Super Micro Computer Inc. NASDAQ: SMCI has been a standout performer year-to-date after shares of the technology company have surged to record heights. Its remarkable year-to-date gains have captured the attention of traders, spectators and investors, as the stock has offered exceptional opportunities within the world's hottest sector.

Initially, the catalyst behind the stock's multi-month breakout was the release of preliminary financial results in its fiscal second quarter, ending December 31. The company released results that greatly exceeded prior expectations, as revenue should have been between $3.6 billion and $3.65 billion, well above the earlier guidance of $2.7 billion to $2.9 billion. That resulted in the stock surging over 36% and trading to new all-time highs.

However, the stock continued to rise in the following weeks and gained immense popularity in the investing and financial community. Year-to-date, the stock has surged over 253% and almost 950% over the previous year.

This staggering rise, amid greater-than-expected earnings for the semiconductor company, now beckons the question: Can the stock continue to rise? Is it overvalued, undervalued or mispriced? Let's look more closely.

What is Super Micro Computer (SMCI)?

Super Micro Computer, led by CEO and founder Charles Liang, is a trusted leader in the technology industry with a 30-year history, specializing in advanced computing solutions for data centers, cloud providers and enterprises.

Under Liang's leadership, SMCI has become a key player in manufacturing computers tailored for data center use, supporting functions like website hosting, data storage and AI applications.

Operating in over 20 countries, SMCI has achieved global prominence, boasting strong financial performance marked by steady revenue growth, a healthy profit margin exceeding 10% and stable debt levels. With favorable valuation metrics compared to industry peers, SMCI solidifies its position as a reliable and financially sound technology partner.

Snapshot of SMCI's fundamentals

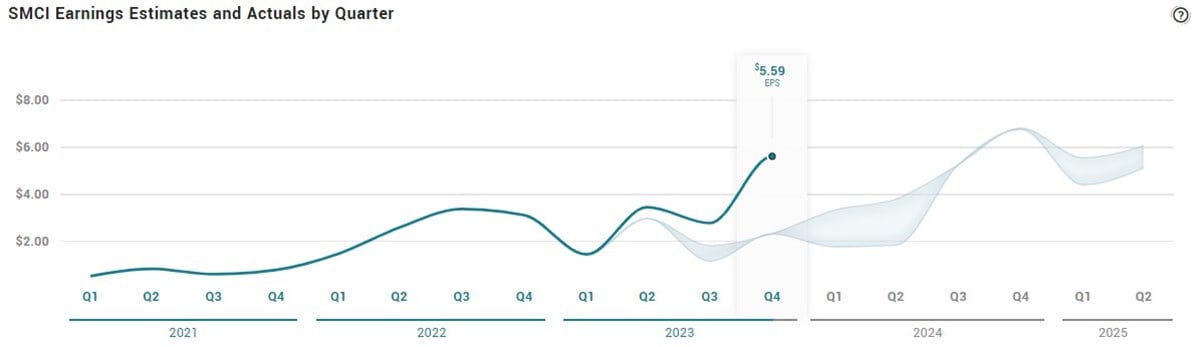

Super Micro Computer announced its earnings data on January 29, 2024, reporting an impressive $5.59 earnings per share (EPS) for the quarter, surpassing the consensus estimate of $4.94 by 65 cents. The firm also exceeded revenue expectations, earning $3.66 billion compared to analyst estimates of $2.80 billion, marking a remarkable 103% increase in revenue on a year-over-year basis.

Over the past year, Super Micro Computer has generated $12.81 earnings per share ($12.81 diluted earnings per share), with anticipated growth of 15.01% in the coming year, projecting earnings to rise from $19.66 to $22.61 per share.

The company has a P/E ratio of 78.38 and a forward P/E of 27.83. SMCI’s market capitalization is an impressive $56.15 billion, and the stock is also a member of the Russell 2000 Index. Notably, before the stock pulled back over 20% from its 52-week high on Friday, it had a 99 RSI, indicating it had become extremely overbought. However, after Friday's pullback, the RSI decreased to 66.21, meaning the stock is no longer in extreme overbought conditions.

Could the pullback be a long entry?

As the RSI suggested this week, the move toward $1,000 per share was vastly overblown and perhaps caused by intraday shorts combined with long chasers who fell victim to peak euphoria and fear of missing out. However, with the RSI now pulling back to the 60s and the stock significantly declining, an opportunity for a long might present itself shortly.

If the stock can continue to pull back along with its RSI and then consolidate over time while stabilizing in price, it might offer its crucial moving averages the chance to converge. Such price action would indicate price discovery has been met and a solid risk: reward opportunity is setting up for a stable upward move.

However, in the immediate term, unless the stock continues to pull back another 20%, the best thing for a prospective investor is to wait for the volatility to decrease and the price to be discovered.

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.