Online art trading platform

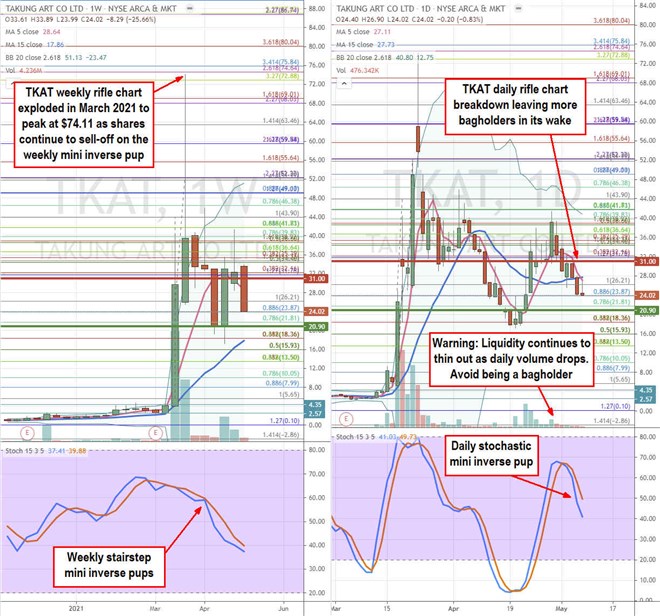

Takung Art Co., Ltd. NYSEARCA: TKAT stock has been on a meteoric rise fueled by the

non-fungible token (NFT) hype and hysteria. The Company operates a shared-ownership model where its art listings are traded in pieces on its platform. The shares gained momentum in March 2021 as soaring interest in NFTs became more mainstream. The stock peaked at a high of $74.11 on March 23, 2021 with trading volume hitting nearly 27 million shares. Keep in mind, Takung shares were trading around $1.78 with under 3,000 shares volume just a year ago. The float is tiny at 9 million shares meaning that liquidity is a major issue for any serious investor. While the

NFT hype has accelerated companies like

PLBY Group NASDAQ: PLBY, the difference is the transparency and the actual underlying operations. Unlike PLBY, Takung is an obscure Hong Kong-based trading platform with only 295 pieces of artwork traded in units among its subscribers, up from 285 pieces in 2019. While the website mentions NFTs, there’s no plan to enter the market nor would it be feasible to compete as an NFT exchange with such dinky liquidity.

About Takung Art

Based on its 10-K filing on March 31, 2021, the Company had 295 sets of artwork on its trading platform as of December 31, 2020. The total value of its listings were broken down by: 70 sets of paintings and calligraphy with total listing value (LTV) of $29.538 million, 35 pieces of jewelry with TLV of $9.37 million, 134 pieces of precious stones with LTV of $17.02 million, 29 pieces of amber with TLV of $12.24 million, 4 pieces of antique mammoth ivory carvings with LTV of $670.5 thousand, 2 pieces of porcelain pastel paintings with LTV of $335.2 thousand, 7 pieces of porcelain with LTV of $1.096 million, 6 sets of Unit+ products with LTV of 1.329 million, 1 piece of Yixing collectible with LTV of $128.9 thousand and 7 pieces of sports memorabilia with an LTV of $1.097 million. The Company splits each piece into unit. For example, a painting with an LTV of $1.531 million may be split into 12,000,000 units priced at $0.13 as traders can bid and trade the units like an IPO on the platform. The Company takes fees from the trading transactions. The trading platform is open from Monday through Friday. The Company instituted subscription-based free trading on certain items. Trading halts may be implemented under certain conditions like irregular trading, 10% of more of the listed artwork is involved in legal proceedings and has been frozen by relevant authorities, the artwork is involved in illegal transactions or artwork is subject to legal proceedings in regard to ownership. Sound ominous.

PRC Enterprise Income Tax Law

The People’s Republic of China (PRC) implemented a uniform 25% enterprise income tax rate to both foreign-invested enterprises and domestic enterprises on Jan. 1, 2008. From page 20 of its 10-K, “Under the PRC Enterprise Income Tax Law and its implementation regulations, dividends generated from the business of a PRC subsidiary after January 1, 2008 and payable to its foreign investor may be subject to a withholding tax rate of 10% if the PRC tax authorities determine that the foreign investor is a non-resident enterprise, unless there is a tax treaty with China that provides for a preferential withholding tax rate. Distributions of earnings generated before January 1, 2008 are exempt from PRC withholding tax. Our PRC subsidiary is subject to PRC enterprise income tax at the statutory rate of 25% on its PRC taxable income.”

Financials and What NFT?

According to its 10-K filing, the Company generated $4,567 million in annual revenues, up from $3.173 million in 2019. Net loss was (-$612.6 thousand). This is hardly a company experiencing robust growth or justifying a $175 million market cap. Also, the website is actually http://en.takungae.com/. While the Company mentions NFTs on its “News and Media” page, it’s not currently engaged in the NFT marketplace nor has announced anything regarding participation or conversion of its art pieces into NFTs. Unlike PLBY, which owns the intellectual property of its 70 years of proprietary photos and artwork, Takung doesn’t own its listings. It operates as a limited trading platform. If the artwork were converted to NFTs, it would still operate as a platform for exchange and trading of units or NFTs in this case. They are miles behind in that department as there are currently massive NFT exchanges like Mintable, Opensea and Superrare complete with tools, robust marketplace activity, constant NFT drops (new listings), easy onboarding capabilities, and most importantly liquidity. The final verdict don’t be a bagholder riding the NFT hype on TKAT stock.

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.