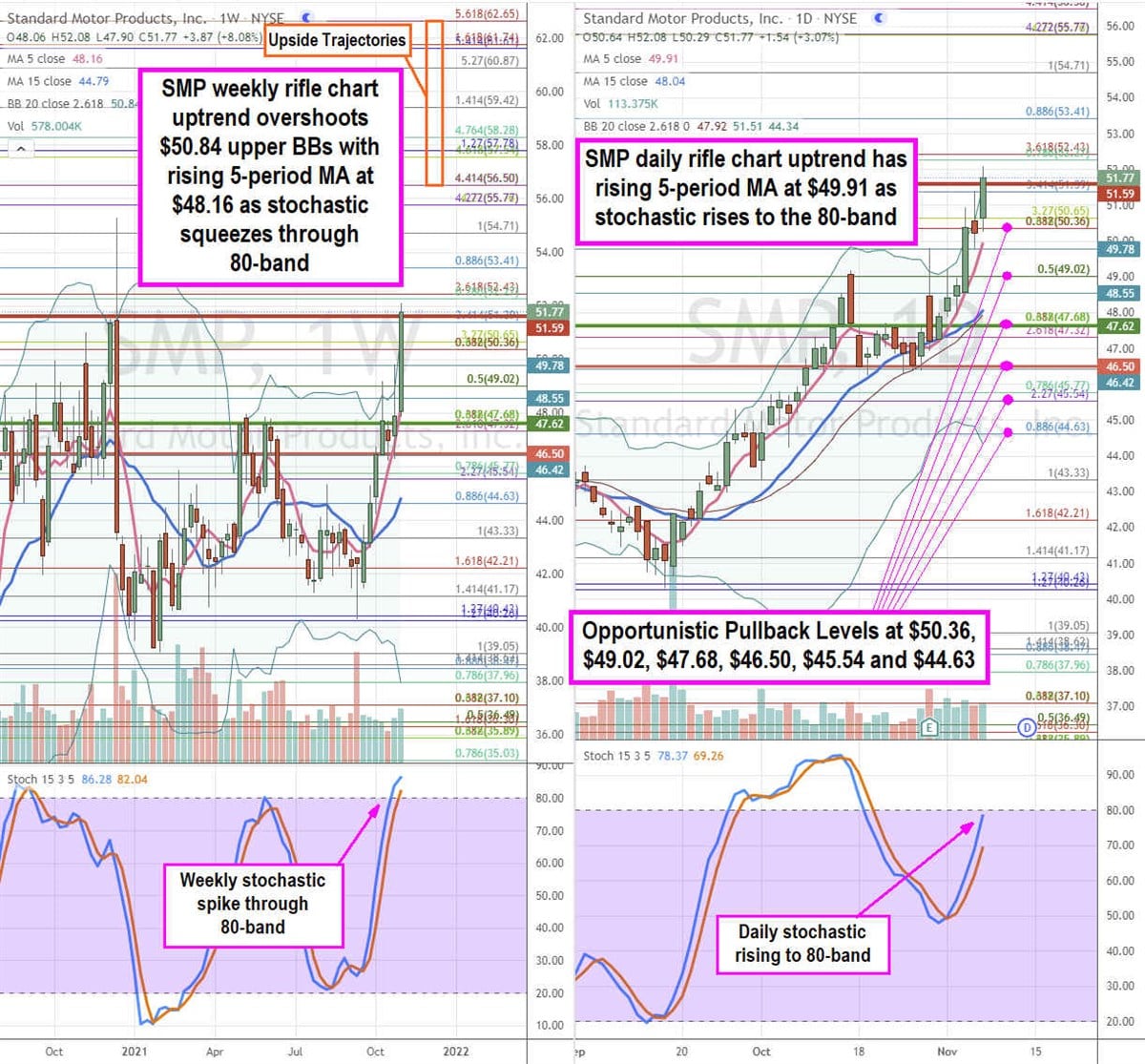

SMP Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a precision view of the price action playing field for SMP stock. The weekly rifle chart exploded higher spiking through the weekly upper Bollinger Bands (BBs) $50.84. The weekly 5-period moving average (MA) support is rising at $48.16 followed by the 15-period MA support rising at $4.79. Shares are testing the prior weekly body resistance near the $51.39 Fibonacci (fib) level. The weekly market structure high (MSH) triggers on a breakdown below $51.59. The daily rifle chart formed a strong pretzel pup breakout spiking through its upper BBs at $51.51. The daily 5-period MA support is rising at $49.91 followed by the 15-period MA support at $48.04. The daily uptrend triggered on market structure low (MSL) breakout above $47.62. The daily stochastic is rising to test the 80-band. Prudent investors can watch for opportunistic pullback levels starting at the $50.36 fib, $49.02 fib, $47.68 fib, $46.50 fib, $45.54 fib, and the $44.63 fib level. Upside trajectories range from the $56.50 fib up towards the $62.65 fib level.

Before you consider Standard Motor Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Standard Motor Products wasn't on the list.

While Standard Motor Products currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.