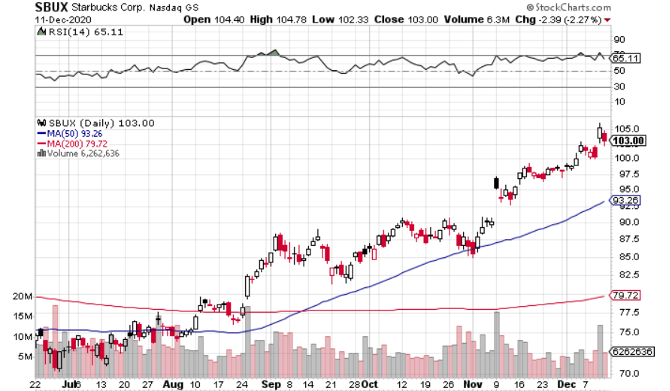

After falling 15% from post COVID highs set in June, shares of

Starbucks (NASDAQ: SBUX) are looking likely to not only retake those heights but to push on past them in the coming months. It’s been a very rocky few months

for the coffee giant but things seem to be stabilizing at last.

On Tuesday the company reported Q3 earnings and gave Wall Street the most up to date look at the internal numbers and the effect COVID has had on them. The onset of the coronavirus pandemic had led to almost all their stores being shut in February and March and their revenue streams effectively being turned off overnight. Though the numbers didn’t make for pretty reading, they weren’t as bad as analysts feared. Revenue still contracted 38% year on year while their EPS number was firmly in the red, however, there were plenty of positives to take away.

Management Optimistic

The company’s channel development business, which relates to things like bottled drinks and bags of coffee beans which you can find in supermarkets, saw its revenue actually grow 5%. Their market share in packaged coffee also increased as US sales rose 21% compared to just 13% for the industry overall.

And given that the vast majority of Starbucks’ stores around the world have already reopened, there’s a feeling that the recovery is well and truly on. Management reported $3 billion in lost sales compared to initial revenue forecasts due to COVID, without that they said sales would have increased 7%. They also managed to open 130 net new stores in the quarter and are forecasting a return to normal sales numbers in the US by next March. To be fair, this seems a little optimistic and assumes there are no additional shutdowns, so we’ll have to wait and see.

In the aftermath of Tuesday’s numbers, Oppenheimer struck a mostly bullish tone when they said "we remain attracted to SBUX's long-term positioning (hence our unchanged Outperform rating), but continue to believe near-term estimates have a difficult risk/reward setup.” BTIG struggled to match management’s optimism and noted how “Starbucks is the only company in our coverage universe providing such an extended outlook. While we applaud management's efforts to provide investors transparency and guidance, China's sales recovery has already been pushed back by a quarter as the virus spiked in Beijing recently, and we fear this could be repeated”.

There’s certainly a long road ahead and it remains to be seen if management can come through on their forecasts but there’s plenty of signs to keep the bulls happy in the meantime. Over the past quarter, there was a 17% jump compared to last quarter in downloads of the Starbucks app which is tied to their Rewards program. Sales from those Rewards members increased through July while Mobile Order and Pay transactions jumped nearly 40% from a year ago.

Opportunity in China

In Asia, the very public downfall of Luckin Coffee, China’s number one coffee chain, and Starbucks’ biggest competitor there, opens the door for the latter to emerge as the market leader. The company is seeing its sales in China rebound faster than in the US and expect full recovery by the end of the year, well ahead of the March date they have tagged for the US.

To that end, the ongoing partnership between Starbucks and Chinese e-commerce giant Alibaba (NYSE: BABA) will play a big role with news last week announcing that customers in China can now place orders on the latter’s Taobao marketplace, digital payment app Alipay and mobile map app Amap. Previously orders could only be placed through Alibaba’s app and the update means Starbucks can now fully tap into Alibaba’s 1 billion users.

Short term volatility is likely to remain as the global economic fallout from the last six months has yet to be fully played out. However, for the long run, it feels like Starbucks has the business model, market dominance and customer base to get back to winning ways.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.