Luxury consumer

apparel and accessories producer

Tapestry NYSE: TPR shares are reaching value territory on its recent sell-off. The owner of Coach, Kate Spade, and Stuart Weitzman brands recruited three million new

customers in North America representing low double digit growth in stores and online combined.

Digital transformation and data analytics has enabled Tapestry to bolster top and bottom lines. The Company has also increased its bets in China to accelerate a 35% growth despite COVID-19, travel restrictions, and lockdowns. The Company also leveraged its agile

supply chain network to expedite inventory. The strong

consumer demand resulted in margin growth due to less promotional activity. The Company bought back 18 million shares in the first-half of fiscal 2022 at an average price of $42.02 with another $850 million left to deploy in its current buyback program. Tapestry is on target to save $300 million in annual run-rate for fiscal 2022. Shares are trading at just over 9X forward earnings. The Company

raised its fiscal 2022 guidance again illustrating continued top and bottom-line growth momentum.

E-commerce now accounts for a third of total sales with the goal of hitting $2 billion in sales for fiscal 2022. Prudent investors seeking a value investment in

consumer retail apparel can look for opportunistic pullbacks in shares of Tapestry.

Q2 FY Fiscal 2022 Earnings Release

On Feb. 10, 2022, Tapestry released its fourth-quarter fiscal 2021 results for the quarter ending December 2021. The Company reported non-GAAP earnings-per-share (EPS) of $1.33 excluding non-recurring items versus consensus analyst estimates for a profit of $1.19, a $0.14 per share beat. Revenues rose 26.6% year-over-year (YoY) to $2.14 billion, beating consensus analyst estimates for $2 billion. The Company gained 3 million new customers, up low double-digits both in online and in physical stores. The Company remains on track for its $300 million run-rate gross savings in fiscal 2022. The Company forecasts $1.25 billion in stock buybacks in fiscal 2023. In the fiscal first-half of 2022, the Company bought back 18 million shares for $750 million at an average cost of $42.02 per share. $850 million still remains on the current buyback authorization. The Company will continue its annual dividend payment of $1.00 per share.

Tapestry CEO Joanne Crevoiserat commented, “We delivered record sales this holiday quarter, highlighted by an inflection at Kate Spade, ongoing momentum at Coach, and a return to pre-pandemic revenue levels at Stuart Weitzman. The combination of bold initiatives, compelling product, and effective execution enabled us to win with consumers across our brands. Based on these results, we are raising our revenue, operating income, and EPS guidance for the fiscal year.”

Raised Fiscal 2022 Guidance

Tapestry raised EPS guidance for fiscal year 2022 to come in between $3.60 to $3.65 versus $3.51 consensus analyst estimates. The Company sees full-year fiscal 2022 revenues to come in around $6.75 billion compared to the $6.59 billion consensus analyst estimates.

Conference Call Takeaways

CEO Crevoiserat set the tone, “We delivered record sales and adjusted earnings in the holiday quarter, highlighted by an inflection at Kate Spade, ongoing momentum at Coach and a return to pre-pandemic revenue levels at Stuart Weitzman. Importantly, we realized the significant acceleration in sales trends, driving strong double-digit growth over pre-pandemic levels and well outpacing our expectations across brands.” She stated that they are a different company than they were just 18-months ago. Tapestry has transformed its business tremendously leveraging data with a digital first mindset to bolster agility. The Company is highly dependent on utilizing its customer data and analytics capabilities to improve key customer metrics. This has helped the Company gain 11 million new customers in the past 18 months as well as bolstering retention rates and reactivating dormant customers. Digital sales account for 1/3rd of total sales with a target of hitting $2 billion in fiscal 2022.

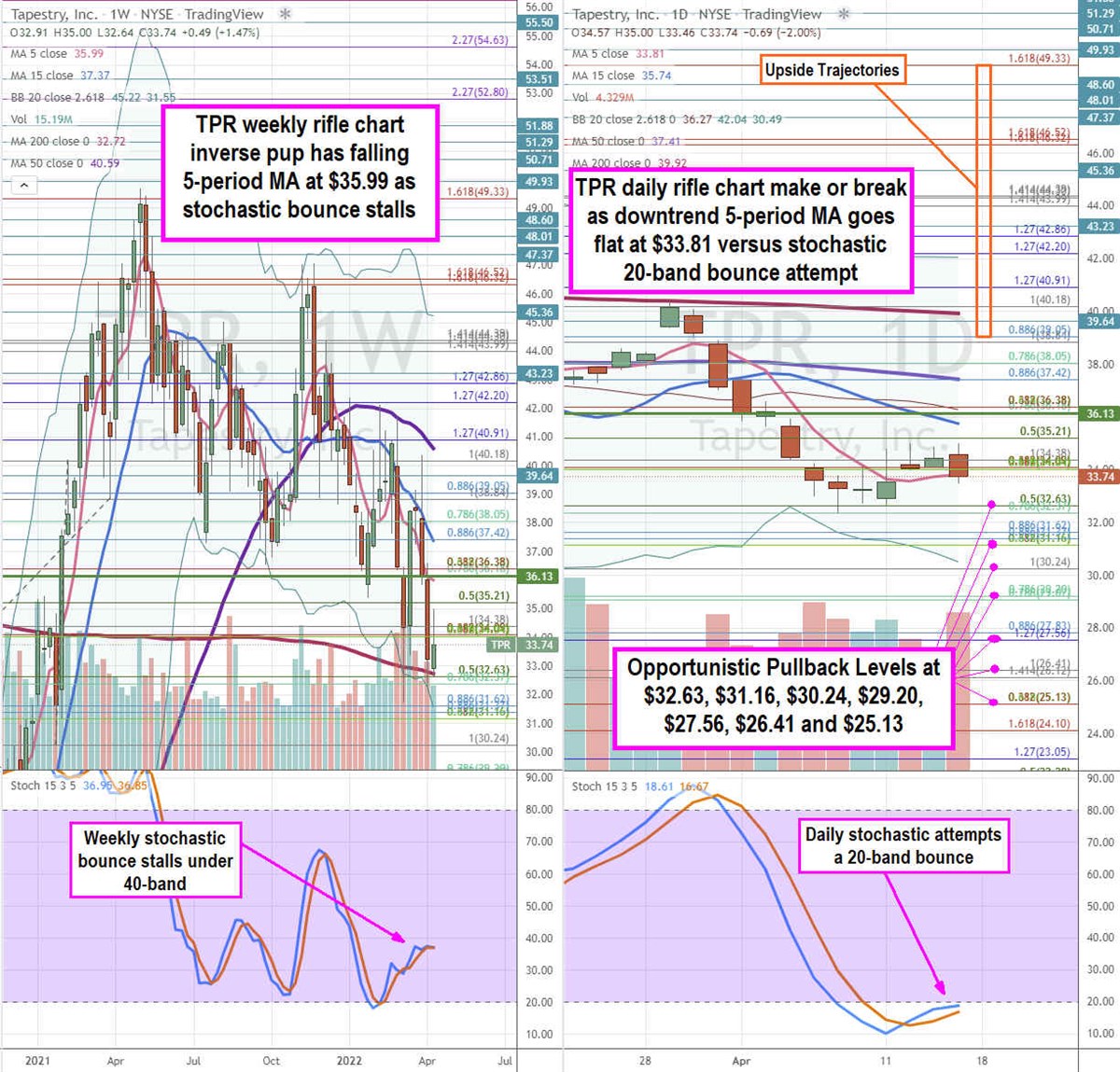

TPR Opportunistic Pullback Price Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for TPR stock. The weekly rifle chart peaked near the $42.20 Fibonacci (fib) level. The weekly inverse pup breakdown has a falling weekly 5-period moving average (MA) at $35.99 followed by the 15-period MA at $37.37. The weekly 50-period MA is falling at $40.59. Shares were able to bounce off the weekly 200-period MA support at $32.72. The weekly stochastic bounce is stalling just under the 40-band. The daily rifle chart downtrend is stalled as the 5-period MA flattens at $33.81 followed by a falling 15-period MA at $35.74. The daily 50-period MA sit at the $37.42 fib, and daily 200-period MA at $39.92. The daily stochastic is attempting to bounce through the 20-band. The daily market structure low (MSL) buy triggers on a breakout above $36.13. Prudent investors can watch for opportunistic pullback levels at the $32.63 fib, $31.16 fib, $30.24 fib, $29.20 fib, $27.56 fib, $26.41 fib, and the $25.13 fib level. Upside trajectories range from the $39.05 fib level up towards the $49.33 fib level.

Before you consider Tapestry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tapestry wasn't on the list.

While Tapestry currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.